Hyperscalers Are Dangling Their Feet in the Network Service Pool, but Have Yet to Dive In

|

NEWS

|

Hyperscalers are forever looking to leverage their core competencies to enter new marketplaces. Most recently, in 2021, Amazon Web Services (AWS) surprised the market by introducing a private 5G solution. Already with a range of enterprise Wide-Area Network (WAN) solutions, hyperscalers are in a position, if they so choose, to double down and compete in the NaaS market:

- AWS has released Cloud WAN, Site-to-Site VPN, and Direct Connect as parts of its hybrid connectivity range.

- Azure delivers low-latency performance for cloud applications through ExpressRoute.

- Google Cloud Platform (GCP) offers Hybrid Connectivity, enabling connections from anywhere to the cloud.

All of these solutions are highly flexible, scalable WAN solutions offering an option for enterprises to simplify connectivity from on-premises to cloud applications across a global backbone.

The NaaS market could offer hyperscalers enormous upside by drawing enterprises into and delivering value-add services with lifecycle management within an end-to-end cloud networking solution. Given hyperscaler dynamism and the slow pace of telco innovation, ABI Research believes that if hyperscalers pivot to the NaaS market, they could become substantial challengers.

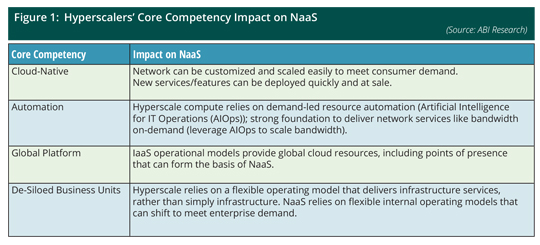

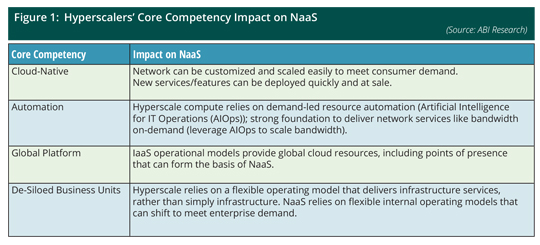

Hyperscalers' Core Competencies Put Them in a Good Position to Challenge

|

IMPACT

|

NaaS is a consumption model that allows enterprises to “rent” virtualized network infrastructure on a “pay-as-you-use” or “pay-as-you-grow” service contract. It relies upon Communication Service Providers (CSPs) offering software-defined, cloud-native network infrastructure hosted in public or private clouds. But what says that hyperscalers, which are mainly IaaS providers, cannot be a force to reckon with if they choose to pivot to this market?

In short, hyperscalers’ core competencies would provide them with a launchpad to deliver a NaaS solution, which would form part of an end-to-end, fully integrated enterprise cloud service. But significant hurdles still exist:

- Lack of Network Infrastructure: Networking remains an under-supported area within hyperscalers (especially compared to telcos).

- Enterprise Multi-Cloud: Fear of “vendor lock-in” means that enterprises are forgoing efficiency, in favor of a “multi-cloud” strategy. Considering the interoperability and barriers between public cloud providers, this will reduce the value of hyperscaler-led NaaS.

Hyperscalers Could Rock the Market, but if Telcos Act Now, They Remain in a Strong Position

|

RECOMMENDATIONS

|

Hyperscalers challenging the NaaS market would offer a valuable proposition to enterprises. First, given the importance of public cloud applications for business operations, using a hyperscaler NaaS will improve performance, as well as resource and networking efficiency. Second, hyperscalers are viewed by enterprises as more forward-thinking and innovative players, which will enhance value perception and provide hyperscalers with a perfect Go-to-Market (GTM) strategy. Third, in terms of aligning with market needs, hyperscalers are rightly seen as cloud specialists, and those looking to migrate toward a cloud-first or cloud-native strategy will favor hyperscaler solutions.

However, ABI Research still strongly believes that telcos can compete in this market. Offering an end-to-end service, owning the network infrastructure, having existing enterprise relationships, and offering multi-cloud accessibility will be key competitive differentiators for telcos. ABI Research expects that enterprises will go to their existing network operators as their first port of call during the transition to NaaS. However, most telcos currently only offer a form of Software-Defined Wide-Area Network (SD-WAN), but they must do more to develop customizable customer-focused network service ecosystems that highlight revenue-generating services. To heighten their NaaS value proposition, telcos need to invest/restructure in three key areas:

- Technology: Invest heavily in virtualizing legacy infrastructure, integrating AIOps, and reducing time-to-market for value-added services.

- Culture: Refresh C-suite and executive positions with recruitment focused on startups and hyperscalers to drive agility and flexibility throughout the organization with a focus on service ethos and positive customer experiences.

- Structure: Reduce internal fragmentation, cannibalize legacy Business Units (Bus), and increase open innovation through partnerships with hyperscalers, network startups, and other telcos.

Telcos remain in a strong position within the NaaS market, but if they do not evolve rapidly, hyperscalers are in a position, if they choose, to pull the rug out from underneath them.