Geopolitics and Macroeconomic Forces

|

NEWS

|

Geopolitics and a volatile macroeconomic environment are creating uncertainty in the market. For example, global supply chains have suffered from shortages, pushing prices up, as recently highlighted by Ericsson in this Financial Times article. Further, high inflation reduces the purchasing power of consumers. That, along with market maturity in some regions for cellular connections, translates to slow growth for Communication Services Providers (CSPs) in the consumer domain. Growth stagnation for CSPs has a causal effect on the supply side, for it is sales in the former that fuel innovation and expansion in the latter. When combined with a mature market, this weighs on margins and results in cost increases for Network Equipment Vendors (NEVs). In fact, the market’s trends and cost of sales for NEVs’ network equipment “classic sales model” have been heading in opposing directions for quite some time. Failing to get them in a better, more synergistic alignment cloud result in lower earnings.

What’s more, a challenging economic environment has created a permanent demand for simpler, lower-cost, and lower-risk network solutions. CSPs continue to scrutinize technology ownership costs (e.g., hardware economics) and Return on Investment (ROI) to shield margins of existing revenue streams. In the same vein, CSPs embrace the disruptive promise of cloud/software consumption models in a bid to reduce operational complexity and lower costs. This complexity, coupled with a rapid proliferation of technology-fueled advances—a trend that has been in the making for the past 2 decades—means that today’s classic sales model for NEVs will take a different structure tomorrow. A weak economy, globalization, and potential declining margins on telco equipment, in part due to the consumerization of telco technologies (see IN-6511), mark a turn in how telco business is conducted. These forces lay the foundation for a paradigm shift in how Ericsson, Nokia, Huawei, and ZTE, and by extension, the industry, must operate to drive new growth.

Impact on the Telecoms Industry

|

IMPACT

|

In almost every industry, globalization is leading to overcapacity—low-priced, high-volume commoditized products, potentially characterized by a diminishing differentiation in long-term value, or utility. Given this shift in demand, what do CSPs want to talk about in their conversation with the supply side? Risk sharing. One, CSPs want to transform their cost structure and shield existing margins by avoiding capital outlays, closely associated with Capital Expenditure (CAPEX), in favor of variable costs over time. Two, fluctuations in the economy create a demand for commercial models that tie technology spending to business value realization through good economic cycles and bad ones. CSPs seek varied capacity models that rise and fall in near-real time based on consumption: “no consumption, no money” models. That is hardly new news, but a tough economy and all-around cost increases accelerate that trend markedly. After all, as CSPs innovate their cost structure, it makes less sense for them to have fixed-price component supplier contracts versus a variable revenue model.

ABI Research believes that, in the future, more contracts will be tied to consumption and/or business outcomes. In a consumption-based setting, one characterized by no real selling cycles and no high price points, product prices and margins stand to be diluted. In other words, the classic product sales model, characterized by standard, high-margin equipment with consistent benefits to a wide range of customers, is becoming more and more challenged each day. The trajectory for CSPs, over the long term, is to move their interests from “who has the best technology features” to “who has the most competitively-priced consumption-based cost model and the services that underpin it?” In this model, the front-end costs are on NEVs’ balance sheets, not CSPs’. CSPs are going to jump on this model with great enthusiasm, so NEVs should get ready to meet that demand. In a world of low price points and no real selling cycles, if NEVs do not hedge their strategic bets, they will be walking a tight rope without a net; a rope with the sole direction heading toward the margin wall.

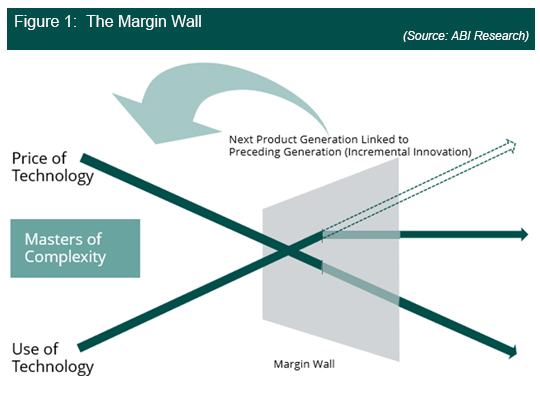

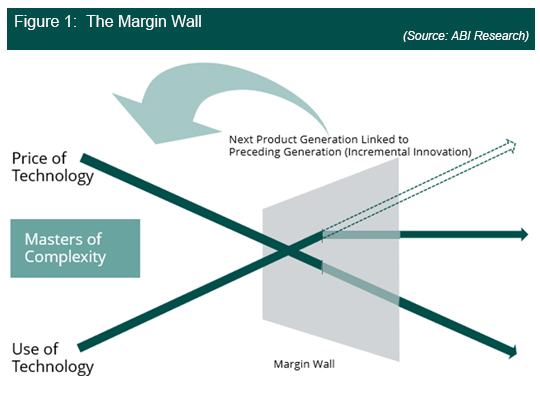

NEVs hit the margin wall when the cost of equipment sold plus the sales, marketing, and service costs add up to more than what CSPs pay for it. The graphic illustrates the margin wall, and the typical trend for technology cost/price over time. It is pointed down, attributable to two reasons. One, complexity. For their part, CSPs are becoming wary of the costs of managing complexity that is handed to them by their suppliers. Complexity exhausts network budget dollars. This same complexity prevents CSPs from obtaining exactly the functionality they want exactly when they need it, and as conveniently as possible. Two, unlike services, equipment prices and margins go down over time as the market reaches maturity. Prices also fall as the market naturally attracts competitors with better economics and utility on offer. If NEVs stick only to this highly competitive, discount-oriented product business and then it hits the margin wall, what do they have left? So, buckle up. If the likelihood of hitting the margin wall is not approached with prudence today, it may well turn out to be a bumpy ride tomorrow.

NEVs Need to Look over the Margin Wall

|

RECOMMENDATIONS

|

Historically, NEVs have viewed product waves and account development cyclically according to the product playbook. Specifically, NEVs’ product playbook centers around selling standard, repeatable, and predictable equipment to penetrate the market and capture maximum margin. The more equipment they sell, the more efficient the factory that makes it—and the supply chain that delivers it—becomes. NEVs build an incremental product through a new cycle that links to the first one, and then repeat the cycle. It is a simple, highly effective cycle in which volume equals profit and standardization drives volume. But, ABI Research asserts that swapping one high-price, high-margin product (cycle) with another is no longer that simple. The disruptive promise of cloud models, alongside increased scrutiny of technology ownership costs and ROI, provide the underpinnings of a sea change in how NEVs must operate to surpass the margin wall. For the next few years, NEVs need to execute a “do both model.” They need to both run the current product playbook and layer-in a new consumption-based economics game plan, as ABI Research elaborates in its research findings (see IN-6172).

Vendors that have successfully overcome the margin wall have built a consumption model for all their products, even their traditional on-premises CAPEX ones. The first assessment that NEVs need to make is how far away from the margin wall they are today and how long they have before they get there. NEVs need an adequate runway if they are to fly over the wall without hitting it. NEVs need to think about both product innovation and service innovation to succeed. Those two dimensions have become a single, integrated concept. NEVs should alter their business model, and they will need to do that in flight. For example, they must build their strategies, their organizational capabilities, and their product design to prioritize and differentiate around consumption. To accomplish this, those in the upper echelons of NEVs should rethink their offers and their go-to-market decisions. But in the end, a consumption model holds the prospect of being a truly winning game plan for NEVs, one that is modernized and ready for the next big wave in the industry’s evolution.

Regardless of whether NEVs face dwindling margins, or start to understand the profound risk-shifting impact of the cloud, the rules of the game are changing. How NEVs build products, how they drive revenue, what services they offer, and what they do to succeed in a consumption economy are all on the table. Ultimately, NEVs must help, not sell. Helping will sell, but selling will not help. The skills NEVs need to “help” may not wholly fit the “traditional” product playbook. For instance, as advocated by ABI Research in several deliverables, most recently in this ABI Insight (IN-6404), helping requires a strong services arm. This is the second step for NEVs to look over the margin wall. Services are becoming just as important as the products. The recent partnership between PCCW and Lenovo, which aimed to pursue growth in the Information Technology (IT) services market, drives that point home. In addition, the market is becoming more complex and riskier. Success, therefore, will go to the fittest—not necessarily the biggest—because “bigness” is weakened by commoditization. Innovation in process—how things get done internally—will be as important as innovation in the products that NEVs sell.