Why is Ukraine Attractive for IoT Investment?

|

NEWS

|

In 2020, Ukraine elevated its global positioning in the World Bank’s Ease of Doing Business index, climbing to 64th out of 198 countries and placing 41st in the Global Innovation Ranking, overtaking more prosperous developing countries like Qatar, Russia, and Brazil. However, thinking about information Technology (IT) and, more specifically, Internet of Things (IoT) developments, Ukraine would not be the first country coming to mind. The ultimate question, therefore, is why not?

| |

|

|

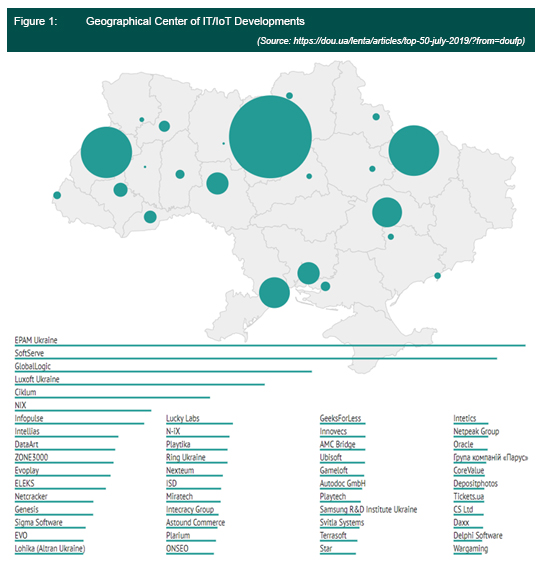

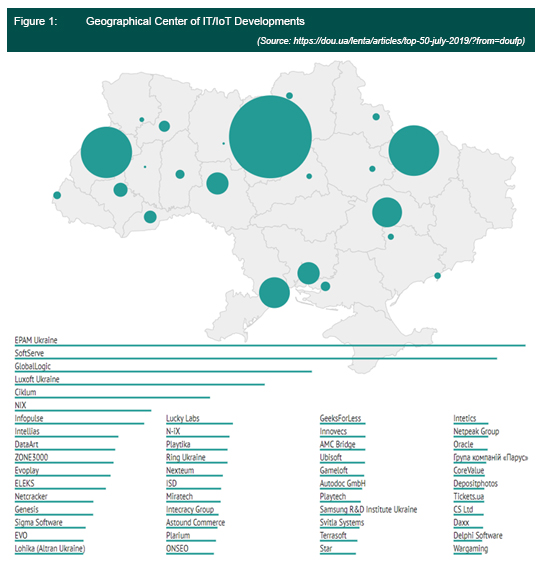

According to IAOP, Ukraine is placed 17th (2019) among IT service providers on the Outsourcing 100 list, exporting more than US$4.6 billion worth of IT services globally. The previous year's official statistic also highlights the fact that the Ukrainian talent pool is approaching 200,000 software developers, alongside 4,000 existing tech companies and more than 110 Research and Development (R&D) centers (established by Samsung, Ericsson, Huawei, Microsoft, Oracle, Boeing, etc.) and further partnerships with the United States, the European Union, and Israel.

Hence, the country is enriched with a highly educated labor market, a talent pool, but also enables much lower Venture Capital (VC) investments for the development of IT/Operational Technology (OT) projects, for which the cost of prototyping, product development, and Proof of Concept (PoC) would be much higher in the United States and other developed countries. Additionally, 2019 showed promise of rapidly expanding IoT ecosystem in Ukraine, with over 2000 emerging IoT enabled startups. So, what are the global and hot IoT startups birthed in Ukraine?

Companies That Are Making a Difference

|

IMPACT

|

ABI Research has lined up a list of companies founded in Ukraine or developed by Ukraine software firms that are already establishing themselves as IoT solutions “to watch”:

- Agri Eye: An IoT technology combining soil analysis and remote sensing for agricultural business

- Cybergrow: A smart IoT solution for Greenhouse systems

- Sentstone: A wearable IoT device for transliterating voice into writing

- Hideez: An IoT keychain for generating passwords to unlock doors and devices

- Petcube: An IoT device with a pre-installed camera to interact with pets

- Blink: A mobile app for IoT development kits

Since the list is extensive, here is a closer look into some of the rapidly growing and successful companies:

- Solar Gaps was founded in 2016 and currently offers the world’s first and only smart blinds, which are enabled to collect solar energy. These plug-and-play blinds automatically track the sun and subsequently generate electricity, which allows users to power their homes. After two years of prototyping, the company has raised more than US$700,000 of investment. The project currently has over US$175,000 and US$5 million of upfront sales in the Business-to-Consumer (B2C) and Business-to Business (B2B) segments, respectively.

- Hideez Technology showcased its invention at CES 2017, where it presented a device with four form-factors: a keychain fob, a wristband, a pendant, and a clip. The device enables users to save passwords, which can be used instead of an actual key to open the doors to a house or office. Since the announcement, a mini version (Hideez Key 2) has emerged and the company managed to secure US$825,000 in funding for further expansion.

- Ecoisme is a company producing smart homes through its Energy Monitoring systems, where the device is connected through the single outlet to the house and attaches to the power line. The “internet” part of the device allows users to track and optimize energy consumption and alert users in case home appliances remained on for an extended period of time (i.e., AC, curling iron, or open fridge-freezer). Since 2014, seed funding has enabled the company to acquire start capital totaling $651,300 and mark itself in the IoT ecosystem.

What Can This Mean for Your Business?

|

RECOMMENDATIONS

|

Finally, the growing question is what does this mean for international business? What can it mean for your business? ABI Research sees the potential of the growing IoT ecosystem in Ukraine, as an opportunity for a) Outsourcing, b) Greenfield and Joint Venture (JV), and c) Clustering around the IoT hardware ecosystem.

Outsourcing: More than 50% of IoT projects do not pass the PoC stage, implying that Return on Investment (ROI) on such projects is anything but negative. Taking into consideration the western price range for software developers, Ukraine appears to be an attractive and affordable space for IoT prototyping and software outsourcing. While other nations like India or Southeast Asia seem to be more dominant, the Ukrainian IoT sector is offering a much higher cost-quality balance, where top-quality development service can be arranged for middle-to-low costs relative to the size of the industry.

Greenfield and JV: Ukraine’s current investment attraction model emphasizes a 4+1 sector strategy, meaning that hot industries including agribusiness, manufacturing, energy (including renewable), and infrastructure, are combined with technological and innovation linage (the +1). Therefore, those sectors represent a particularly attractive segment for JV, greenfield, and brownfield investments. As part of the reduction of financial risk, Ukraine is known for rapidly growing startups, which can expand to the global market in less than two years. Examples of Silicon Valley’s significant Ukrainian Mergers and Acquisitions (M&A) include Google’s acquisition of Viewdle and Snapchat’s purchase of Looksery for more than US$150 million.

Clustering around the IoT hardware ecosystem: The Ukrainian startup ecosystem has a rate of 500 tech companies monthly, implying that start-up VC is growing accordingly. Although the software business has dominated the Ukrainian tech scene, past years have also highlighted the influx of hardware and R&D IoT development centers and incubators. There are more than 50 R&D centers and 20 Incubators related to IoT technologies; the hardware cooperation also includes companies including but not limited to NetCracker Terrasoft, Augmented Pixels, La Metric, Samsung, Huawei, Ericsson, Oracle, Microsoft Incubator, Airbus, and Boeing. Hence, since the technical knowledge and labor potential has grown significantly and the IoT hardware ecosystem is experiencing momentum, this can be a beneficial opportunity for many global hardware and middleware enterprises!