TIP EMEA Open RAN Latest Updates

|

NEWS

|

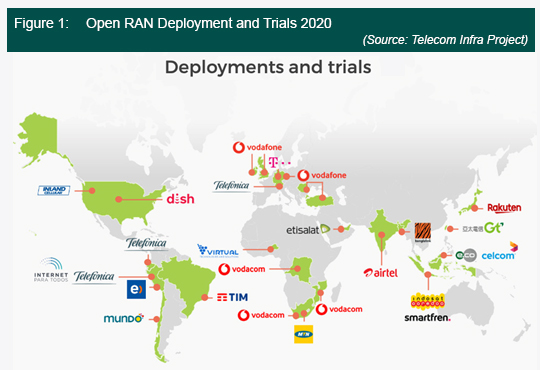

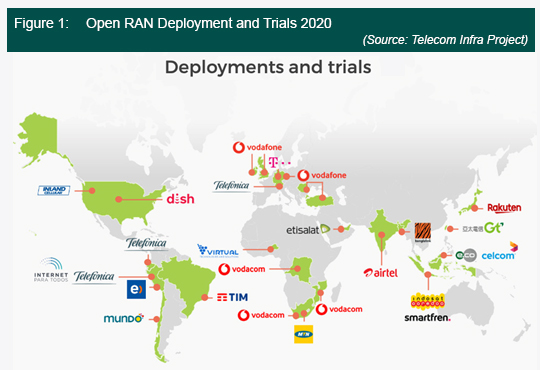

In the latest Telecom Infra Project (TIP) Insights Series 2020 for Europe, the Middle East, and Africa (EMEA), the CTO of UK Vodafone announced Vodafone’s commitment to deploy 2,600 Open Radio Access Network (RAN) sites between now and 2027, reaching 1,150 installed base by 2023. This is one of the first large-scale deployments of Open RAN in Europe. Vodafone would also initiate a tender covering more than 100,000 sites in 14 countries in Europe. Open RAN deployment is focusing more on rural deployment in the first half of the deployment forecast, and then shifting to urban deployment once the technology and ecosystem mature further.

TIP has been spearheading Open RAN development and is asking all operators to start using Open RAN in Europe. It is transitioning to be more of a coordinating body rather than a standardization body, which is essential for Open RAN moving forward, because operators will have different requirements that need to be consolidated for small vendors to address. The O-RAN Alliance continues to be the main standardization and specification body and is in charge of developing specifications for open transport interfaces and reference designs, RAN intelligent controllers, and other RAN-related functions.

Open RAN Deployments Ramping Up for 2021

|

IMPACT

|

In November this year, Rakuten finally joined the O-RAN Alliance, signaling a greater commitment to developing Open RAN specifications, a key towards the success of its Rakuten Communications Platform (RCP), which promises to bring multi-vendor cloud-native functionality for operators worldwide. The company has also partnered with Saudi Telecom Company (STC) to collaborate on Open RAN and its RCP.

These Open RAN developments show that vendor diversification has become an important point for many operators. One reason for this is its potential in reducing Capital Expenditure (CAPEX). A traditional single-vendor deployment approach utilizes proprietary solutions that are provided by one vendor across the whole telco cloud stack, resulting in vendor lock in where the same vendor is required for hardware, software, and legacy equipment upgrades. This lock in puts operators at a price disadvantage because the vendor has leverage in price negotiation and could raise prices, thus boosting operators’ CAPEX. However, with vendor diversification, different vendors can provide different components of the telco cloud stack due to the open interfaces and disaggregation of hardware and software. This increases competition and choice, putting downward pressure on price, thus allowing operators’ CAPEX to be reduced, and also allowing greater cost efficiencies to be realized, as each vendor has their competitive advantage in providing different services.

Another reason is that vendor diversification galvanizes innovation and is better suited for new B2B value creation for enterprise end verticals. This is because an Open RAN with a multi-vendor environment is likely to involve pure-play network software providers with cloud-native and software expertise, which can help operators improve network flexibility and agility. This is crucial in a 5G era for enterprises that have specific latency and bandwidth for features such as network slicing that requires workloads to scale dynamically and on-demand. Furthermore, an open network exposure allows operators to implement new business models through partnerships with different vendors and innovation by developer communities, which initially were gated by single-vendor proprietary solutions in the telco stack. This is crucial for disruption in the enterprise market. The conventional approach to deploy private 5G for Small and Medium-sized Enterprises (SMEs) is not cost-effective, according to Rakuten CTO Tareq Amin. Open RAN is well-positioned to solve the problem by introducing vendor diversification and innovation to provide “plug-and-play”-like deployment of private 5G solutions on the factory floor for SMEs.

Of course, there is much debate towards whether a multi-vendor Open RAN environment is vital to the telco industry. While most incumbent vendors (like Huawei and Ericsson, as examples) might argue that current operator requirements can be fulfilled through the proprietary carrier-grade solutions offered by them, operators and smaller vendors like Rakuten and Altiostar have been collaborating on Open RAN on a commercial scale, with the RCP incorporating multiple vendors such as NEC and Altiostar into its open cloud-native platform. As such, we might conclude that the debate is not grounded on technological advantage, but more about maintaining and holding market share, with operators making decisive efforts towards Open RAN.

Weighing the Pros and Cons of a Multi-Vendor Open RAN

|

RECOMMENDATIONS

|

Open RAN will create a positive impact on the industry in the years to come, and even big vendors like Nokia, which is part of the O-RAN Alliance, are looking long term to ensure that they do not get disintermediated. However, Open RAN is not a silver bullet for all the pains of the current technology standard. Operators must understand certain challenges of utilizing a multi-vendor approach when it comes to deploying Open RAN, which are outlined below.

ABI Research’s Telco Cloud Strategies finds that while Open RAN does bring about many new opportunities for the telco industry, due to fragmentation brought about by multi-vendor solutions and current orchestration abilities, the Time-To-Market (TTM) for deploying multi-vendor deployments could be higher than using single-vendor proprietary solutions. One such result is the time taken to troubleshoot network problems, which ABI Research finds to be 2.7X longer in the case of a multi-vendor approach. This is because it will be hard to attribute network failures to the correct vendor, and due to the difference in cloud OS and VNFs update cycles, there could be compatibility issues. For example, the cloud OS provider may not support In-Service Software Upgrades (ISSUs), and thus when the cloud OS is upgraded, there could be a service interruption in upper-layer VNFs due to changes in software compatibility.

However, with better orchestration capabilities in the future and as the ecosystem matures, Open RAN will become extremely beneficial for the telco industry. ABI Research recommends trialing use cases in manageable scopes first, such as providing private networks to the enterprise domain, where use cases can be isolated and limited to certain factory floor sizes. Then, operating models and business use cases should be analyzed after trialing. This is so that the perceived risk of Open RAN can be slowly mitigated and understood over time. While Open RAN is indeed a trend that is and will shape the industry, operators should not rush into a multi-vendor Open RAN, but instead understand their current requirements for certain markets and threshold for risk before deploying.