A Nascent Technology Struggling to Break Free

|

NEWS

|

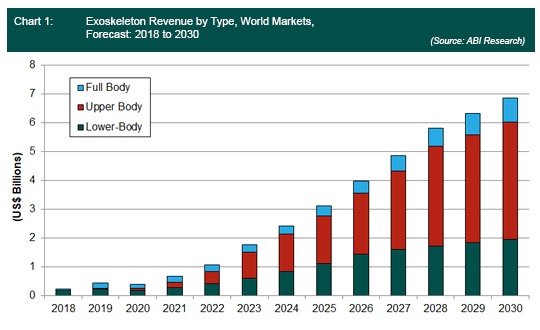

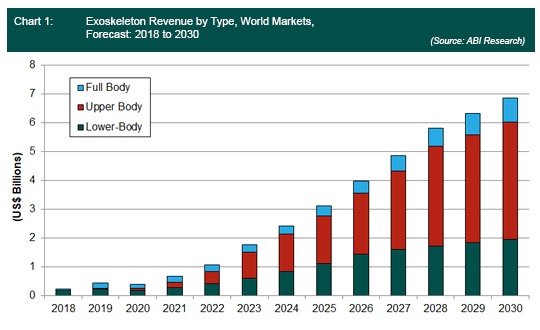

Based on ABI Research’s latest Commercial and Industrial Robotics market data (MD-CIROBO-105), the exoskeleton market is valued at US$392 million in 2020 and will grow to US$6.8 billion in global revenue in 2030. This represents significant growth, but is a contraction from previous studies, which were more optimistic about the fledgling technology. Although exoskeletons are being deployed in a greater variety of roles, they have not proven their worth to the degree that other nascent robotic technologies like Collaborative Robots (cobots) and autonomous navigation systems have. There are comparatively few investments of significant size in the exoskeleton market. Of the 863 major private and venture investments in robotics companies from 2017 and 2020, only 12 went to companies developing exoskeleton technology, with the largest being a US$100 million investment in Ekso Bionics from Zhejiang Youchuang Venture Capital Investment Co. (ZYVC).

| |

|

|

The public finance results of many public exoskeleton providers have rendered limits to gains and even substantive losses, with a notable example being U.S. health exoskeleton developer ReWalk Robotics.

Many of the exoskeletons currently sold are passive, particularly in the industrial space. These systems are, in some cases, mandated as Personal Protective Equipment (PPE) (e.g., in U.S. Toyota plants) and do offer some assistive force to workers. However, there have also been concerns, particularly among workers, that the passive suits merely distribute pressure from one muscle group to another, and may even have negative physical effects.

The potential risks of active exoskeletons are numerous and relate to their design and functionality. Active systems might include mechanical and technical defects. In this case, a malfunction could lead to injury, because the drive mechanism of active exoskeletons can exert additional forces on the body of the worker.

As the EU-OSHA noted; “The topic of exoskeletons is currently receiving considerable attention. However, despite their apparent promising potential, the application of exoskeletons in a wide range of fields should be questioned. It remains to be seen whether or not exoskeletons will be used extensively in the future to protect workers from overload injuries or to economize work processes”

Given this level of skepticism, it is little surprise that exoskeletons are somewhat marginalized as a nascent technology.

The Value Is There to Be Extracted

|

IMPACT

|

However, there is promising news. Toyota has mandated exoskeletons as PPE, and Innophys is the first exoskeleton provider to declare selling more than 10,000 in 2020 (albeit with some skepticism). Interest has been up during the COVID-19 pandemic, even as deployments have become challenging.

The value of the hardware is clear, but given the investment, more emphasis needs to be placed on the importance of exoskeletons in developing the smart workforce through data collection, analytics, and services. This is being spearheaded by German Bionic Systems and Sarcos Robotics, which are hoping to develop their exoskeleton business based on an Exoskeleton-as-a-Service model. This will require companies to develop a triad of capabilities, notably real-time data insights and updates, IoT-enabled integration with smart infrastructure, and the development of data analytics and business intelligence services. Given the early stage of development of exoskeleton hardware, providers need to deliver an end-to-end software solution that is worth paying for to help transition users from the current suits to the next generation.

German Bionic, an Augsburg-based developer, is arguing that both active systems and connectivity to the industrial internet of things are essential to popularizing exoskeletons. Their “Cray” suits can reduce muscular strain and general fatigue, and as connected systems, they provide actionable analysis to individual workers and the wider operation. The company is looking to help companies protect workers, with a focus on making sure younger operators close to the age of 35 do not get injured. This will result in fewer injuries as workers age.

Moving Forward

|

RECOMMENDATIONS

|

The exoskeleton industry is at a crossroads and needs to take stock of the last few years of development, focusing proactively on the following key issues:

- Develop IoT Services: Develop a suite of services that can connect your exoskeletons to the wider industrial Internet ecosystem, or at the very least place them into your roadmap. Digitization is taking manufacturing by storm and exoskeletons cannot be out of step with this broad trend. German Bionic Systems is currently the major exoskeleton vendor planning to connect its exoskeletons for data collection purposes, but adjacent vendors like Storngarm Technologies are collecting data via smart clothing and tags.

- Know Your Audience: The Chief Executive Officer (CEO) and Chief Technology Officer (CTO) will be well disposed toward pitching exoskeletons, but to make things work, companies need to spend more time developing best practices with workforces and site managers. These are the constituencies whose opinions will make or break the technology.

- Market Validation: Get mandated as PPE for big companies and use powerful insurance firms to make your case.

- Prioritize the Edge: Edge deployments/intelligence allows for greater flexibility and agility (e.g., Mobile Edge Computing (MEC) and edge-cloud).

- Reframe the Conversation around the Cost of Inaction (COI): Focus on the opportunity cost of not augmenting the workforce.

There are also some other areas where caution is required:

- Think More about the Business Case: Rather than the technology, demonstrable profitability and quick Return on Investment (ROI) will be vital. Many customers are scouring technology solutions, and exoskeletons have much less validation than most other categories. The incremental reduction in worker injury and lower insurance claims are currently bigger selling points than the enabling effects of the suits.

- Resilience, Cost Savings/ROI, and Productivity: These tenets are the hallmarks of any legitimate Industry 4.0 solution and need to be baked into messaging. Uber-style economics will not work for a technology that faces an uphill battle to receive validation from skeptical stakeholders.

- Do Not Just Think about Payload: Outside of specific markets like ship-building or heavy logistics, limited force assistance can still make a significant difference.

- Get the Fundamentals Right during COVID-19: There will be real pressures on vendors, notably slowdowns in sales (despite increase in interest), major issues with repairs (given social distancing and disruption), supply chain disruption, and delays in regulatory approval due to government backlogs.

The value of exoskeletons is unquestioned and they represent a real opportunity to improve the future workforce, but the industry needs to take advantage of the post-COVID-19 opportunity decisively or risk further development postponements.