By Phil Sealy | 08 Feb 2022 | IN-6434

Despite overall eSIM market growth throughout the COVID-19 pandemic, 2022 is a critical year and expected to be impacted more severely by the chipset shortage.

Log In to unlock this content.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

COVID and the Chip Shortage—the Double Impact |

NEWS |

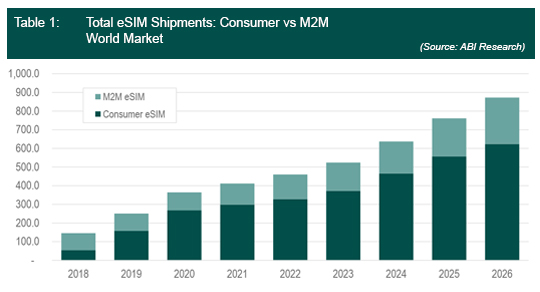

From an eSIM perspective, both the consumer and Market-to-Market (M2M) side experienced some form of impact from COVID-19. Although the overall market grew Year-over-Year (YoY), certain end markets suffered and this resulted in a limitation as it related to eSIM market growth potential.

In 2021, a new market constraint made itself known: the chipset shortage. Considered a byproduct of COVID, the chip shortage has the potential to impact markets more greatly and over a longer period of time. With 2021 just closed, vendors are beginning to better understand the chip shortage impact potential and although in 2021, the impact was not as severe as first anticipated, all eyes are now turning to 2022, considered by most industry players as the critical chip shortage impact year.

What Happened Driven by COVID |

IMPACT |

Though both the consumer and M2M side experienced some form of impact from COVID-19, eSIM markets overall did not result in a market decline.

In 2020, new eSIM-enabled consumer devices came to market and/or were being developed as part of the future eSIM devices pipeline, and any short-term market disruption was directly driven by supply chain issues, rather than by depleting demand.

Despite COVID-19, the consumer category for eSIM continued to grow impressively YoY, but this is largely thanks to the launch of the Samsung S20 and Note, alongside Huawei’s P40 devices, which began shipping in 2020, alongside continued eSIM device shipments, most notably across Apple’s range of devices. Therefore, the consumer eSIM market remained on a significant growth trajectory, with 2020 eSIM shipments growing 69% YoY in the consumer segment.

From an M2M/IoT perspective, automotive continued to be the dominant force. A significant reduction in auto sales in 2020 impacted this side of the M2M business, where auto eSIM automotive shipments were down 7% YoY. Despite this, eSIM integration into other applications including smart metering, asset tracking, and other industrial applications that counterbalanced the market, with the overall M2M IoT category growing 4% YoY.

Moving into 2021, consumer eSIM growth slowed. Although eSIM integration remained within all Apple smartphone models, Samsung continued to limit eSIM usage within its flagship devices and Huawei removed eSIM support from its P50 range of devices.

Despite the downward market trend within the automotive segment, demand from an M2M/IoT perspective is expected to increase post-COVID-19 and chipset shortage, as enterprises and businesses look toward further digitization to get themselves “pandemic ready” for the future. The ability to further automate systems and provision and manage Over-the-Air (OTA) and life cycle capabilities will shape enterprise strategies moving forward, as digitization and global connectivity are enabled to ensure continual operations.

Now all focus is shifting to 2022, which is considered the critical point in time as it relates to the chip shortage and its potential impact on the eSIM market.

eSIM Chipset Shortage Impact to be Minimal |

RECOMMENDATIONS |

Overall, the expectation is that the eSIM market will not be impacted by the chip shortage directly but rather indirectly. If Original Equipment Manufacturers (OEMs) cannot procure other components, then device manufacturing will be slowed, which could result in an indirect market impact.

Although supply of eSIMs may be healthy, the market risk is being presented by other chip component types and subsequent allocations. In 2020 the eSIM market experienced a low level of impact from COVID-19, not resulting in a market decline, but rather creating a limiting impact on growth. This limiting growth theme continued in 2021 and despite the market growing 12% between 2020 and 2021, post chip shortage annual growth expectations was in the 45% range, demonstrating this limiting growth factor.

2022 will likely mark another year of eSIM growth limitation, with ABI Research currently forecasting YoY shipment growth in the 12% range. A return to more aggressive double-digit growth is not likely until 2023, at the earliest, or at a time when additional chip manufacturing capacity comes online to help alleviate the strain on overall chip supply.