5G Slices vs. Private Networks

|

NEWS

|

Network Slicing (NS) is a key enabler of new business models and a key feature for 5G. It revolves around the notion of designing and redesigning current static networks with new constructs that enable the creation of logical networks/partitions. Communications Service Providers (CSPs) can slice the network using different criteria, such as application types (e.g., MTC, uRLLC), security, mobility, traffic types, and quality of service (QoS). A CSP can configure its network assets based on specific criteria or establish a hybrid categorization. Either way, new service creation based on 5G NS takes a “global” span extending to multiple domains (e.g., radio, core, and transport) to connect to customer data centers and networks. This lays the groundwork for a more controllable, flexible connection environment without modifying the properties of the underlying infrastructure that provides the raw network capabilities.

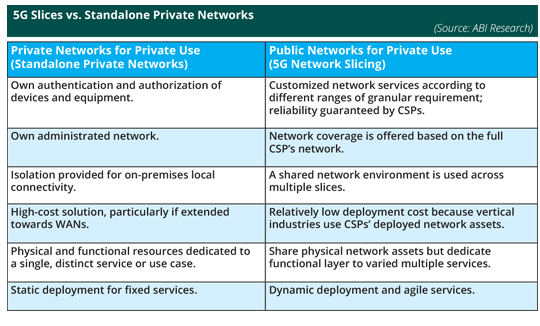

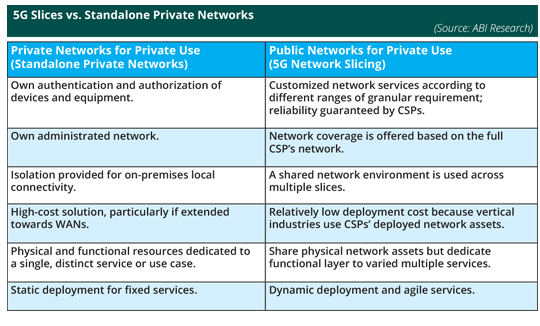

A private network can be viewed as the evolution of non-3GPP private networks (e.g., virtual private networks) to customized 5G connectivity arrangements tailored to a vertical’s requirements. A private network affords better isolation of resources and local connectivity. Private networks can be customized in line with different use cases, services, throughput, and latency for better security, particularly for mission-critical services. This comes at the expense of rigidity, because with private networks, physical and functional resources are dedicated to a single, distinct service or use case. Consequently, challenges may arise when adopting services that must be mapped to different ranges of QoS, service level agreement (SLA) requirements, and service function chains. Private networks, as shown in the table below, require larger investments—particularly if connectivity is extended toward wide area networks (WANs).

Commercial and Technology Outlook for 5G Slicing

|

IMPACT

|

There are three business drivers for 5G NS. One, new services can be deployed with little or no disruption to existing services. With today’s networks, service agility is a challenge because the introduction of new services necessitates reconfiguration of underlying networks. Two, verticals can achieve lower deployment costs. A shared network infrastructure used across multiple slices promotes better resource utilization and can, in theory, reduce integration scope and complexity. Three, 5G NS enables vertical partners to bring to market a wider range of business services based on 5G slices that are customized in line with required SLAs and network KPIs. Importantly, a wide-ranging pool of SLAs and network KPIs will require different network configurations at the functional layer. Therein lies a key differentiator of 5G slicing compared with private networks.

When considering 5G static private network deployments with dedicated resources, there is a uniform architecture. Here, physical resources and the functional layer are dedicated to each service type. This architectural uniformity may pose challenges because different services will almost certainly have different functional requirements. For example, there may be services that require high mobility and there may be services that require low or no mobility because they reside in fixed locations. 5G NS, by contrast, enables the creation of multiple logical networks, and by extension, multiple functional layers, atop a common shared physical network infrastructure. Different functional layers can be created for specific services with different mobility, SLA, and business requirements.

By opting for dynamic 5G slicing, verticals can execute a high degree of network polling across physical network assets. They can categorize the services according to different ranges of criteria and service function chains. The latter is particularly noteworthy because with E2E 5G slicing, there is involvement of multiple professional categories of the radio access network, transport network, core network, and even device level. In addition, 5G slicing will almost certainly span multiple vertical industry applications. Eventually, a full 5G slicing mechanism will involve interworking with a plethora of existing systems and interconnection among multiple vendors. For instance, the reconstruction of business support systems (BSS) and operations support systems (OSS) for slicing management will be a key discussion point in the future. Slice subscription, slice ordering, slice charging, and E2E assurance and QoS monitoring require further enhancements, and are expected to be considered in Release 17 and beyond.

This extensive scope of 5G slicing requires the maturity of the wider ecosystem. However, vendors are already investing to propel ecosystem cohesion and bulk up their 5G slicing capabilities. ZTE, for instance, has a comprehensive portfolio that spans slicing management for core network, transport, and access with its CloudStudio and ElasticNet offerings. Similarly, Amdocs, Ericsson, Huawei, and Nokia are some vendors, among many others, that are designing slice-specific packages that offer synergies with existing systems. But beyond technology and ecosystem maturity, when it comes to widespread deployment of 5G slicing, the onus is on CSPs to go beyond existing trials by building up trust with vertical partners to better solicit their commercial requirements.

Build End Vertical Trust

|

RECOMMENDATIONS

|

5G slicing is not the only technology that offers logical partitions of a network. So which services are good candidates for it? In general, services that require a different functionality—SLAs, QoS types, and security—are all good candidates. For example, a smart port use case raises low latency requirements for remote control capabilities, but a video surveillance use case needs high bandwidth capacity. Another example is IoT, where the connectivity requirements to support millions of devices will almost certainly be different to what we see in static networks. It is impracticable to add that service to a static 5G private network with dedicated physical resources and functional layer. Moreover, applications at the edge, for instance, require low latency so that services which utilize that infrastructure can be classified as one service category. Best effort traffic can be categorized as another.

It will take time for a full-maturity, slice-ready ecosystem to emerge. With a mature ecosystem in place, end verticals will have choices as to whether they choose private networks or the public network (i.e., 5G slicing) for private use. That choice will depend on two factors: one, individual use case requirements; and two, investment capacity at a vertical’s disposal. New investments will need to be channeled on five fronts: one, investment in edge computing to properly develop URLLC; two, introducing network slicing in the core with widespread adoption of hybrid/stand-alone core; three, increasing the number of terminals that support network slicing; four, evolving 5G network slicing with new technologies such as AI and ML; and five, continuing to develop eMBB while also accelerating investment in URLLC and eMTC.

5G slicing is a journey for the industry. Campus/local area network (LAN) deployments and same-vendor implementations are likely to be commercialized in 2021 and 2022. Multi-vendor and wide area network (WAN) deployments will materialize further down the line with industry-wide alignment on terminal support and more enhancements in Release 17, particularly for QoS monitoring and assurance. Ultimately, widespread deployment of 5G slicing requires that the industry adapt traditional ways of doing business to include enterprise capabilities. To that end, the telecoms industry should aim to extend trust and build relationships with vertical partners. That will enable CSPs can better address end verticals’ pain points, collectively identify the business models to be adopted, and eventually transition from existing proofs of concept (PoCs) and trials to commercial deployments.