Latest Developments on Release 17

|

NEWS

|

Release 17 was scheduled to be completed in 2021. The COVID-19 pandemic, however, has impeded the progress and has caused delays on key dates. The “freeze” or finalization date for Release 17 Stage 3 was set for September 2021, but a decision on a delayed date will be considered in December 2020, according to a September 21 post by 3GPP. That’s when they will decide if Release 17 will be delayed by 3, 6, or more months.

Release 17 is extending enterprise-related 5G features such as introducing positioning and sidelink enhancements, Integrated Access Backhaul (IAB), more support for Non-Public Networks (NPN), and further specifications on New Radio (NR) operation in higher millimeter wave frequencies, including operating in unlicensed spectrum (NR-U). A key specification is the introduction of the NR-Light device class that aims to cater to use cases that need higher throughput/low latency requirements while preserving device simplicity and maintaining lightweight form factors.

The Middle Ground: How NR-Light Fits In

|

IMPACT

|

5G Low-Power Wide-Area (LPWA) IoT communication is currently based on Release 13’s enhanced Machine Type Communication (eMTC) technologies: LTE-M and NB-IoT. These device classes are utilized in large-scale deployments, involving massive volumes of IoT devices across multiple use cases and deployment scenarios such as asset tracking, IIoT sensors, and low-end wearables. These devices have the lowest complexity, lowest power requirements, and have higher latency tolerances.

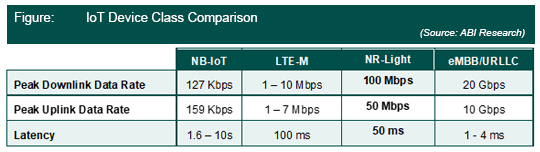

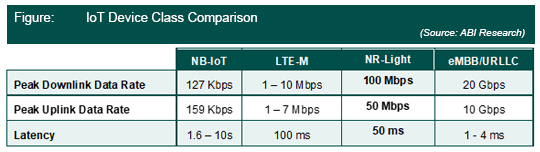

As seen in the figure below, the wide disparity in data rate and latencies highlight the diversity of use cases that LTE-M (Cat-M1 and Cat-M2) and NB-IoT (LTE Cat NB1 and NB2) devices handle, respectively. NB-IoT is mainly used in low data rate applications in challenging radio conditions, providing improved indoor coverage and supporting an increased number of low-throughput devices that offer high battery life at lower costs. LTE-M, on the other hand, functions at higher data rates, greater device complexity, higher cost, and lower latency than NB-IoT. This increased sophistication enables its accurate device positioning capabilities that support connected vehicles.

On the other end of the spectrum, there are high-end devices used in enhanced Mobile Broadband (eMBB) and Ultra-Reliable Low Latency (URLLC) scenarios that require distinctly higher data throughput and extremely low latency. These devices cater to use cases such as high-end smartphones, maintenance Virtual/Augmented Reality (VR/AR), and advanced autonomous robotics used in industrial scenarios.

| |

|

|

With respect to how NR-Light compares to the other device classes, NR-Light devices’ capability and complexity falls in between the higher data rates and complexity of eMBB devices and the simpler User Equipment (UE) features of NB-IoT/LTE-M. Release 17’s NR-Light is an additional device class that can support Industrial Wireless Sensor Networks (IWSN) and “relaxed-IoT” wearables to address more sophisticated use cases that require higher data rate/reliability. NR-Light communication is based on NR features (such as flexible numerology, beamforming, massive (MIMO) coverage, and Single-Sideband Modulation (SSB) bandwidth), while also meeting additional device requirements such as reduced complexity and user equipment power consumption. Examples of NR-Light devices include high-definition inspection cameras, advanced sensors, remote-controlled drones, and 5G-compatible smart watches.

Many industrial sensor designs and standards do not fall squarely within the clearly defined eMBB, URLLC, and Massive Machine Type Communications (mMTC) Release 15/16 performance objectives. The allure of NR-Light is that it would be able to complement (not replace) LTE-M/NB-IoT and eMBB devices. NR-Light can cater to more sophisticated use cases with higher data rates/reliability when compared to LTE-M/NB-IoT. With respect to how it matches up with eMBB devices, NR-Light devices are more suitable in deployments that need lower cost, lower complexity, and longer battery life, and are not as data-intensive/mission-critical (in which case eMBB devices would have to be utilized).

Introducing Variety

|

RECOMMENDATIONS

|

Introduction of NR-Light devices within the operations of enterprise verticals will provide implementors more options in addressing varied use case requirements with appropriate connectivity specifications. Integrating NR-Light would also allow enterprises to streamline their spectrum asset management (by migrating all their devices to IMT-2020 5G bands) and would avoid the management of three separate networks. Enterprises can port all of their IoT device classes in the same frequency bands (including FR2/5G millimeter wave frequencies), with NR spectrum supporting both NR-Light and eMBB/URLLC devices, while lower bandwidth-consuming NB-IoT/LTE-M can be deployed in the guard bands. Using NR-Light devices would also better position the enterprise in leveraging future 5G core features such as network slicing and its Service-Based Architecture (SBA).

The fragmentation of device classes requires implementors to discern the connectivity needs and intended outcomes of each use case they desire to adopt. Successful navigation of these diverse device classes is therefore dependent on identifying accurate connectivity requirements of each use case and applying the appropriate device that can execute the desired outcome. Specifically, prescribing the appropriate device class technology involves identifying the correct type of data that they want to analyze (i.e., detecting minute, imperceptible errors on manufactured products versus merely measuring the vibration rate of a particular machine), while taking into account the latency requirements (mission-critical or does the process have high delay tolerance) and power requirements of the use case in question.

Tier One vendors such as Nokia, Huawei, Samsung, Ericsson, and ZTE have been driving the discussion forward for NR-Light within the 3GPP discussions. As 5G continues its forward march, the demand for more capable wearable devices will only increase as the maturity of use cases catches up. It remains to be seen when exactly NR-Light devices would finally emerge in an enterprise environment given the delays of Release 17. An expedited timeline would definitely please IoT device vendors because they have much financial incentive to produce NR-Light devices once Release 17 is frozen. The ABI Research market data (MD-WEAR-103) forecasts that global wearable device revenues would balloon from US$21.9 billion in 2020 to US$34.2 billion in 2025, and the introduction of NR-Light would only serve to push these financial projections higher.