The Rise of Corporate Social Responibility in the Payments Card Market

|

NEWS

|

As the smart card market becomes increasingly aware of the usage of first-use PVC, the major ecosystem players are looking for the optimal materials and technologies which are sustainable and enable them to pivot away from non-biodegradable plastics. While sustainable materials have been explored as substrates in the payment card market for a number of years, they have so far failed to gain traction and transition to a mainstay for card issuers. Now, with an increased awareness of the global ecological situation and a growing eco-conscious consumer base, the smart card market (and major ecosystem players) are looking to make sustainable substrates and practices a mainstay.

However, it is important to consider that next-generation smart cards will need to be looked at from a marketing perspective as well as the manufacturing and personalization process. This includes how the substrates are sourced, collected, manufactured into raw resources, transported, and personalized right across the value chain. As such, sustainability in the smart card market must remain a concerted effort by all involved.

With Opportunities Come Shortcomings

|

IMPACT

|

The development of sustainable and alternative substrates to PVC opens a number of opportunities for the major ecosystem players:

- Banks and Financial Institutions can offer alternative materials which appeal to end-users who are conscious of the environmental impact of the cards they carry, demonstrating the bank or financial institution’s willingness to take their role of corporate responsibility seriously.

- End-Users can sport a payment card which is made of a sustainable material such as PLA or reclaimed ocean plastic and be perceived as involved in the preservation of the global ecosystem.

- Smart Card Personalization Solutions Providers open the market for personalization solutions which cater specifically to the myriad requirements of alternative and sustainable substrates where typical PVC personalization equipment may not function to its full potential.

Before sustainable materials can truly take hold, there is a requirement for global standardization to fulfill. As a result, a number of organizations have introduced certifications or formed consortiums to provide guidance at the lower level for ecosystem players looking to reduce the carbon footprint of their product portfolios:

- Greener Payments Partnership – Mastercard, in league with Thales, G+D, and IDEMIA, are looking to reduce the presence of first-use PVC in all payment cards and lead research and development into bio-sourced and recyclable materials. This partnership is arguably the one with the largest reach, issuing alternative, greener materials to over a dozen countries and resulting in over 60 financial organizations.

- PAS 2050 – From the British Standards Institution, in cooperation with ISO standards and the European Commission, PAS 2050 provides best practice guidance in terms of ecological output and relates primarily to the manufacturing and personalization stage of card issuance, as well as the end-of-life card disposal through the use of incineration, etc.

- ISO 14017 – Introduced in 2018, ISO 14017 was published to quantify the carbon footprint of goods in order to reduce the overall production of greenhouse gases and increase sustainability of business practices.

Although some of these requirements have not been fulfilled yet, sustainable materials are taking hold in a number of regions.

Regional and Material Adoption Trends

|

RECOMMENDATIONS

|

Europe and Asia-Pacific will champion the growth of sustainable materials on the global scale. Europe, due to the presence of a high number of major card vendors such as Thales, IDEMIA, and G+D, along with significant research and development into alternative card materials and personalization technologies, will establish recycled PVC as a mainstay material and PLA as the most prevalent niche material. Meanwhile, PETG enjoys a strong market in the Asia region, in countries such as Indonesia, Taiwan and Japan.

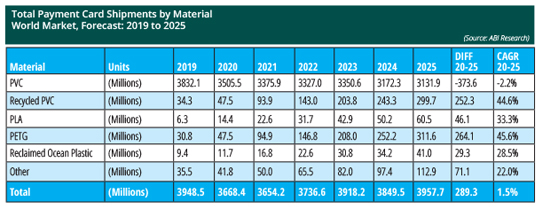

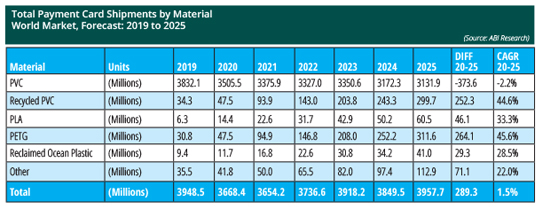

Derived from biomass sources such as plant leaves and corn rather than petroleum, PLA can be grown from entirely organic sources, and can be reused at the end of its lifespan or biodegraded to continue the environmental cycle. ABI Research forecasts PLA payment card shipments rising from 14.4 million in 2020 to 60.5 million in 2025.

PETG and recycled PETG are considered a strong contender to PVC. With a long lifecycle, PETG is considered sufficient for usage in applications such as payments and banking, with the ability to sustain wear and tear. It also sports a recyclability matching that of PVC to ensure a limit on the need for more first-use PETG coming into the ecosystem. Recycled PETG as a post-industrial material is beneficial, as it involves reducing the carbon footprint by reusing material that is already processed. ABI Research projects strong growth for PETG and recycled PETG, rising from 47.5 million shipments in 2020 to 311.6 million in 2025.

Diverting plastic from the ocean waste stream through the use of post-consumer recycling opens the door for reclaimed ocean plastics to be used as a smart card material. Reclaimed ocean plastic cards provide excellent marketing opportunities for banks and financial institutions who can offer a card that is very appealing to an eco-conscious end user. However, supply-chain issues and the use of additional glues and solvents in the manufacturing process can hamper sustainability. ABI Research sees reclaimed ocean plastic cards as a niche material, rising from 11.7 million shipments in 2020 to 41.0 million in 2025.

With the combined efforts of multiple ecosystem players across the value-chain and the inexorable development of standardization and certification, sustainable materials look set to become a mainstay in the payment card market. With shipments of first-use PVC cards set to fall from 3.5 billion in 2020 to 3.1 billion in 2025, there is a concerted effort to reduce the introduction of first-use PVC into the ecosystem. As we move into the forecast period, more and more card vendors, banks, and solutions providers will add their weight to the effort, accelerating growth even further.