It's Not All About COVID-19

|

NEWS

|

The focal point of the Subscriber Identity Module (SIM) market in 2020 has been how COVID-19 will impact the SIM card market. Pre-COVID-19, the SIM card market was already decline as it related to the removable SIM card, with over 80% of SIM card shipments delivered to the handset market, so it should come as no surprise that 1H 2020 was one of significant challenge.

COVID-19 has had and continues to have a disastrous impact on the global devices market, particularly during 1H 2020, driving major disruptions for production lines, related supply chains, labor shortages, and inactive logistics, delaying shipments and weakening the development of next-generation products.

Although the SIM card market is expected to bounce back, the damage will have already been done in 1Q and 2Q 2020. Along with the COVID-19 impact is the additional and continued focus on Embedded SIM (eSIM) technology. eSIM device integration continues to gain traction and is a market beginning to evolve with new converged chipsets, encompassing eSIM, and Secure Element (SE) functionality beginning to make their marks within the market.

This insight takes a closer look at the longer-term impacts on the SIM market, driven by eSIM and other market factors; market trends already well established pre-COVID-19, with COVID-19, likely to result in further acceleration of eSIMs.

Extremely Positive eSIM Market Trajectory

|

IMPACT

|

Today, the greatest threat for the removable SIM form factor is not that of the eSIM, but the fact that the handset market is already extremely saturated, limiting growth opportunities. In addition, smartphone Average Selling Prices (ASPs) are steadily increasing, directly impacting churn rates for the removable form factor in a negative way.

Higher handset costs are applying additional pressure to the market, as operators and end users look to spread the cost of higher priced devices over a longer period of time. Operators have already reacted to higher-cost devices by extending contract lengths from 12 to 24 months to 36 months and, in some instances, 48 months.

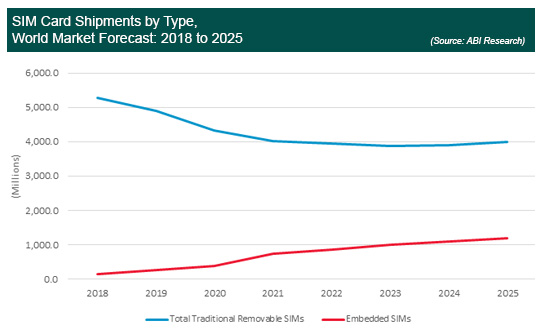

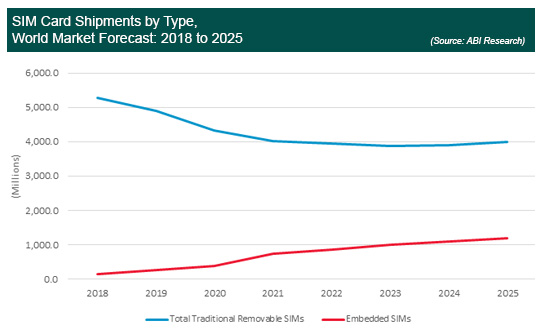

Over the course of the forecast period, these dynamics are expected to have an impact on the removable SIM supply, forecast to decrease from 4.89 billion in 2019 to 3.99 billion in 2025. Overall, the reduction in removable SIM card demand will be offset by eSIM issuance across the consumer and Machine-to-Machine (M2M) market, which is forecast to hit over the 1 billion mark by 2024, resulting in a market capable of achieving a minor Compound Annual Growth Rate (CAGR) of 1.9% between 2020 and 2025.

ABI Research expects that the market for removable SIMs will only marginally be impacted by eSIMs in the short term (next 2 years), thanks to a continuation of dual SIM device issuance (encompassing a removable SIM slot and eSIM).

Today, no operator is exclusively supporting eSIMs from a consumer perspective, but increased eSIM support across carriers and further integration by major OEMs will result in a higher level of impact, likely starting in 2022 at the earliest, with the largest impact on the consumer devices category.

It's Time to Get on Board with Converged eSIM Solutions, although Standalone eSIMs Will Remain Relevant

|

RECOMMENDATIONS

|

In addition to increased eSIM adoption, a newer trend is the use of converged eSIM chipsets, which combines eSIM and SE functionality, with Samsung currently leading the way.

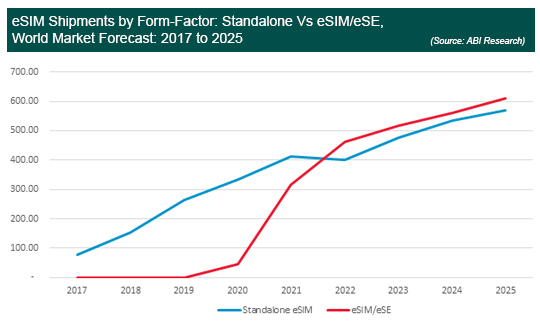

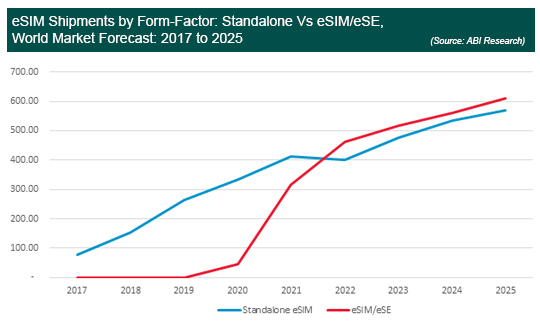

Overall, ABI Research is forecasting exponential growth within the market for converged eSIM/SE solutions, growing from an initial base of 45 million in 2020, driven by Samsung's S20 and Note ranges to more than 600 million in 2025, as other Original Equipment Manufacturers (OEMs) look to combine secure connectivity with the ability to house, store, tokenize, and/or encrypt different credential types linked to other applications, such as mobile payments.

Samsung is placing an emphasis on product streamlining, moving from several model variants to its A range devices, so expectations are that Samsung will significantly increase its use of eSIM/SE across its A range in 2021.

ABI Research anticipates that Apple will also move to a converged eSIM/SE solution integrated in its 2021 device launch. The synergies between Samsung and Apple from a service perspective, given their respective mobile payment platforms, makes Apple the favorite as it relates to the next OEM that will take advantage of the convergence trend.

In addition, combining functionality and reducing chip quantity per device lends itself well to smaller form factors, most notably smartwatches, where design space comes at a premium and a market in which Apple has a significant market share.

ABI Research expects that the converged eSIM/SE market will almost be fully driven from a consumer device standpoint, most notably smartphones and wearable devices during the forecast period ending in 2025.

Despite the clear trend in converged eSIM chipsets, ABI Research believes an overall growing market for standalone eSIMs exists. Converged solution adoptions are directly driven by higher-end computing device types that are multi-application in nature. This cannot be said for other device types, particularly within the M2M domain, where cellular enablement is the key requirement, and particularly within devices with low-power and low-computing constraints, such as asset trackers. A one-size-fits-all eSIM approach can no longer be considered relevant in the market, so ecosystem players must broaden product and service portfolios to encompass both standalone and converged eSIM solutions.