Brain Corp, a developer of robot operating systems, has received US$36 million in funding to help buttress its rapid expansion of cleaning robots throughout retail stores and public locations in the United States. With over 10,000 scrubbers enabled with autonomy and thousands deployed, Brain has deployed more active Autonomous Mobile Robots (AMRs) in retail stores than any other vendor. The company more than doubled its revenue for 2019 and is in the lucky minority of companies that can hope to benefit from the coronavirus pandemic. With shortages in labor at retail stores, the desire to automate time-consuming tasks like cleaning has expanded. As well as this, the emphasis on cleanliness has lead retailers like Walmart, Target, and Kroger to document their maintenance operations.

Brain might be the best-known vendor for commercial cleaning robots, but it is far from alone. Avidbots, a Canadian robotics developer, has deployed over 250 Neo scrubbers worldwide and has recently etched a landmark deal with logistics giant DHL, which will be deploying hundreds of Neo scrubbers over the next 24 months.

While Brain’s fleet size grew considerably in 2019, Avidbots has highlighted the value of its product in the wake of COVID-19. With the success of both companies supplemented by Ultra-violet powered disinfection robots like UVD Robotics, autonomous cleaning and maintenance machines are being adopted at an ever-accelerating rate.

Product Conversion or Purpose-Built Robot

|

IMPACT

|

There is a degree of contention between the vendors in this space. While Brain Corp has acquired its enviable position by creating a hardware-agnostic Operating System (OS) that enables manual equipment, Avidbots has built its NEO robot from the ground up. The difference is analogous to the comprehensive design package offered by Apple’s IOS and the hardware-agnostic Google Android. As in the case of smart phones, there is plenty of room for both approaches to function effectively. Given the sheer variety of applications for cleaning vehicles, there is a lot of promise in automating manual equipment to optimize flexibility. Different vehicle sub-types include:

- Burnishers

- Polishers

- Extractors

- Vacuums

- Scrubbers and Sweepers

Besides this, there a variety of different form factors, from smaller walk-behind products to larger ride-on vehicles. The floor care market is pretty established, with a few vendors like Karcher, Nilfisk, Minuteman, and Tennant dominating the space. All these companies have pedigrees going back decades, and thus there is logic to the product conversion model, which builds on this legacy and enables it without significant disruption.

The purpose-built robot model is arguably more challenging as the robot developer is competing not just with other robotics vendors, but also with Original Equipment Manufacturers (OEMs). While robotics and software engineers come at a premium and are going to be able to build an excellent product, they will not initially have the built-up intangible knowledge that OEMs like Nilfisk and Tennant have built up.

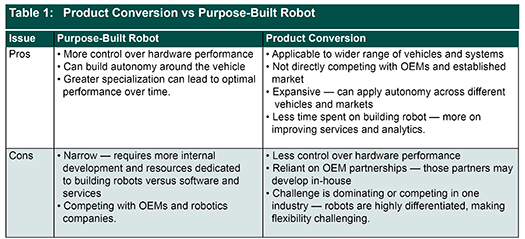

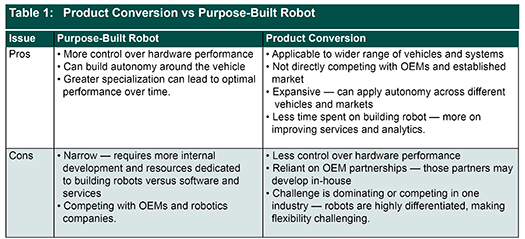

That being said, there are also advantages to building a robot from scratch. Creating a circular base means not relying on additional sensors at the back of the vehicle to reverse, and the ability of the vehicle to navigate different environments effectively and with greater adaptability, at least for the first generation of product conversions. While Avidbots does not have a circular base, it sees its partnership with DHL as a vindication for building a product that is autonomous, requires no pre-programming, and is adaptable to changing environments. That being said, warehouses and fulfillment sites generally have a lower set of cleaning standards than retail stores or malls, and so cleaning quality standards translated from one space to another might not be acceptable. The table below highlights the benefits and disadvantages of the two models:

| |

|

|

The opposing positions held by Brain Corp and Avidbots are somewhat fluid. Brain currently has a strong network of partnerships with retailers and cleaning OEMs and is expanding into the material handling space with partner in Unicarriers (owned by Mitsubishi heavy industries) and Dane Technologies. This provides access to market, an ability to draw on the experience and technical expertise of its partners, and the ability to scale its OS quickly. Besides the preferences of some vendors for purpose-built robots, there is a risk to this solution, in that navigation, perception, and Simultaneous Localization and Mapping (SLAM) are all technologies that are increasingly within the reach of other robot developers, and OEMs are also interested in developing the technology themselves. Currently, Nilfisk and Tennant partner with robotics companies, but should the market be validated, and say 10% to 50% of new orders are for autonomous systems, will they be tempted to bring that competency in house? The same question could be asked of major vehicle manufacturers like John Deere and Caterpillar. A way to mitigate this is to use the product conversion model to partner with robotics vendors and OEMs from as wide a range of verticals as possible, with Brain pushing on multiple fronts to automate scrubbers, vacuums, and tugs.

Avidbots does not have the technology partnerships or the fleet size, but they do have the ability to pivot to a product conversion model in the future. Robotics companies are currently exploring opportunities to offer parts of their technology stack and lease out certain competencies like navigation as a secondary source of income.

Scaling up Autonomous Cleaning

|

RECOMMENDATIONS

|

The current fleet of commercial cleaning robots is just the start of a broader trend of automation. According to the American Association of Cleaning Equipment Manufacturers (AACEM), in 2017, 134,782 hard floor cleaning vehicles (scrubbers, polishers, and burnishers) were sold in the United States alone, alongside 790,000 commercial vacuum cleaners, 37,000 extractors, 50,000 blowers, and 35,852 sweepers. The global market oppurtunity for automating this manual equipment is therefore enormous, and ABI Research sees massive growth for the market for the next 10 years.

Nonetheless, autonomy exception remains a huge challenge for mobile robotics, especially with a looming economic crisis. While companies are going to get lots of demand for deploying cleaning robots, they are not necessarily going to be in a position to hire engineers and field teams to maintain rapidly expanding fleets. Thus, the main challenge is to increase the ratio of robots to employees needed to maintain them. This is being achieved through the adoption of better tracking, data collection, reporting, and the use of analytics services, usually from third parties. While autonomous scrubbers will collect data, it will then be sent up to cloud services from which third-party analytics companies will derive insights to the end user. This requires strong support from management systems and cloud service providers, given the sheer amount of data being collected. As companies like Avidbots, Brain, and Enway get bigger, they will take a bigger chunk of this value-added services market, but for now, they are heavily reliant on third parties.

What is more, the power source is important. Does the solution warrant opportunity charging, or basic battery swapping? The latter is easier and less expensive, but opportunity charging requires less intervention, and with the onset of wireless charging being developed by the company Wibotic, the options for flexible charging are going to become more available. In most environments, there will not be a need for a scrubber to work more than four hours, but for warehouses working with foods and other perishable goods, there is a demand for 24/7 cleaning with high quality needs. In such a situation, lithium-ion batteries are necessary as they provide longer lifetimes of six + hours. Currently, Brain is not using Lithium-ion but is working on incorporating them into its next range of products, while Avidbots uses cheaper lead-acid batteries. So far, these provide the four to six hours of operating time needed for the DHL warehouses.

Ultimately, the technology only takes autonomous cleaning so far. For this opportunity to be seized, workers have to be trained, mistakes have to be documented, and fleets need real-time management and updates. The cleaning robots are also a platform for collecting data about the greater environment, understanding stock levels, keeping inventory, and tracking various business metrics. With the help of cloud service providers and robot software vendors like InOrbit or Rapyuta, companies can process this data, orchestrate between the cloud, the edge, and the device, and develop long-term insights that generate a more significant Return on Investment (ROI).