Marginal Market Growth Expected Over the Next 5 Years

|

NEWS

|

The payment cards market continues to be one that is going through a level of transition. On one hand, the market is now extremely saturated with only a few largely populated countries yet to migrate to EMV, and on the other hand, COVID-19 has created a level of acceleration as it relates to contactless adoption. On top of this, ecosystem players continue to prepare and position themselves to take advantage of the perceived next-generation migration opportunity, related to new innovative card form factors including the Dynamic Card Verification Value (DCVV) and biometric payment card. This ABI Insight will explore and provide insight on ABI Research’s latest payment card market forecasts, alongside expectations related to a future market defined by the COVID-19 pandemic and how accelerated contactless migration is the foundational piece from which next-generation card form factors can succeed.

The Future Payments Cards Market Will Be Defined by Reissuance Cycles

|

IMPACT

|

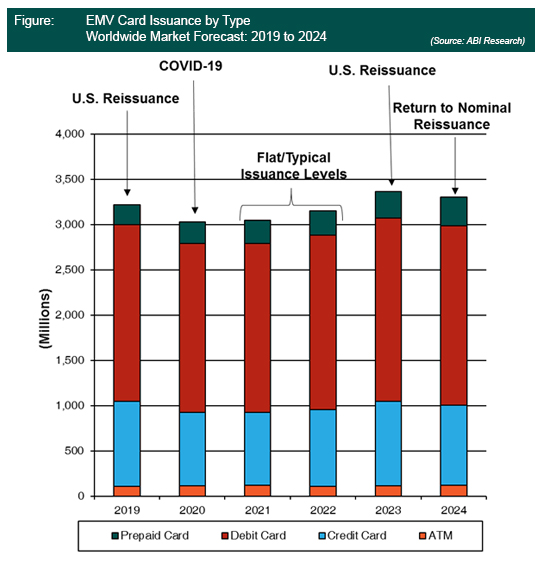

Globally, around 3.2 billion payment cards were issued in 2019, marking YoY growth for the payment cards industry in the 5.5% range, largely thanks to significant reissuance programs in the United States. For 2020, ABI Research is forecasting payment card issuance hitting just over the 3 billion mark with the market. This YoY market reduction will be directly driven by a softening of issuance in the United States, as well as a result of COVID-19, linked to an expected reduction in certain card types, most notably credit cards (U.S. credit applications were down 40% in March) and premium cards, which continue to be pinned to added value alongside services largely pinned toward rewards, and points systems geared towards international travelers.

As it relates to EMV, the payment cards market can be considered one of considerable maturity with all major economies already migrated to EMV. A few exceptions and volume opportunities remain, most notably Indonesia and Vietnam, but the future market will be primarily defined by replacement rates of expired cards.

Despite the high market maturity levels, China, the United States, and India remain three countries that the market continues to closely monitor. Combined, payment card issuance into these three countries accounts for approximately 50% of global issuance, meaning minor impacts in any one of the three can have a major impact on the global market picture.

Overall, for 2021 and 2022, issuance of payment cards will likely remain flat. This will not be a post-COVID-19 effect, but rather an impact driven by flattening issuance in China and reduced reissuance opportunities in the United States with significant global market growth not expected to return until 2023 as U.S. record reissuance sets to repeat. With the market now dominated by payment card replacements and reissuance, understanding issuance cycles should now be considered imperative in order to better benchmark sales and understand and map future sales targets and revenue opportunities.

Contactless No Longer a Differentiator, but the Market Foundation for Next-Generation Form Factors

|

RECOMMENDATIONS

|

Overall, contactless payment card issuance remains a positive story and the overall growth trajectory continues, already reaching the milestone of 50% of all shipments in 2018 and forecasted to increase and to account for more than 80% by 2025. Prior to COVID-19, contactless migration was already a significant trend and growth area; however, COVID-19 will accelerate contactless migration, pitched as a technology to improve hygiene and offer a touchless Point-of-Sale (POS) experience. For the above reason, ABI Research no longer considers contactless as a differentiator, but rather a form factor required in order to remain relevant in a post-COVID-19 world. Contactless can no longer be considered a nice-to-have solution to enable convenience, but rather a must-have form factor in order to protect merchant staff and customers at the POS.

Contactless critical mass and market saturation is now extremely close, thus making contactless a shorter-term opportunity, with the United States remaining a key primary driver for contactless growth over the forecast period, with significant activity noted and expected to continue. In addition to the United States, India is looking more positive from a contactless migration point of view thanks to support from the State Bank of India (SBI), which is expected to have a market impact from 2021 onward.

With the overall market flattening and being largely defined by reissuance programs, and although the shorter-term opportunity is being presented by the contactless form factor, longer-term revenue growth will be driven by innovation. Most notably, biometric payment cards and DCVV card variants are considered the next considerable payment card evolution, and contactless is helping set the foundations from which next-generation payment card credentials can flourish.

The continued rise of contactless migration is a positive signal for active vendors within the biometrics payment cards market. This is the Total Available Market (TAM) from which biometric payment cards will look to target, and understanding financial institution renewal cycles and gearing sales strategies aligned with significant reissuance programs will be key in determining who wins out as the leading biometric payment card supplier.