BlueBotics Develops Robots via Partnerships with OEMs

![]() 02 Nov 2020 |

IN-5953

02 Nov 2020 |

IN-5953

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

![]() 02 Nov 2020 |

IN-5953

02 Nov 2020 |

IN-5953

Something Happened |

NEWS |

In September, Swiss vehicle automation provider BlueBotics partnered with Ultra-Violet (UV) disinfection vendor Engmotion to develop UV-equipped robots for disinfecting areas in the wake of COVID-19. Using its Autonomous Navigation Technology (ANT) module, the disinfection systems are mounted with UV lights that are used to disinfect hospitals and medical facilities. These systems have become increasingly popular in the wake of COVID-19, and while Danish vendor UVD Robots is the main player, other vendors like BlueBotics and Fetch Robotics have repurposed their technology stacks to provide these robots.

The UVD robots are not cheap, with sales and deployment costs reaching close to US$100,000 per system. Chinese healthcare providers ordered 2,000 earlier in 2020 at the height of the crisis. There is also demand in other public spaces, as the BlueBotics/Engmotion system was recently deployed at an international airport in Italy as part of a pilot project carried out by Software Design. Airports and other areas need to disinfect, but are suffering from low employment, so demand for robots has increased.

Based on multiple studies, UVC light is proven to destroy up to 99% of viruses on surfaces, including the SARS family of viruses and vegetative bacteria, and the mobility created by placing UVC light on robots makes for an effective solution. The costs of secondary infections in hospitals can mount to US$15,000 per patient. In the age of COVID-19, this challenge needs to be met with automated disinfection.

Nevertheless, major challenges come with deploying these systems, notably integrating them with local management systems and integrating the user interface effectively. The BlueBotics ANT server is an important fleet management tool that can centralize the entire operation of the robotics fleet and connect to other robots developed by BlueBotics for different purposes.

It Is Having an Impact |

IMPACT |

Disinfection systems for hospitals are a big short-term opportunity for robotics, but they are a fraction of the wider opportunity in automating manual cleaning equipment. Commercial cleaning systems are a big business. In 2017, the American Association of Cleaning Equipment Manufacturers (AACEM) released figures on the domestic industry, tracking the sale of commercial cleaning vehicles, including;

- 134,000 hard floor commercial cleaners sold (US$486 million)

- 35,000 sweepers sold (US$88 million)

- 36,000 extractors sold (US$64 million)

- 792,000 vacuums sold (US$182 million)

The multi-billion-dollar industry is characterized by a small number of key vendors, with Tennant and Nilfisk being among the largest. Both companies recorded US$1.13 billion in revenue for 2019 and are weathering the challenges of COVID-19 well. Both companies have invested in developing automated cleaning equipment.

Tennant, an American vendor, has focused on a long-term partnership with Brain Corp. The combination of the Brain Operating System (OS) with Tennant’s expertise and support network has created a powerful combination that has seen grocers like Walmart and more localized grocers like Schnucks deploying robots for scrubbing.

Nilfisk is a Danish vendor that competes with Tennant and is very much its equivalent in the European market. In 2019, Nilfisk also partnered with Brain Corp. Later in 2020, the company rolled out its Liberty SC60 autonomous scrubber, powered by Brain OS. The robotics vendor has received considerable funding and is closing in on 4 million autonomous hours of operation by the end of the year, claiming to have enabled 14,000 vehicles with autonomous navigation so far.

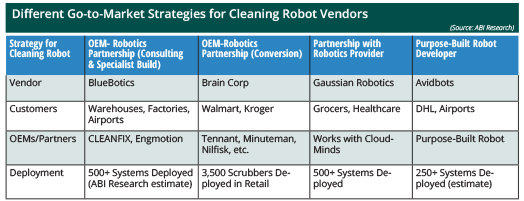

While Brain has enabled the most autonomous cleaning systems, BlueBotics is also partnering with Original Equipment Manufacturers (OEMs) to automate vehicles, and is gaining competitive advantage in a number of industries. The rapid development of a UV disinfection robot with Engmotion showed the vendor’s ability to respond rapidly to customers’ needs, and this focus on deep partnerships has seen BlueBotics become one of Europe’s premier mobile automation vendors, with more than 2,000 ANT-driven systems deployed and operating globally.

Alongside these giants, there are smaller players like Swiss-vendor CLEANFIX, which partnered with BlueBotics to develop the RA Navi robot. Its cleaning system is a purpose-built robotic scrubber (the old Navi system cost US$33,000) and can be deployed across a wide range of environments. However, unlike many other vendors, most of BlueBotics’ customers are in the warehouse and industrial spaces. It also has partners in retail, notably NEX Mall in Singapore, and has begun cleaning floors at Japanese train stations and even the Changi Airport in Singapore. The new BlueBotics-powered RA Navi 660 XL robot comes with a fully automated charging station co-developed with German manufacturer Kuka AG, and can be controlled from a fleet management app. The CLEANFIX partnership has, so far, yielded hundreds of autonomous cleaners in operation for BlueBotics.

Canadian developer Avidbots has deployed close to 500 cleaning robots, which are purpose-built as opposed to being the result of a partnership with OEMs. While BlueBotics and Brain Corp play a complementary role with the dominant market players, Avidbots is competing with them. There are benefits both ways, with a dedicated robot option allowing the design team to optimize performance from the ground up. This has led to the success of vendors like Avidbots, which has more than 250 scrubbers deployed. Purpose-built strategies also mitigate the problems of vendor lock-in for the robotics company. It does not have to worry about partnering between different OEM rivals as it is entering the market as a standalone competitor.

Partnering with established industry players gives robotics companies the resources to scale quickly. Companies like Tennant, CLEANFIX, and Nilfisk are employing hundreds and even thousands of technical workers worldwide, so they can be relied upon to assist with installation and maintenance challenges that a robotics vendor cannot afford to focus on. Based on shipments alone, the OEM partnership model is proving the most successful way for robotics vendors to enter the cleaning equipment market.

Here's What We Think |

RECOMMENDATIONS |

The partnership with Engmotion and their competitiveness in the cleaning space is evidence that the BlueBotics approach of close partnerships with OEMs, consulting to build high-quality robots and using a broad net of distributors is an excellent strategy for Autonomous Mobile Robot (AMR) companies. Having existed since 2001, the company has not relied on the generous funding afforded to its younger competitors, and so it is less threatened by short-term downturns or by increased scrutiny on Return on Investment (ROI). This has allowed BlueBotics to develop a strong foundation of 2,000 automated vehicles that will help them reap the benefits of widescale automation over the next 10 years.

ABI Research projects the number of commercial cleaning robots (including vacuums) shipped annually will grow from 4,000 in 2020 to more than 800,000 by 2030 worldwide. Combined with the millions of consumer-focused robotic vacuums, cleaning will be automated to the same degree as material handling throughout the supply chain.

As the demand for cleaning systems grow, prospective buyers need to keep a few questions in mind:

- Infrastructure: While robot vendors increasingly tout the benefits of AMRs and the lack of need for magnetic tape or other expensive infrastructure to navigate the environment, many mobile cleaning systems still rely on other infrastructure like Quick-Response (QR) codes for localization. Even more advanced systems that use natural navigation are relying on user-generated maps that have to be updated based on changes to the environment; without external infrastructure, errors and edge cases are more common. End users should keep an eye out for technology solutions that provide greater technical redundancy for automated cleaners. An example might be Radio Frequency (RF) beacons that are already being popularized in ports and subway stations.

- Expected Speed of Rollout: Rollouts of such complex systems can be hampered by delays, but vendors are improving, particularly those being assisted by OEMs like Tennant and Nilfisk. Brain Corp managed to roll out 50 cleaners in 3 weeks when it partnered with grocer Schnucks.

- Distributor Network: Does the robotics vendor have a local supplier or system integrator partner that can assist you and speed up the process?

- Remote Installation: Does the vendor offer remote installation and/or how long does installation take?

- Key Performance Indicators (KPIs): Does the vendor effectively keep track of KPIs like autonomy exceptions, uptime, and usage, monitoring that the area is cleaned every session?

Taking all of these into account, companies will increasingly use companies with mature solutions like BlueBotics and its channel partners to supplement their workforces and improve productivity by siphoning off cleaning duties to autonomous machines.

Some might argue that robotics deployments are moving too fast. Rather than deploying autonomy early and having to risk costly installations and challenges like configuration and autonomy interventions, some end users might wait 2 to 5 years for more comprehensive and tested solutions to come to market. But this approach ignores the external environment. The impact of the pandemic on the global economy is proving to be seismic, and while many sectors struggle, larger vendors like Amazon in e-commerce and Walmart in retail are investing heavily in automation. While companies should not uncritically install robots for their own sake, they have to keep pace with the trends set by the largest and most well-resourced corporations, or risk falling further behind in productivity and market share.