2023 Has Been a Slow Growth Year for Open RAN

|

NEWS

|

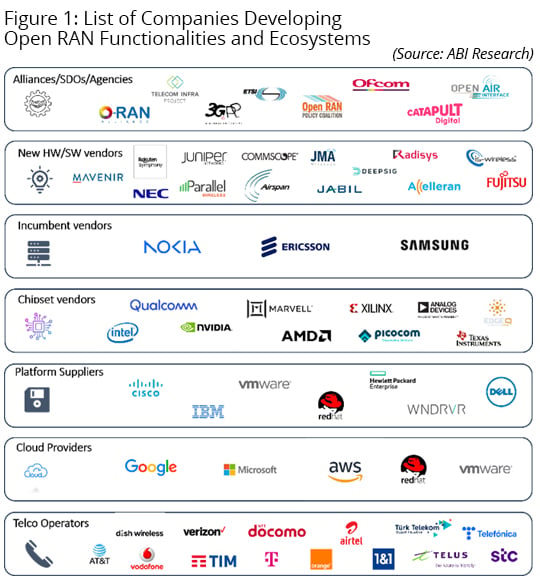

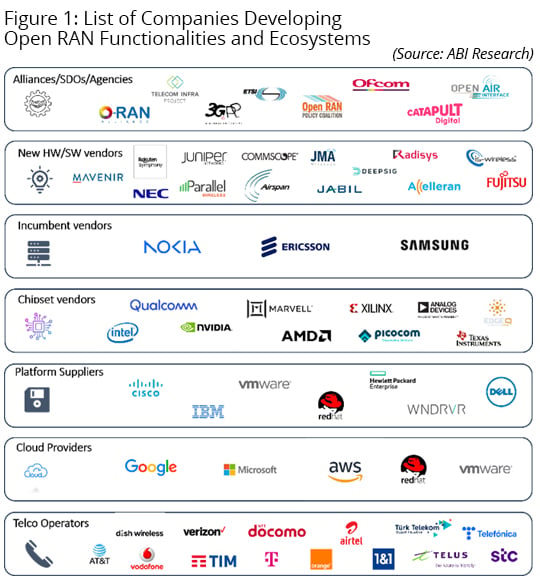

The year 2023 turned out to be one full of Open Radio Access Network (RAN) announcements from mobile network infrastructure vendors, cloud providers, chipset vendors, and mobile operators. These companies have been involved in several Proofs of Concept (PoCs), live trials, certifications, and PlugFests, and during the second half of the year, the market experienced several announcements related to multi-vendor interoperability partnerships and tests. While by no means an exhaustive list, Figure 1 highlights some of the major companies partnering to develop open RAN ecosystem.

The biggest announcement, by far, was made by Ericsson in December 2023, with one of the latest Open RANs, which announced a US$14 billion deal with AT&T to accelerate Open RAN deployments in the United States. A recent ABI Insight, “How AT&T’s US$14 Billion Contract with Ericsson Impacts Nokia and the Entire Open RAN Market,” provides more details about this announcement, with one of the most important takeaways being the following: Ericsson claimed that more than 1 million of its radios deployed in the market are hardware-ready for open fronthaul. This is also the biggest and only large-scale announcement in a brownfield network.

Fierce Competition & Confusion Is Expected in the Open RAN Ecosystem

|

IMPACT

|

These developments are expected to change the Open RAN market significantly in 2024. The following list highlights a few of these developments and their implications:

- Impact of Ericsson’s Change of Tack: The AT&T-Ericsson contract is a loss for Nokia, which adopted an Open RAN strategy long before Ericsson, and it’s not clear what impact it might have on smaller vendors, including Mavenir, NEC, and Samsung. Moreover, it is noted that Ericsson’s new fronthaul (ULPI) proposal for Massive Multiple Input, Multiple Output (mMIMO) in the O-RAN Alliance was not initially supported by AT&T, and considering the fact that ULPI has not been finalized, this might create confusion in Open RAN industry. However, ABI Research expects that commercial traction will likely result in consolidation and acceleration in O-RAN Alliance specification developments.

- Geopolitical Impact on Open RAN Ecosystem: As in previous generations of cellular networks, regional vendor dominance continued to be expected in the 5G network deployments. Although vendor dominance is somewhat a lesser issue in legacy RAN, it plays a huge impact in Open RAN, with smaller vendors not being able to spread their operations across a wide geographical area, especially for large contracts. Moreover, an uncollaborative approach may lead to unbalanced and incompatible development of technology that may create further confusion within the industry.

What's Next for Open RAN—Key Recommendations & Forecasts

|

RECOMMENDATIONS

|

ABI Research believes that there is still long way to go for Open RAN to discover its full potential with the inclusion of full-scale mMIMO, RAN Intelligent Controllers (RICs), including non-Real-Time (RT) RIC and near-RT RIC, and its integration with Service Management and Orchestration (SMO), and other innovative technologies, including Network Slicing (NS) and Multi-Access Edge Computing (MEC). Therefore, it will be interesting to see vendors’ approaches in the next couple years to accomplish the full potential of Open RAN. Moreover, ABI Research recommends that the mobile industry should continue to collaborate and compete to establish a broad Open RAN ecosystem driven by technology and the economy.

Market Indications for 2024:

- Smaller Vendors Will Start to Win Bigger Deals: Open RAN vendors are investing heavily in open RAN; for example, Mavenir, with revenue primarily driven by its core business, is investing more in Open RAN innovations and the company has yet to get major revenue out of its Open RAN business. Therefore, vendors need to start winning big contracts by bringing their best-in-class and innovative Open RAN solutions to the marketplace and by performing interoperability testing with other vendors to validate their Open RAN portfolios to win global recognition.

- Who Can Deploy RIC in 2024 and Reach Economies of Scale? RIC is considered a make-or-break technology for Open RAN, but there is still a technology gap between legacy and Open RAN in terms of higher-order and large-scale mMIMO deployments. Moreover, all Open RAN small-scale deployments are happening without RIC. It will be interesting to see who leads the RIC development and overcomes the hurdles related to onboarding processing, conflict management, and security concerns related to xApps and rApps.

- Use RIC as a Catalyst for Sustainability: Sustainability has become a critical topic and is now considered a key criterion for vendor selection. Several vendors have been deploying sleep mode operations across different components of their network, including the Central Unit (CU), Distributed Unit (DU), and Radio Unit (RU), to reduce their energy footprint. As radio represents more than 80% of total RAN power consumption, there is an opportunity to reduce energy consumption at the device level by executing deep sleep modes, including symbol shutdown, mMIMO muting, and traffic shaping. Another interesting area for the industry is to develop an efficient execution of sleep modes via the RIC to further optimize energy efficiency at the radio.

Forecasts:

ABI Research’s forecasts for Open RAN in 2024 are as follows:

- ULPI: ABI Research believes that ULPI will continue to remain a hot topic and skepticism will remain until ULPI is frozen. ABI Research expects that the ULPI specification will be finalized by 1Q 2024; meanwhile, operators and Open RAN vendors will continue to deploy Open RAN in small-scale brownfield environments. Ericsson’s recent development related to Open RAN looks promising and it is expected that Ericsson’s proposal for ULPI will be approved.

- RIC: Vendors are expected to announce SMO/non-RT RIC during 1Q 2024, but near-RT RIC may not be ready for commercial deployment in 2024; although the industry is expected to see some early trials and testing of near-RT RIC later in 2024. ABI Research forecasts that RIC will be commercially available for deployment by the start of 2025.

- Open RAN Market Share: ABI Research projects that Open RAN will account for 6% to 8% of the overall RAN market by the end of 2024. However, further advancements related to Open RAN silicon and software technologies could have more favorable results during early 2025.

- Open RAN Chipsets: Considering RISC-V, an open-source-based design for Open RAN silicon, new chipset vendors such as EdgeQ and Picocom, along with other chipset vendors, are expected to enter the market. This may continue to diversify by giving operators more choices for selecting equipment from several vendors and creating a larger ecosystem in the next couple of years.

- Couple of Large-Scale Deployment to Kick Off: Considering the recent ongoing momentum during the end of 2023, ABI Research forecasts that a couple of large-scale deployments will kick off by the end of 2024.