Digital-First Demanded by Customers

|

NEWS

|

Customers are now increasingly demanding easy-to-use and convenient payment methods that are built from a digital-first approach. Financial institutions currently occupy one of two groups: 1) traditional incumbent banks that are distinguished by physical proximity to customers and a high level of client stickiness through years of business; and 2) neo and challenger banks that offer digital-first, branchless services and a simplified banking process prioritizing the client experience.

The issue arises when customers prefer the ease of accessing banking services and making transactions through an app, but may also rue the loss of bank consultants to speak to face-to-face when making significant financial decisions. Clearly, to ensure all bases are covered, financial institutions are having to find a way to blend these two bifurcated approaches and strike a balance between physical and digital touchpoints.

- Customers are demanding increasingly more management over their banking experiences, with a strong preference leaning toward app-based banking, something that financial organizations of all sizes are having to consider. The brick-and-mortar bank branch is being condensed and distilled into the handheld smartphone, accessible 24/7, and with no loss in available services.

- Cardholders are increasingly reliant on services provided in real time; the process for applying for a new account or ordering a replacement payment card must now be immediate and accessible through a mobile device.

- Users expect the cards they carry, whether physical or digital, and the services they use to satisfy their banking requirements in all use cases and environments, including in physical retail as well as online. Rapid innovation driven primarily by neo and challenger banks have resulted in the banking app evolving into a services smorgasbord with simplified onboarding processes and more value-added services being developed.

Card Issuance Platforms Must Evolve

|

IMPACT

|

In order to fulfill these demands, and in order to support this approach with a modern card program, card issuers are having to rethink and develop nascent card issuance platforms. The crux of it is the integration of pre-existing banking processes, such as payment authorization, fraud detection, and account management with an ever-present, highly-secure contemporary front-office system that has the ability to upscale to new innovations and grow in parallel to the market.

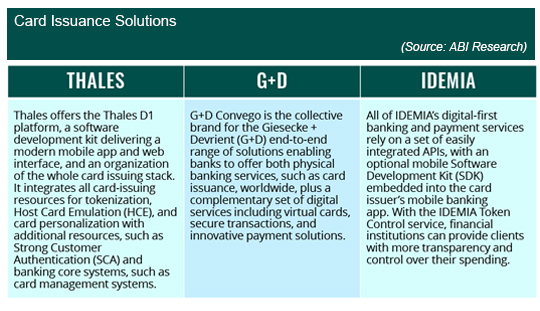

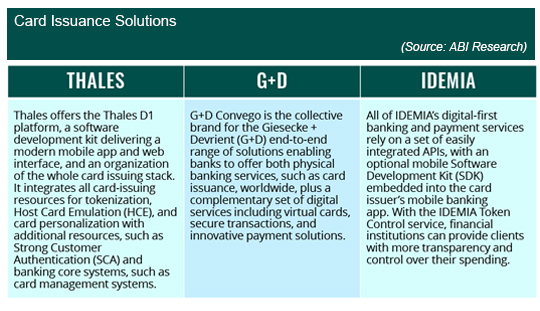

The issuance solution should be made compatible with a wide range of personalization equipment to ensure as wide a range of choice as possible. Customers are becoming increasingly selective about the businesses they transact with and the banks from which they procure services. Offering solutions with compelling and attractive designs or allowing the end user to select their own design is very much recommended in order to draw in new user bases. A number of vendors active in the banking space have developed modernized card issuance platforms to cater to this demand.

By providing a unified and coherent customer journey across banking channels, both physical and digital, financial institutions will retain relevancy to their customer bases and can remain competitive to disruptors like neo and challenger banks. This process is more involved than simply launching a mobile banking app to accompany in-person branched banking, as many incumbent high-street banks have done, and is instead a new banking philosophy that shifts attention toward the customer’s experience in how they interact with their bank. This reinforces the importance of brand recognition and increasing interaction levels across all channels, subsequently creating additional revenue channels.

Ultimately, the modern banking market can no longer be considered a purely hardware-based discussion, now having migrated to an all-encompassing platform and service discussion. A shift in approach and buyer persona has seen the market rapidly transform into an Information Technology (IT)-oriented conversation, combining Primary Account Number (PAN) management, tokenization, Application Programming Interfaces (APIs), SDKs, regulation, wallets, personalization, and cloud infrastructure as banks look to manage the cards they issue, in physical, digital, and virtual form factors.

Digital-First Payment Cards Continue to Grow

|

RECOMMENDATIONS

|

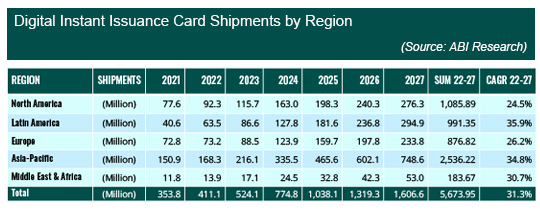

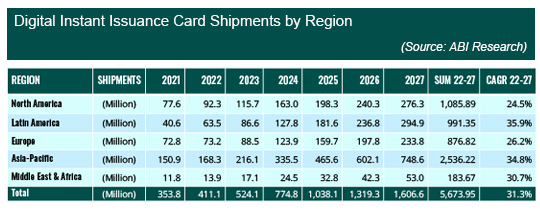

The market for digital payment cards is clearly increasing, with the total market increasing from 411.1 million units in 2022 to over 1.6 billion in 2027. North America is seeing virtual cards proliferating as financial organizations in this region are increasingly focusing on providing digital services, while also pushing for secure and smart payment methods. Younger and more tech-savvy user bases are increasingly demanding convenience and speed as it relates to banking and card management services, with virtual cards able to provide this alongside the physical card.

Similarly, Latin America is leaning toward mobile banking and online payments, particularly due to the growing penetration of smartphones, as well as the neo and challenger bank boom, which is seeing an increasingly digitized and agile banking ecosystem grow in the region, catering to a previously underbanked population. Contactless payments are continuing to grow in adoption in the region with countries like Colombia, Peru, and Chile becoming increasingly contactless.

The Asia-Pacific region is also seeing a good level of growth as there is a clear push toward digitized banking and payment solutions, such as mobile wallets and digital payments, coupled with a rapid proliferation of QR code-based transactions. Rapidly increasing smartphone penetration rates are assisting in digital card provisioning, and this is coming about as many countries in the region have seen government initiatives toward digital transformation.

Ultimately, the shift toward phygital banking will be most successfully adopted by card suppliers that are digital-savvy and that understand the market from a holistic perspective, prioritizing the customer and recognizing their needs. However, it is important to remember that all that is gold does not glitter, and not all emerging trends in the payments and banking market are going to gain traction in the long term. For example, while card personalization has become a central tenet of securing new customers through attractive card designs and even customer-designed payment cards, Dynamic Card Verification Value Card (DCVV) as a solution still has yet to take off in the payments market.