Pandemic Demand for Lab Automation Serves as Springboard for Precise to Achieve an Exit

|

NEWS

|

Precise Automation, a well-known provider of cobots for the pharmaceutical industry, has been acquired by larger automation provider Brooks Automation for US$70 million. Precise has been built by the same team that kickstarted commercial robotics with Unimate, and then went on to pioneer mobile robotics with Adept Motion Technology (both companies were in the end sold to larger automation vendors).

Precise has benefitted greatly from the increased demand for lab automation in the wake of COVID-19. The company saw sales outstrip manufacturing capacity for its systems, with talk of demand growth exceeding 300% for 2020. Precise Automation achieved revenues of US$17 million in 2020.

Brooks Automation, a life sciences and semiconductor automation vendor, reported increased revenues of US$897 million in 2020, up from US$781 million in 2019. The addition of Precise will be a major boost to not only cement Brooks’s place in the lab automation space, but could open new opportunities in manufacturing and industrial applications.

The Wider Cobot Industry

|

IMPACT

|

While Precise has been successful in defining its product for a particular industry, many other new vendors have struggled to find their place. A few select vendors, particularly Universal Robots (UR) and Techman, have built platforms for third-party vendors that allow for easy customization of their cobot solutions. The big four robotics manufacturers (ABB, FANUC, KUKA, and Yaskawa Motoman) all have their own cobot products, but other vendors like Yuanda, Franka Emika, Neura Robotics, and Kassow Robots have yet to impact the commercial market significantly. There are many other players in what is increasingly looking like a saturated market.

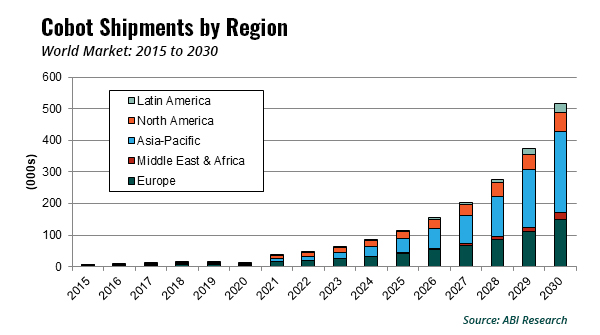

This is not to say that the future of cobots is bleak. Far from it. ABI Research projects up to 570,000 cobots to be sold in 2030, as opposed to the 16,000 that were sold in 2020. The demand fuelling this projected growth is the need for redeployable robots that are accessible to SMEs as well as larger vendors. There are technological hurdles holding the industry back, particularly regarding the limited payload and accuracy of current cobots, but these problems are not insurmountable.

Looking Forward

|

RECOMMENDATIONS

|

Precise is a case study of a cobot developer that may not have achieved the fanfare of UR but provided clear unique value and thus was able to make a successful exit. Cobot vendors should consider their example in the following ways.

- Be Solution- and Market-Oriented: There are already too many cobot providers. The market will almost certainly see some consolidation as the value of cobots becomes quantified and normalized. For vendors offering cobots, it is important to have a clear definitive answer about which particular markets and applications you wish to assist. UR, FANUC, and ABB likely will dominate the general-purpose cobot space due to their preferred position in the market. The remaining vendors that succeed will be those that either offer a product so cost-effective that it has general appeal across SMEs or, more likely, those that have targeted specific markets. This is exemplified by companies like Precise Automation, which cornered the lab automation market.

- Stress-Test Your Product and Focus on USP: Many new cobot vendors focus on their technology stack when advertising their product. It is important to consider what the barriers are for the larger vendors to acquire similar capabilities. With the exception of a few players like UR and the large industrial robot manufacturers, most companies that succeed going forward in cobots will be specialists that focus on specific markets like lab automation, or those that act as third parties to cobot developers, system integrators, and distributors.

- Consider Dropping the Term “Collaborative” and Remarket as “Convenience” Robots: Collaboration suggests that these systems are somehow working with humans in a way that industrial arms do not. In fact, most cobots work independently of human workers, and their main value is their ability to be redeployed, flexible, and useful (convenient) across different applications without the need for significant infrastructure investments.

Potential buyers and end users of cobot equipment should also hope to see these lessons reflected in the vendors they buy from.