Partnership Ecosystems are Emerging, but More Needs to be Done

|

NEWS

|

Deutsche Telekom were an early starter in the partnership ecosystem; in 2012, they created ‘hubraum’ to bring startups and leading telecoms together to drive use cases/applications to market. Over the last year, more telecoms have begun to realize the opportunity of a partnership ecosystem for innovation. Telefonica has driven ‘Alaian’, a global alliance between six of the world’s leading telecoms, an arrangement seeking to bring together and connect expertise to create innovative customer-focused solutions. It also highlights that selected 5G startups will be able to access knowledge, resources, and a pool of investment funds that members make available for them. Although this is a good start, it is by no means complete. The issue is that, with the exception of Telefonica, the members are not the industry ‘giants’. This reflects the continued skepticism surrounding telecom-telecom partnerships. However, it is encouraging that telecoms have realized the potentiality of open startup-led innovation within the 5G market.

BT has followed suit by expanding their scope to target strategic startup investments and their aim is to drive digital platform transformation through strategic investments and ‘down streaming of relationships’. Further, Airtel has recently acquired a stake in 5G-ready Network-as-a-Service (NaaS) provider, ‘Cnergee’, with the hope that this will help sharpen their service proposition for small and medium enterprises (SMEs). These partnerships are a step in a right direction, but more still needs to improve the telecom value chain.

Startup Incubation Will Accelerate 5G Monetization

|

IMPACT

|

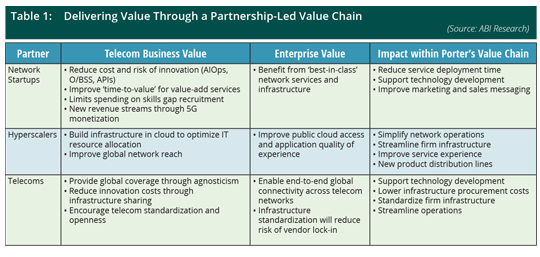

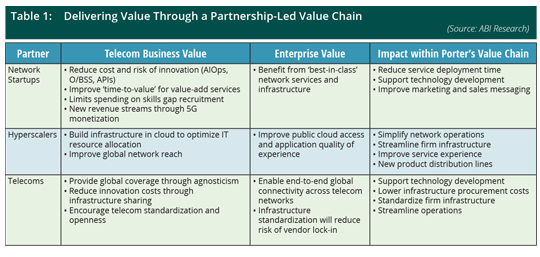

ABI Research believes that telecoms should draw three different groups into their ecosystem value-chain: telecoms, hyperscalers, and network startups. But how exactly will each partner impact the value chain from both the telecom and enterprise perspectives?

Network startups offer telecoms the greatest potential Return on Investment (ROI). 5G monetization is critical given the on-going squeeze on the cost of connectivity and relies on delivering network slices on demand ‘as-a-service’ for which enterprises will pay a premium. 5G network Slice-as-a-Service (SlaaS) requires significant technological evolution, especially within software development (integration of Artificial Intelligence for IT Operations (AIOps), exposing Operation and Business Support Systems (O/BSS), leveraging Application Program Interfaces (APIs) aggressively) and this contributes to considerable costs (recruitment of software developers, bridging skills gaps, investment budgets) and a long ‘time-to-market’. For this startup incubation is not only beneficial but will drive market readiness of SlaaS with relatively low risks and associated costs. But why should capital heavy telecoms not simply acquire startups?

- Risk—Acquisition increases investment risk, as it makes telecoms place bets on relatively few players, while partnerships have a lower capital requirement and allows the risk to be spread amongst various players.

- Culture—Startup and telecom cultures differ significantly, and this is one of the key areas telecoms want to tap into. Acquisition could lead to a cultural merger which could stifle innovation. Partnerships provide sufficient resources to facilitate development, while preserving separation ensures that startup culture remains unaffected by legacy telecom mentality.

But partnership ecosystems will not be without their challenges. First, telecoms must get past their ‘not-invented here’ mentality. Secondly, they must look to collaborate with hyperscalers and other telecoms, but both parties fear openness as they see it as a step towards losing control of the customer relationship and the network. This is not unfounded, as significant value lies within enterprise connectivity especially given the growing importance of public cloud infrastructure, and telecoms/hyperscalers are competitors in this area. However, looking past this will deliver bi-directional value. Thirdly, some question the continuity of the subsequent partner-led service, with enterprises valuing ‘in-house’ built solutions higher, like Vodafone’s. But ABI Research does not believe this is strictly true; assuming that telecoms ‘stitch together’ different services with ‘in-house’ software developers, the resultant solution will be market leading, not substandard.

Telecoms Must Define Their Strategy Now, and Bring Partners into Their Value Chain

|

RECOMMENDATIONS

|

Developing a partnership ecosystem to support startup incubation is the way to go, but how should telecoms execute this strategy?

- Assess gaps in solution: Provide a blueprint with which telecoms can look to target relevant startup partners driving completeness.

- Determine relevant skillset required to fill gap: This may involve bringing in service-orientated executives that can attract startups, shifting c-suite focus, or directly recruiting software developers to stich services together.

- Bring together other telecoms to form basis of ecosystem: Telecom-telecom openness is important and will attract best-in-class startups looking to access knowledge and capital.

- Draw startups into ecosystem: Telecoms should look to draw specific startups into their ecosystems with solutions that address critical service gaps.

- Make investment funding, knowledge, and skills available to startups: It is not sufficient to provide ‘mentoring’ or shared resources. To truly drive innovation, telecoms must dip into their own capital to support startups. ABI Research recommends that all startups receive sufficient ‘series A’ funding. This is likely to drive ‘time-to-value’ and will remain relatively low risk for capital rich telecoms.

- Regularly assess startup developments.

- Integrate components into telecom value chain: Each component must be tightly integrated, loosely coupled point solutions will dampen enterprise experience and perceived ROI. A small team of ‘in-house’ software developers is key.

In short, telecoms must encourage partnerships ecosystems and leverage each partner to stitch together a more enterprise-outcome orientated value chain. For example, telecoms could incubate startups to access industry leading software developed tools (e.g., O/BSS and AIOps) and expand value-add services; collaborate with hyperscalers to build cloud-native network infrastructure and increase global backbone coverage; work together with other telecoms to improve global network standardization and end-to-end coverage. This will likely maximize ROI as it reduces investment risk, improves ‘time-to-market’, optimizes IT resource allocation, and supports network monetization.