By James Hodgson | 13 Sep 2021 | IN-6278

In August 2021 Qualcomm ramped up their ambitions in the automotive space by making a US$4.6 billion acquisition offer for Tier 1 automotive supplier Veoneer.

Log In to unlock this content.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

Rival Bids for a Software-Savvy Tier 1 |

NEWS |

In August 2021 Qualcomm ramped up their ambitions in the automotive space by making a US$4.6 billion acquisition offer for Tier 1 automotive supplier Veoneer. This bid quickly followed an earlier offer of US$3.8 billion from Tier 1 supplier Magna in July 2021 and could represent the culmination of a multiyear technology development partnership between Qualcomm and Veoneer that is focused on the development of Advanced Driver Assistance System (ADAS) and Autonomous Vehicle (AV) platforms.

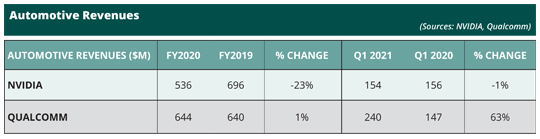

Qualcomm has been ramping up their automotive business in recent years, enjoying particular success in the digital cockpit domain. According to ABI Research interviews with vendors in the connected infotainment supply chain, Qualcomm’s System on Chips (SoCs) feature in almost every digital cockpit scheduled for production in the next few years. The table below demonstrates the recent acceleration of Qualcomm’s automotive revenues that have even overtaken fellow automotive semiconductor player NVIDIA earlier this year.

Now the acquisition of Veoneer has the potential to catapult Qualcomm’s ambitions in the ADAS and AV space.

No Ordinary Tier 1 Supplier |

IMPACT |

In recent years, the automotive industry has been growing their expertise and capacities in the digital domain either through organic processes such as setting up new digital divisions and hiring data scientists/software developers or through more direct acquisitions. Examples of the latter range from GM’s acquisition of Cruise in 2016 to Toyota’s acquisition of Lyft’s AV development division in 2021. Now the shoe is on the other foot—companies from a consumer technology background are adding traditional automotive know-how through the acquisition of an established automotive supplier.

Certainly, that would be one advantage for Qualcomm’s acquisition of Veoneer. While the offer valuation of US$4.6 billion confirms Veoneer as a relatively small Tier 1 supplier compared with the likes of Bosch or Conti, the acquisition would nevertheless give Qualcomm access to considerable experience in automotive-grade design and manufacture as well as access to an existing customer base that includes Original Equipment Manufacturers (OEMs) such as Volvo and Mercedes-Benz and seven OEMs who have confirmed standard operating procedures for Veoneer’s fourth-generation ADAS camera system.

However, the deal would offer much more to Qualcomm as Veoneer is no normal Tier 1 supplier. Veoneer is a spin-off from former Tier 1 supplier Autoliv and is divested from typical Tier 1 concerns such as engine and chassis systems. It has deep software expertise and a laser focus on the ADAS and AV domain. Until 2020, Veoneer co-owned Zenuity, a software company focused on the development of AV software functions. Veoneer retained much of that development effort after the stand-alone entity was dissolved. Veoneer has continued to develop a comprehensive AV stack called Arriver that covers perception and driving policy in conjunction with Qualcomm as well further generations of their ADAS software solution.

Therefore, the acquisition of Veoneer would give Qualcomm not only increased access to the automotive supply chain and automotive-grade design competence but also ownership of software assets critical to the delivery of AV functions ranging from ADAS to more comprehensive forms of automation.

Integrated Hardware and Software Development for Autonomous Vehicles |

RECOMMENDATIONS |

To date, Qualcomm’s collaborations with Veoneer have exhibited a clear pattern—marrying Veoneer’s software modules with Qualcomm’s suite of Snapdragon Drive SoCs and accelerators. This acquisition enables Qualcomm to take the codesign of AV hardware and software to a deeper level—an ability that has been critical to the success of its key competitor, Mobileye. Another hallmark of Qualcomm and Veoneer announcements to date is the term “open,” giving further indication that a Veoneer-bolstered Qualcomm would seek to provide OEMs with an alternative to Mobileye, whose solutions has been labeled as a black box by Qualcomm-Veoneer communications in the past. In the event that Qualcomm successfully completes the Veoneer acquisition, it will be essential for them to demonstrate a platform that rivals Mobileye’s in terms of performance and cost and to delineate the case for a more “open” solution to OEMs. What do OEMs have to gain in opting for a Qualcomm-Veoneer platform, and how can they take advantage of the apparently greater degree of “openness” offered by their rival competitor?