Consumer Confidence Will Drop, and Network Will Cope

|

NEWS

|

The global pandemic that started with the outbreak of the COVID-19 virus has created a massive impact on stock markets and the financial performance of even the largest global companies and caused consumers great concern. As a result, consumers are limiting their spending, which is now affecting smartphone sales. ABI Research expects that handset sales may drop by 30% Year-on-Year (YOY) in the first half of 2020, meaning that the smartphone supply chain will likely be seriously affected. This will likely have a cascading effect in the telecoms market, where giants like Apple, Huawei, and Samsung will see revenues stagnating, at least in the first half of the year.

On the other hand, consumer telecom networks are currently coping under the increased stress of most employees working from home. To underline this, operators around the world have shared statistics that follow an almost uniform composition: fixed broadband traffic is increasing (some cases by more than 50% daily), WiFi calling is also increasing (sometimes as high as 80% daily), and so are mobile calls. However, no mobile operator is reporting statistics regarding 4G and 5G networks, which will have likely declined as most subscribers are in self-isolation and most likely use their home broadband for most communications. Moreover, the lack of general availability of skilled installation technicians will also mean that aggressive 5G deployment plans will likely be slowed down.

Mobile CAPEX Slowdown Due to COVID-19

|

IMPACT

|

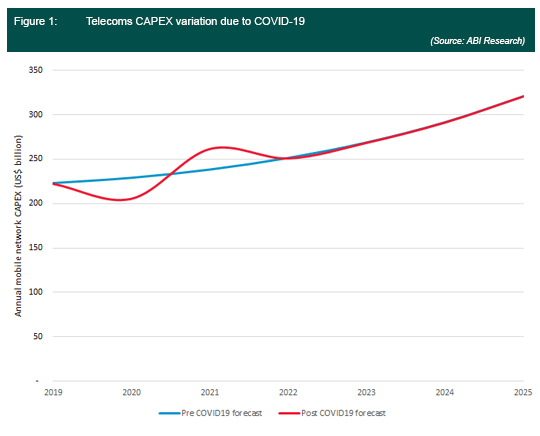

ABI Research expects that the effects of the global pandemic will start to slow down after June 2020, when governments and health institutions will be better positioned to protect citizens against the virus. By that time, most countries will have cautiously returned to normal operation, meaning that mobile operators will also return to their normal plans. However, in terms of Capital Expenditure (CAPEX) plans and taking the above challenges into account, it is very likely that there will be a slowdown that will spill over into 2021 as well. The following chart illustrates ABI Research’s forecasts for mobile Capital Expenditure (CAPEX) and the potential effect of the pandemic:

The year 2020 will likely see a CAPEX slowdown of 2-3% because of the coronavirus that will be offset in 2021 to counter the slowdown. This dip will mostly be driven by the shortage of manual labor to install 5G macro cellular base stations.

The Global 5G Supply Chain is Robust Enough to Face Major Incidents

|

RECOMMENDATIONS

|

Despite the global reach of the pandemic, the telecoms supply chain—including both mobile infrastructure and devices—has proven to be robust and well-shielded to face this global challenge. Any mobile operator that has aggressive plans to deploy 5G will not be faced with equipment shortages, since Tier-1 equipment providers (Ericsson, Huawei, and Nokia) have diversified their supply chains and have manufacturing plan redundancy to face regional lockdowns. The moderate CAPEX slowdown discussed above will likely put a strain on the financial position of all infrastructure vendors, but they will likely endure with short-term improvements without long-term effects, assuming they were in a healthy financial position before the outbreak.

In fact, early 5G deployments in China illustrate that the new generation has been pivotal in addressing the increased communication requirements of temporary hospitals and other infrastructure to combat the pandemic crisis. It could also be said that the pandemic will accelerate the application of 5G in enterprise verticals and, most certainly, healthcare. The question remains whether 5G will be deployed through existing networks and infrastructure or enterprise deployments will be greenfield, as it was in the example of China. At the moment, these questions cannot be answered, but the pandemic will certainly illustrate the vital importance of mobile networks and 5G for both consumer and enterprise use cases.