Cloud- and Edge-Based MLaaS

|

NEWS

|

DataProphet is a six-year-old startup based in Cape Town, South Africa, that offers Machine Learning-as-a-Service (MLaaS) solely for industrial and manufacturing firms. Made up of a team of 40 engineers, computer scientists, and statisticians, the startup serves a wide range of multi-national corporations, ranging from metal producers (GKN Sinter Metals, Gusswerke) to automotive Original Equipment Manufacturers (OEMs) and Tier-1s (Maxion Wheels, Nexteer, BMW) and mineral processing companies (Manganese Metal Co., Sibanye Stillwater).

The company’s key product, DataProphet PRESCRIBE, is a cloud Artificial Intelligence (AI)-based overall efficiency enhancement solution targeting continuous optimization. By ingesting data aggregated from various software, including Enterprise Resource Planning (ERP), Supply Chain Management (SCM), Product Lifecycle Management (PLM), Manufacturing Execution Software (MES), and Quality Maintenance Software (QMS), and training its AI models using those data, DataProphet PRESCRIBE is able to suggest optimal control parameters, implement those parameters, and automate key control procedures in the manufacturing process. Similar to other peers such as Landing AI and Smartia, DataProphet offers on-site data integration and solution deployment, offloading the data science workloads from end users and making AI adoption less laborious for end users.

One Tech Inc., on the other hand, is located at the other end of the industrial AI deployment spectrum. Similar to the hardware-agnostic AI vendors profiled in the previous ABI Insight Hardware Agnostics AI Deployment to Drive the Next Wave of AI Adoption (IN-5731), One Tech offers endpoint-based overall efficiency enhancement and security. ML algorithms are used to ingest and process asset data collected from sensors and other IT systems, such as acceleration, vibration, pressure, sound, and humidity, before generating insights. These ML workloads take place in a gateway that is connected via LTE or 5G network.

The MLaaS Landscape

|

IMPACT

|

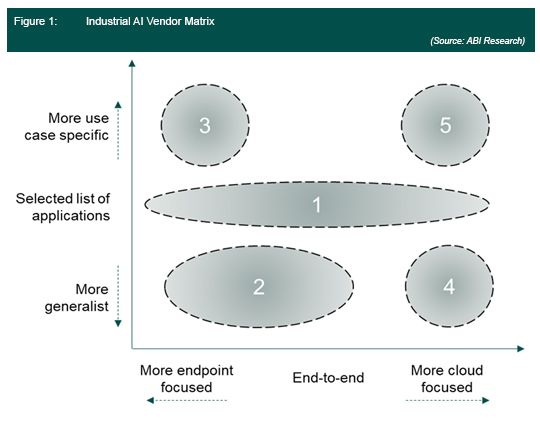

Since the popularization of ML expertise and the increase in public cloud availability, the industry has witnessed the emergence of many AI startups, focusing on industrial and manufacturing. In order to better visualize the positioning of different AI vendors in industrial and manufacturing, ABI Research has formulated the following schematic diagram to highlight these niches in the industrial AI value chain:

Two main parameters are considered; namely, the type of AI services (from endpoint centric to cloud centric), which formulates the X-axis, and the range of AI applications (from all-encompassing to specialist). Based on those parameters, we have identified five major categories of industrial AI vendors:

- Smart Manufacturing Platform Vendors with AI Capabilities: These are generally incumbents in the Industrial Internet of Things (IIoT) space that have existing End-to-End (E2E) smart manufacturing portfolios and are adding AI to their suite of solutions, such as PTC, Siemens, Predix, and Librestream. Entefy is a notable exception, as it is a startup with an E2E solution platform.

- Endpoint-Based AI Vendors: Refers to startups that are primarily offering endpoint-focused analytics capabilities via software runtime installed on edge devices, with a complementary cloud platform that results in the elongated oval-shaped circles. Key players include Ekkono Solutions, Falkonry, FogHorn, Neurala, and One Tech. These vendors support multiple use cases, including predictive maintenance, quality inspection, health monitoring, emission monitoring, and asset tracking.

- Application-Specific AI Vendors: These are AI vendors that focus on specific AI applications in specific hardware, such as camera, robotics, and warehousing solutions. Noteworthy examples include Cognex in machine vision and Kindred Systems in warehousing.

- Cloud-Based Vendors that Feature a Wide Range of Solutions: Refers to vendors that offer cloud-based solution that can ingest multiple data sources, analyze them, and generate insights. Some even feature tools that allow end users to develop their own AI solutions. Key players include SparkCognition, C3, Noodle.ai, Sight Machine, and Uptake. This is generally done in partnership with public cloud vendors such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

- Hardware-Agnostic ML Specialist Startups: Refers to startups that are made up of small teams of deep learning experts that focus on developing cloud-based, industrial ML solutions, such as machine vision and overall efficiency enhancement. Key players include DataProphet, Landing AI, and Smartia. These vendors often partner with public cloud vendors such as AWS, Microsoft Azure and Google Cloud.

Granted, the schematic diagram above is an extremely crude representation of the actual market and product dynamics, but it serves as a good reference point. Based on the diagram, One Tech and DataProphet are in Sections 2 and 5, respectively, diagonally opposite each other. As more and more industrial AI startups emerge and market gaps are filled up rapidly, we expect the diagram to become increasingly complex. The wide array of use cases and application domains in both greenfield and brownfield settings are complicated, allowing various AI deployment strategies to thrive.

How to Maximize the Value of MLaaS

|

RECOMMENDATIONS

|

As such, it is the onus of end users to understand their own AI requirements before deciding to select a MLaaS partner. Start with a few simple questions: are you looking at specific use cases, or a more general AI development platform that can accommodate multiple use cases? Any data privacy and latency concerns? Do you prioritize cost over value? What are your internal AI capabilities? Do you plan to hire AI engineers, or do you prefer to outsource AI solutions?

Next, you must evaluate future product roadmap and upgradability. A good AI platform features constant updates and clear future upgrade pathways. However, you should not treat AI as a piece of enterprise software or an expense item under capital expenditure. In fact, AI is a tool that requires constant maintenance and close collaboration between AI service providers and end users. Treat AI vendors as an extension of your Information Technology (IT) or Operational Technology (OT) team.

Finally, have a vision of your factory in the future and use AI as a catalyst for transformation. At the very least, avoid treating AI as a simple off-the-shelf solution for automation. Such a mindset will cause you to incur technical debt. Incurring technical debt means you will end up putting in additional cost and reworking your current simplified AI solution somewhere down the road. If your aim is to achieve a fully automated factory in the future, you are better off deploying a more comprehensive approach that would take longer to implement.