Has Apple Gone Too Far? Why Carmakers Should Be Apprehensive about the New CarPlay

![]() 26 Aug 2022 |

IN-6646

26 Aug 2022 |

IN-6646

Log In to unlock this content.

You have x unlocks remaining.

This content falls outside of your subscription, but you may view up to five pieces of premium content outside of your subscription each month

You have x unlocks remaining.

![]() 26 Aug 2022 |

IN-6646

26 Aug 2022 |

IN-6646

Next Generation of Apple CarPlay |

NEWS |

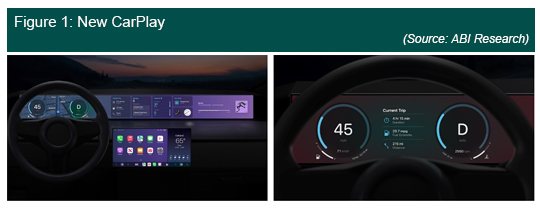

Apple announced the next generation of CarPlay at Apple's 2022 Worldwide Developers Conference (WWDC22). In this significant update, CarPlay takes advantage of modern infotainment systems that feature more and larger displays by offering a seamless multi-screen experience. The software is now deeply integrated with vehicle Electronic Control Units (ECUs), so that the experience does not break when users use vehicle functionalities. For example, drivers can control vehicle temperature or tune the radio through CarPlay.

The new CarPlay also features widgets that fit into different central and cluster display sizes, shapes, and layouts. In fact, the cluster display integration is the main highlight of this launch. Through communication with the vehicle's real-time systems, CarPlay can show all vehicle information, such as speed, Revolutions per Minute (RPMs), fuel level, and temperature, in crafted layout options and gauge styles combined with widgets like navigation.

Apple claims that 14 carmakers, including Ford, Volvo/Polestar, Mercedes, and Audi, are excited to adopt this new version of CarPlay and will announce vehicles featuring the solution by the end of 2023. Nevertheless, when contacted for further comments, the listed carmakers—except Polestar, but including Volvo—were evasive at best, making many wonder whether Apple has gone too far.

CarPlay Will Continue to Be an iPhone Experience |

IMPACT |

After the launch, many began questioning whether CarPlay would become an embedded experience. After all, it is hard to believe carmakers would hand over that much control to a phone-based solution. The answer is no. CarPlay will remain an iPhone-based mirroring experience, and Apple does not intend to release an Operating System (OS) that runs in in-vehicle infotainment systems as Google did with Android Automotive OS (AAOS) and Google Automotive Services (GAS).

However, despite running the infotainment software on the iPhone, Apple does not intend to fully own the user experience. The company understands that collaboration is essential for success in the automotive industry and realizing the next generation of CarPlay. Therefore, it is working with Original Equipment Manufacturers (OEMs) to find an equilibrium between a look and a feel that is closer to their brands, yet consistent with the iPhone experience.

There are rules governing the rendering of key vehicle information, such as speed and vehicle alerts and warnings, meaning they cannot be off-boarded. Because CarPlay will communicate with the vehicle's real-time system, which handles mission-critical functionalities and information, measures are being taken to preserve the safety and integrity of the system. For example, much of the content is rendered locally, so users can still see the vehicle information in case of any interference or connection problem. Nevertheless, these are still early stages. Apple does not have a clear idea yet of what would be the vehicle system's minimal requirements and recognizes that there is much to be done regarding safety and validation before the system is ready for production vehicles, which will require intense collaboration with carmakers. Therefore, the first vehicle announcement will only take place in late 2023.

Are Carmakers Onboard?

The reaction of those carmakers supposedly onboard the new update illustrates their uncertainties with the new product. Mercedes-Benz and Land Rover were evasive about whether they will include the new CarPlay in their vehicles, and Ford, Honda, and Nissan preferred not to comment on the announcement. Among other carmakers, BMW made it clear that it is enhancing its iDrive embedded system, while eluding the possibility of considering the new CarPlay integration. Meanwhile, Stellantis emphasized that this is more like an Apple OS for automotive applications than a CarPlay upgrade.

How Does CarPlay Align with Carmakers' Strategic Goals? |

RECOMMENDATIONS |

Carmakers are increasingly betting on revenue from delivering software-enabled services and features Over-the-Air (OTA). Because this strategy essentially relies on establishing revenue-generating consumer touchpoints, carmakers are investing considerably in cockpit hardware and software to increase user engagement with their embedded infotainment systems. Considering the new CarPlay will be a mirrored system running on the iPhone, and the seamless user experience will make consumers even less inclined to use embedded systems, will carmakers buy into the idea? That depends on how Apple positions itself and how flexible it is willing to be.

During the announcement, Apple cited research suggesting that 79% of U.S. vehicle buyers would only buy vehicles featuring CarPlay—a timely reminder for automakers of two minds about featuring the updated CarPlay, particularly given the potential impact on new vehicle sales. However, the current success of CarPlay should not be seen as a guarantee of automakers' buy-in to the ambitious update, which nearly looks like a new product, that requires access to a wide range of user and vehicle data and significantly expands Apple's influence over the in-vehicle experience. In fact, the main competitive edge carmakers' embedded infotainment software has over mirrored systems is the integration with vehicle functionalities, especially in the case of Electric Vehicles (EVs), where real-time vehicle and battery information are critical elements for improved EV routing and range estimation. Handing that over to Apple would mean giving up control of the user experience and likely the potential revenue from lifecycle management.

It is important to highlight that automakers always had full ownership of the in-vehicle experience, and their inability to provide compelling services led to the dominance of mirroring solutions. Therefore, one could argue that by adopting the new CarPlay, OEMs would move from a situation in which they have no control over the mirroring experience to one in which they will have at least partial ownership.

What Should Apple's Strategy Be?

If Apple prioritizes its direct relationship with final users and consistency with the iPhone experience over carmakers’ interests, the new CarPlay will become a strategy for entry-level vehicles equipped with less powerful hardware or Internal Combustion Engine (ICE) models that will receive less innovation. This is not necessarily bad. Mirroring applications became ubiquitous only after mass market brands, which did not have much to lose, took the plunge and forced the premium brands that initially resisted integration protocols to follow suit because they could not produce a competitive experience. Nevertheless, the market has changed. According to feedback from chipset suppliers, carmakers currently request at least 50% of additional headroom in their vehicle platforms to accommodate on-demand features and updates throughout the vehicle lifecycle. Some even envision equipping all vehicles with a complete feature set at the point of sale and selling features on demand. Therefore, Apple must be fast because the market segment of vehicles with low computing power will shrink in the mid-term.

Alternatively, Apple could develop a strategy based on lessons from Google and Amazon's experiences. GAS is struggling to gain traction due to Google's low User Interface (UI)/Human-Machine Interface (HMI) flexibility and concerns over user experience and data ownership. Meanwhile, Amazon is thriving because it was willing to adopt a highly flexible approach. For example, it now offers a white-label version of embedded Alexa, Alexa Custom Assistant, that carmakers can use to create their own branded voice experience.

Apple should follow Amazon's steps and allow carmakers to highly customize CarPlay and integrate their applications in the App Store, allowing them to profit from on-demand features and OTA upgrades. Some carmakers would give up part of their ownership in exchange for a user experience that yields sales and service revenue. Nevertheless, data ownership must be revisited.

Apple is following the current CarPlay model of storing data in the iPhone. According to Apple, the proposition is more amicable than what Google proposes with GAS because the user and vehicle data stay in the phone and are, therefore, said to be inaccessible. Nevertheless, the data will be analyzed through Apple software. It is unclear whether carmakers will be cut off from data related to their own customers, but if that is the case, that will certainly not be well received by the industry. Apple must understand that the new CarPlay completely changes its level of ownership over the in-vehicle experience and, consequently, will change its relationship with car OEMs.

Apple may have developed exactly what end consumers have been looking for in their infotainment systems. However, for now, the new CarPlay is a compelling infotainment user experience that creates touchpoints for Apple, rather than carmakers, as they do not have full ownership of the data or apps. The new CarPlay is on the verge of what car OEMs fear the most, the surrender of software profits to big tech companies, as happened in the smartphone industry, and Apple must realize that they will not give up their ownership easily.