eSIM and Now the Chip Shortage - Is this Creating the Perfect Storm?

|

NEWS

|

Given the drive towards further digitization and the rise of the embedded-SIM (eSIM), alongside challenging market conditions created by the chip shortage, questions are being asked related to the future fate of the traditional removeable SIM form-factor.

Although the chip shortage is a new market challenge, the integration of eSIM technology into devices has been around for many years. While the eSIM has been on a significant growth trajectory, it is fair to say that the removeable SIM form-factor is yet to experience the impact from the eSIM.

Today the market is presented with a combination of short- and longer-term challenges, arguably creating the perfect market disruption storm and how market vendors and ecosystem players react today will define how they perform in the future.

What Will Happen to the Removeable SIM Card?

|

IMPACT

|

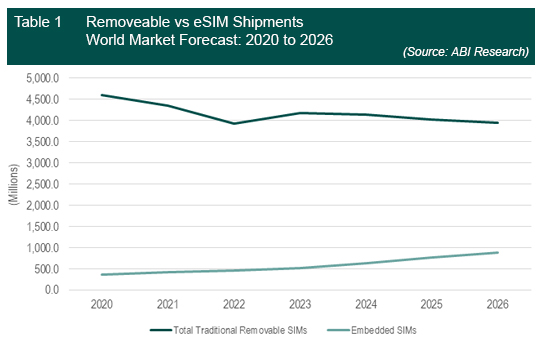

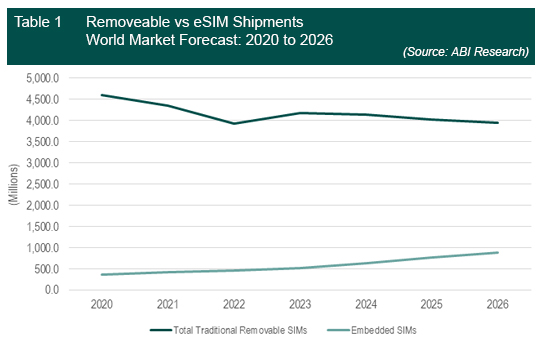

Table One outlines ABI Research’s forecast expectations covering both the removable and eSIM form-factors.

Forecast Expectations:

- There remains an expectation for a significant chip shortage impact on the removable SIM market, where ABI Research foresees shipments declining from 4.36 billion in 2021 to 3.93 billion in 2022 as the critical chip shortage year hits.

- Despite the chip shortage, this should be considered a shorter-term market challenge, likely to improve in 2023 as further manufacturing capacity comes online and the market briefly bounces back.

- Despite the foreseen market bounce back, ABI Research does not forecast a return to pre-COVID shipment levels for the removable SIM card form factor, driven by a reduction in replacement rates, alongside the eSIM impact.

- On top of longer SIM replacement cycles is the increasing use of eSIM. Overall, it is ABI Research’s understanding that the market for removeable SIMs will only marginally be impacted by eSIM in the short term (next twelve to eighteen months), thanks to a continuation of dual SIM device issuance (encompassing a removeable SIM slot and eSIM). However, with strong rumors circulating around the launch of an eSIM-only Apple device, a higher level of impact should be expected from 2023/2024 onwards.

- eSIM will not be as greatly affected by the chip shortage. It is ABI Research’s expectations that eSIM shipments will continue to grow throughout the shortage crisis, but allocation constraints and challenges related to the sourcing of other device components will limit growth in 2021 and 2022.

- Over the course of the forecast period, these dynamics are expected to have an impact on removable SIM supply, forecasted to reduce from 4.18 billion in 2023 to 3.95 billion in 2026. Overall, the reductions in removeable SIM card demand will be offset by eSIM issuance across the consumer and Machine-to-Machine (M2M) markets, which is forecasted to hit over the 685 million mark by 2026, resulting in a market capable of achieving a minor Compound Annual Growth Rate (CAGR) of 0.2% between 2021 and 2026.

- However, that data includes SIMs used within the M2M segment. It is important to note that ABI Research’s expects that the consumer segment for removeable SIMs will be impacted the most. In terms of consumer removeable SIMs, ABI Research has forecast that shipments will decline from 4.25 billion in 2021 to 3.52 billion in 2026 with significant Year over Year (YoY) shipment declining coming into force through 2024 through to 2026, as Apple’s eSIM only device launch begins to significantly impact the market and other Original Equipment Manufacturers (OEMs) launch eSIM only devices.

Clear Strategy Required to Mitigate Any Impact

|

RECOMMENDATIONS

|

The good news is that the removeable SIM form-factor is here to stay for a little while longer. However, ecosystem players need to be mindful of the fact that a downward market trajectory is going to happen, as it’s a case of when, rather than if.

In terms of vendor recommendations, ecosystem players need to react now, and while tackling issues related to the chip shortage in the shorter term, begin implementing longer term plans to ensure a level of market readiness as the eSIM begins to disrupt the traditional removable SIM card form factor.

First and foremost, the chip-set shortage is an opportunity for smart card vendors to reassess the markets to which they are active. They may opt out of lower-end opportunities in order to focus on more profitable sectors. Alongside this is the ability to further pivot towards the reoccurring revenue streams associated with eSIM.

Balancing demand with a future prospect of some Integrated Chip (IC) vendors exiting the SIM market should be tackled by not only increasing IC/foundry relationships, but increased emphasis on in-house SIM chip design in order to reduce reliance on IC vendors.

Having your own SIM Card design will place you in a much stronger position. Although this doesn’t give unlimited buying power, it does present the ability to discuss directly with other foundries and a higher level of flexibility.

Transparency will remain a key market requirement in the shorter term and/or until the chip shortage situation improves. Clear communication, education, and close collaborative work will be required to best navigate during this turbulent time. Communication from the leading SIM card and chip suppliers has been improving over the past twelve months and this level of transparency needs maintaining in order to achieve the collaborative ecosystem effect required to minimize market disruption.

In terms of blending the shorter-term chip shortage impact with longer term eSIM strategies, new connections should utilize the eSIM, with new customers offered eSIM activation where possible. This will help reduce the likelihood of a Mobile Network Operator (MNO) not being able to replace or supply a removable SIM card and reduce market strain and set the foundations for an eSIM future.

MNOs should be encouraged to use the chip-set shortage to audit themselves and use as an opportunity to streamline processes related to SIM card inventory management alongside eSIM readiness.

Using the chip shortage crisis to help flesh out and build upon eSIM readiness will not only help mitigate short term chip shortage impacts, but additionally used as the building blocks to help further scale future eSIM operations and readiness.