Autotalks Announced That Its C-V2X/DSRC-Enabled Chipset is Ready for Deployment in the United States

|

NEWS

|

Autotalks, a Vehicle-to-Everything (V2X) communications provider based in Israel, announced that its second-generation chipsets achieved the Federal Information Processing Standard 140-2 (FIPS 140-2) for secure deployment of Cellular V2X (C-V2X) and Dedicated Short-Range Communications (DSRC) in the United States. According to the FIPS certification, the Autotalks’ Embedded Hardware Security Module (eHSM) provides a tamper-proofing environment required for the secure processing of automotive V2X communication systems. The certification comes at a time when the coexistence of both technology standards (802.11p and C-V2X) is the most likely scenario. While some Original Equipment Manufacturers (OEMs) have committed to deploy 802.11p (e.g., Volkswagen and Toyota) and others are vocal about their preference to C-V2X (e.g., Ford and Audi), the technologies are not compatible with each other. Thus, in a scenario of bifurcation between the two standards, hybrid solutions such as Autotalks’ C-V2X/DSRC-enabled chipset are an attractive solution for OEMs that operate in regions with different V2X standard specifications.

Short-Range Communication: DSRC and C-V2X

|

IMPACT

|

DSRC between traffic agents provides Device-to-Device (D2D) communication, able to share messages about the sensed environment and detected objects or obstacles with lower latency and higher reliability, which is ideal for basic safety messages and safety-centric and Non-Line-of-Sight (NLOS) use cases. Direct communication does not require network coverage for message exchange, as it uses radio spectrum, and can be deployed via 802.11p and C-V2X technology protocols. Both technologies can equally support safety applications that require End-to-End (E2E) latency of 100 milliseconds reliably. However, due to their incompatible architecture, vehicles with different technology standards do not communicate with each other. Additionally, the technologies have completely distinct market adoption paths.

802.11p-equipped vehicles have been commercialized since 2015, providing the quickest alternative for V2X implementation. The technology is likely to be enabled via a dedicated standalone module embedded within the vehicle devoted purely to V2X, requiring the installation of additional communication equipment. Thus, high market adoption would only happen in the case of a mandate or multiple OEMs simultaneously committing to adoption. On the other hand, C-V2X can be implemented more organically as an additional functionality growing out of the Telematics Control Unit (TCU)/Head Unit. The cellular modem that currently enables infotainment applications will serve as the Network-Assisted Device (NAD) for D2D communications. The technology will likely be commercially deployed by OEMs in China in 2020 and in the United States in 2022.

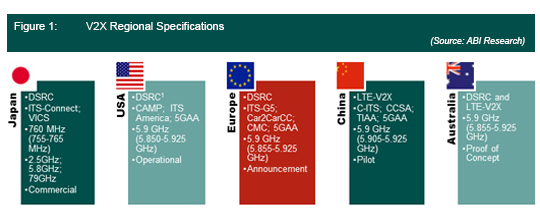

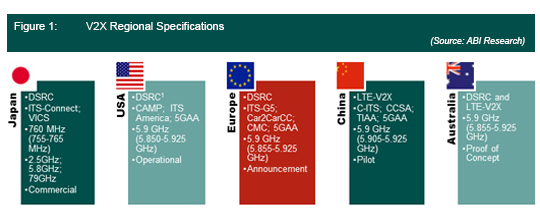

The coexistence of both technologies hinders the true potential of V2X that would only be fully achieved with maximum market adoption. Additionally, the transmission of the same content within the same frequency band would be highly inefficient. However, as presented in Figure 1, countries have adopted different mandates and some OEMs have committed to or already started to deploy different standards.

| |

|

|

Autotalks is striving for competitiveness in the DSRC market as Volkswagen and General Motors (GM)—the only OEMs currently deploying V2X—have both opted for NXP’s RoadLINKV2X technology, which will soon be a standard feature of the mass-market Volkswagen Golf in Europe. Autotalks may find more opportunities in the C-V2X market, as it recently participated in live interoperability and performance C-V2X tests in China with over 30 leading Chinese automotive companies. Moreover, the different regional V2X standards represent a market opportunity for Autotalks, as OEMs operating in different regions would benefit from a dual mode chipset that is able to speak both languages.

V2X Market Opportunities

|

RECOMMENDATIONS

|

As 802.11p and LTE-V2X will not achieve the high market adoption required to deploy V2X major benefits in the next few years, the focus of V2X deployment in the short-term should be the investment in infrastructure communication as all phases of cooperative mobility, from the exchange of local status and warning messages to cooperative automated driving.

OEMs: Considering the imminent V2X multi-standard scenario, OEMs should develop hybrid TCUs able to support different protocols and consequently conform to regional legal requirements. Moreover, as Vehicle-to-Infrastructure (V2I) applications are the most efficient way to deliver V2X value while the number of vehicles equipped with V2X is still low, OEMs should collaborate with municipal, city, or transportation authorities to maximize the value of V2I investment. These actors are more likely to engage in considerable infrastructure investments if OEMs commit to deploy V2X at low-to-no cost in early years.

Government Agencies: Governing agencies should provide higher clarity and future- proofing when setting rules regarding spectrum allocation. Failure to do so will continue to make the DSRC and C-V2X landscape uncertain, which ultimately leads to slower traction. Moreover, government authorities must recognize the importance of infrastructure investment to boost V2X adoption

Tier 1 and Chipset Suppliers: Due to the probable technology mandate coexistence, Tier 1 and chipset suppliers should invest in hybrid solutions able to provide technology compatibility at the device level, such as Autotalks’ dual mode chipset, Bosch’s hybrid V2X connectivity control unit, and Harman’s dual mode system that can switch protocols with Over-the-Air (OTA) commands.