Enterprises Increasing Looking to Move Operations to the Public Cloud

|

NEWS

|

Multi-national companies, such as Goldman Sachs, BP, and Coca-Cola, continue to transition from private data centers to run compute/storage in the public cloud.

This trend is motivated by a few factors:

- Cost: Running workloads in a private data center requires Information Technology (IT) management resources, compute resources, and facilities. These rely on a Capital Expenditure (CAPEX), rather than Operational Expenditure (OPEX) model. Transitioning to a public cloud reduces overhead and limits upfront costs.

- Scale and Complexity: As more and more Internet of Things (IoT) are integrated into enterprise networking, the sheer amount of data created will continue to increase exponentially, which not only has cost implications, but also complexity issues. Public clouds can abstract this complexity, offering easy to use facilities with nearly unlimited scalability.

- Agility: Private data centers have long lead times, taking months, if not years to build within colocation facilities, while public clouds take minutes to build.

- Critical Applications: Public cloud applications have become critical to business operations.

With all these benefits, it is clear why enterprises, regardless of size, IT management capabilities, or vertical are shifting to hybrid cloud solutions. The story is the same for service providers; by leveraging hyperscaler facilities, they can deliver the necessary scalability and flexibility required to optimize costs.

It's Not All Doom and Gloom, but Enterprise Hybrid Cloud Strategies Will Squeeze Profits

|

IMPACT

|

Enterprise data are growing at an alarming rate, but enterprises (especially multi-nationals) are increasingly seeing the value of the public cloud for non-essential data operations, rather than using colocation facilities. But how bad is this trend for neutral hosts? On one hand, hybrid cloud strategies mean greater demand for interconnection services. For example, Megaport offers Hybrid Cloud Connectivity solutions that provide central control/visibility across public, private, and on-premises resources. This service is likely to become table stakes for enterprises moving forward. On the other hand, if we look at their other core competencies, the story is worse. For companies like Equinix, Digital Realty, and Console Connect, which rely heavily on colocation provision, shifting demand toward the public cloud could be troubling.

Although colocation demand is unlikely to drop off quickly (given security and data sovereignty), if we look at the biggest enterprises, which will be the biggest revenue generators, we see considerable interest in integrating on-premises infrastructure (for sensitive data) and public cloud applications (for everything else). This leaves little room for colocation facilities, and given the existing infrastructure that companies like Console Connect, Digital Reality, and Equinix have, a decrease in demand (however small) will have a large financial knock-on effect.

Deeper Integration within the Hyperscaler Value Chain Could Be the Answer

|

RECOMMENDATIONS

|

Currently, interconnection providers play a fairly small role within the public cloud/hyperscaler value chain. They enable enterprises access to public cloud services through their connectivity hubs. Given the importance of the public cloud, becoming more of an integral part of the value chain could lead to considerable upside. Equinix has already demonstrated interest in this area by investing heavily in xScale alongside GIC (a 20/80 ownership split). These data center facilities provide digital infrastructure in line with hyperscaler scalability and networking requirements. Built on an OPEX, lease model, these facilities provide hyperscalers with easier entrance points to new geographic regions and help drive global coverage without CAPEX or ongoing associated maintenance costs. So far, it looks like xScale has proven successful, with Microsoft, Salesforce, and Amazon Web Services (AWS) all leasing space within Europe, the Middle East, and Africa (EMEA).

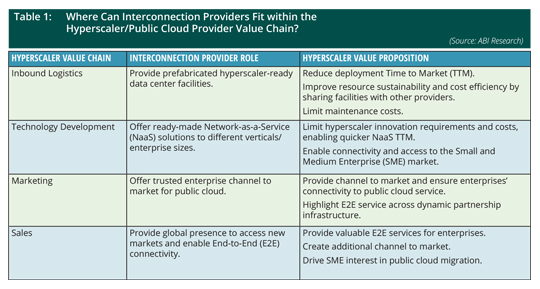

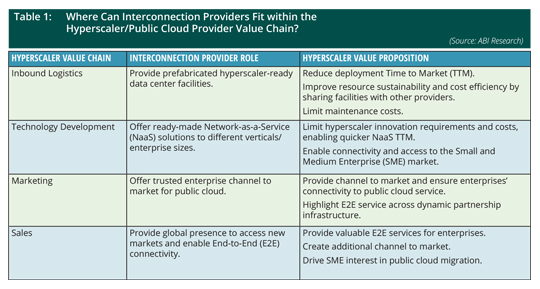

But this is just one role that interconnection providers can play within the telco value chain. Table 1 looks at how interconnection providers could become fully integrated within the hyperscaler value chain.

Colocation facilities will always have a role to play, but diversification will be prudent for interconnection providers. Integrating with the hyperscaler value chain is an interesting idea, as ABI Research believes it offers significant bi-directional value. For interconnection providers, it offers an avenue to monetize their existing services and build upon their core competencies to drive new revenue opportunities. From the hyperscaler position, it reduces CAPEX in “new sites” and new network services, while also providing a foundation to better service SMEs.