Building Inroads into the High-End and Next-Generation Devices

|

NEWS

|

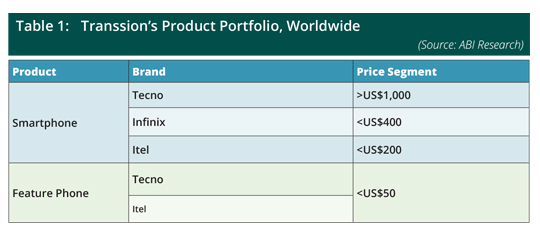

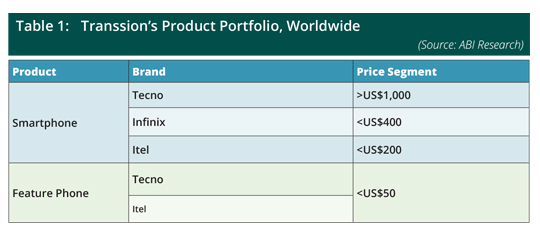

Transsion Holdings, a China-based manufacturer, is famous for its wide range of feature phones and smartphones available around the world. The company has a strong legacy in Africa and operates brands that include Itel, Tecno, and Infinix, with its Carlcare after-sales service brand, Oraimo accessories brand, and Syinix electronics and appliances brand. The company has manufacturing units in China, Pakistan, and Ethiopia, and is now manufacturing in Bangladesh and India. Transsion operates in entry- to mid-tier price band with its triple-brand approach that has helped it grow in terms of sales and make tremendous advancements in high-value markets like India. Through its sub-brand, Tecno, Transsion has launched its first high-end foldable product, the Tecno Fantom V-Fold, enabling the brand to enter the ultra-premium (US$1,000+) price segment to compete with the likes of Apple and Samsung. The company is continuously working on its Research and Development (R&D) and bringing out products that aim to have a unique selling point. The group has also partnered with HERE Technologies to enhance the location accuracy experience for its smartphone users in emerging markets. To improve the digital experience in Africa, Tecno partnered with telecommunications giant MTN to launch its new set of smartphones. There has been a massive issue with the connectivity of mobile networks in African countries and the collaboration with MTN has enabled Tecno devices to leverage MTN’s vast network coverage and offer its customers faster and reliable mobile Internet connectivity. Transsion is also working with Google on serving emerging markets like Africa, which involves in-depth cooperation on Android OS, online advertising, and cloud services.

Transsion is now shifting its focus to the mid-premium segment with new launches from its sub-brands Tecno and Infinix, undertaking several marketing initiatives to increase the visibility of its products. The group is known to customize its products to meet consumers’ needs, working in collaboration with various technology partners, such as ArcSoft, Visidon, and Richtek Technology. It has also been working extensively on Artificial Intelligence (AI) platforms to optimize the battery life of its phones.

Transsion's Journey from Africa to the Rest of the World

|

IMPACT

|

Transsion stared its operations in 2006 in Hong Kong with a focus on bringing customized products to meet demand and requirements of consumers. The company originally started as Tecno Telecom Limited in 2006 and, by 2007, it had launched its second mobile phone brand, Itel. In its initial 2 years of existence, Transsion focused solely on the South Asian market and, in 2008, the company decided to stop selling phones in Asia and started focusing on the African market. In 2012, it launched a new sub-brand Infinix to target millennials. Transsion started its operations in the Middle East & Africa more than 10 years ago and has now expanded to other geographies like Southeast Asia, South Asia, Latin America, etc. Transsion has been shifting its focus to markets in Asia-Pacific from its key base in the Middle East & Africa since 2019, and increasing smartphone shipments in its product portfolio. Transsion’s competitive entry-level products and active channel penetration, such as onboarding new offline distributors, have been key reasons for the vendor’s success.

The three sub-brands for Transsion operate in different price segments. Itel is an entry-level brand that offers both feature phones and smartphones. The brand usually sells in the under US$200 price segment and is the first choice for first-time smartphone buyers and consumers migrating from a feature phone to a smartphone. Tecno, on the other hand, operates in the entry-level to mid-level price segment. The brand has started to climb up the ladder by investing in 5G smartphones and recently launched a foldable device above the US$1,000 price point. Infinix, the third sub-brand of Transsion, targets young millennials who are looking for ultra gaming experiences at affordable prices.

Active online and offline channel penetration followed through social media and celebrity marketing has resulted Transsion group breaking into South Asia’s most competitive markets, especially India. Demand from home learning during the COVID-19 pandemic, when consumers chose to buy an extra smartphone at an affordable price, helped Transsion further penetrate emerging markets. Also, the continuous shift and migration to smartphones from feature phones was high in markets of South Asia where Transsion’s entry-level brand, Itel, was the first choice for consumers who wanted to buy an affordable smartphone. Large markets like India also turned out to be favorable for Transsion as ~75% of smartphones were in the

Transsion's Approach to Competing with the Other Ecosystem Players

|

RECOMMENDATIONS

|

Transsion is expected to continue to show growth in terms of shipments and revenue in the next few years, sustained by its access to a huge addressable market, competitive pricing, and channel expansion. However, intense competition from other vendors and the changing dynamics of the market due to macroeconomic uncertainties may disrupt its momentum. In addition, some of the vendor’s under-penetrated markets that revolve around mid-range and high-end price segments may not yet be the right fit for its products. Also, despite being a China-based vendor, Transsion does not have a footprint in China, which is the largest market for smartphones in the world. The huge competition from home brands like Huawei and HONOR, and limited penetration in China justify Transsion’s focus on emerging markets. However, product differentiation will still be crucial for the company’s short- and long-term success. Its less competitive footprint in Tier One and Tier Two cities is also a big barrier for the vendor where other Original Equipment Manufacturers (OEMs) have a sturdy base and distribution structure.

To compete with the top OEMs, such as Apple, Samsung, and the BBK group (which operates under the OPPO, vivo, and OnePlus brands), Transsion needs to expand its operations in Tier One and Tier Two cities in emerging markets like India. While Transsion has a strong presence in the affordable or mid-range price band, the group needs to increase the Average Selling Price (ASP) and contribute to the top tier cities to compete with global brands and change its brand image which is currently limited to entry-level or mid-range brands. However, the vendor is already investing heavily in marketing campaigns and will reap the benefits in years to come. It needs to position its products in the mid-range price segment with better chipsets like those from Qualcomm and MediaTek to attract more consumers who are tech oriented, while adding more 5G smartphones to its portfolio with product differentiation. Notably, Infinix is marketed as a youth-centric and gaming brand and should improve its product portfolio with more game-centric devices with advanced AI features and use cases.

By increasing its expenditure on R&D, the vendor will show commitment to widening its product portfolio range with an aspirational move into the higher-price tier smartphone segment, which it has kick-started with the launch of the Tecno Fantom V-Fold. From a market perspective, Transsion is expected to focus on product improvements that will serve the vendor’s core customer technological demands, while bringing premium features down the price tiers to cater to consumers who want a high-end smartphone experience at a more affordable price. Transsion should also slowly focus on adjacent markets like wearables, tablets, and other Internet of Things (IoT) products to add more consumers to its ecosystem. Tecno recently displayed its Megabook laptop series, followed by the launch of smartwatches by Itel. With the consumer appliance brand under its belt, followed by the after-sales service ecosystem, Transsion has strong brand equity in Africa and should replicate the same in the other regions of the world.