RedCap Device Launches Reveal Likely Application Markets

|

NEWS

|

5G Reduced Capability (RedCap) was finalized in The Third Generation Partnership Project’s (3GPP’s) Release 17 (R17) to cater to devices with throughput requirements sitting between those of full 5G and Low-Power Wide Area (LPWA). Enhanced Mobile Broadband (eMBB) requires the highest throughput and data rates, and lowest latency, which demands the full spectrum of 5G capabilities.

The Internet of Things (IoT) rarely needs eMBB-level performance, with such devices only required to send and receive smaller data packets, rendering full 5G unnecessary. While LPWA technologies such as Cat-M and Narrowband IoT (NB-IoT) are suitable for IoT device segments that require minimal data rates, the so called “mid-tier” of IoT devices rely on something more powerful.

5G RedCap aims to serve the middle ground between eMBB and LPWA, providing an affordable pathway to 5G. With a throughput performance of ~150/50 Megabits per Second (Mbps) Downlink (DL)/Uplink (UL), RedCap offers equivalent data rates to Long Term Evolution (LTE) Cat-4 and, in some cases, LTE Cat-6. Consequently, 5G RedCap has potential to be a natural successor for device Original Equipment Manufacturers (OEMs) currently using or planning to use these LTE categories in the future.

A multitude of connected IoT devices make use of LTE Cat-4 and LTE Cat-6, providing the suppliers of RedCap hardware with an extensive addressable market. In a recent whitepaper, Ericsson outlined likely application markets as being wearables, industrial wireless sensors, video surveillance cameras, and low-end Augmented Reality (AR)/Virtual Reality (VR) applications.

Launches of RedCap devices are now ramping up, revealing the markets that are likely to accelerate their migration to RedCap. According to ABI Research’s imminent report series, 5G RedCap for the IoT, the device launches that pertain to RedCap only fall within video surveillance and Fixed Wireless Terminal (FWT) applications. The report also reveals the growing interest in non-IoT verticals, with a series of FWA devices, including outdoor units and routers, and MBB devices, such as Chromebooks and MiFi devices, being released.

According to the report, only 34% of devices launched up to 1Q 2024 are for the IoT, with 64% made for non-IoT applications. While the RedCap market is still in its nascent stages, supply-side hardware vendors will need to consider the factors that are likely to incentivize OEMs from other IoT verticals to migrate from LTE.

Are 5G RedCap Chipsets Suited to IoT Applications?

|

IMPACT

|

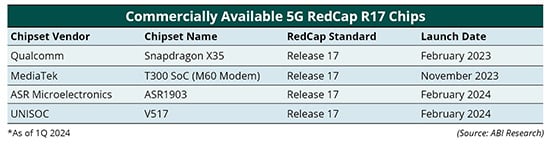

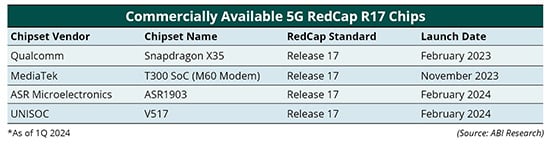

There are currently four commercially available 5G RedCap chipsets, which all conform to 3GPP’s R17 standards. Qualcomm fast-tracked the development of its 5G RedCap chip, unveiling the X35 one year on from R17 finalizations in February 2023. MediaTek’s T300 System-on-Chip (SoC) made its commercial debut in November 2023, with ASR Micro’s ASR1903, and UNISOC’s V517 showcased at MWC Barcelona in February 2024. Each chip is expected to have LTE Cat-4 fallback to ensure network support until the widespread availability of 5G Standalone (SA).

While the existing R17 RedCap chips unlock access to the 5G SA core and the associated advantages of network slicing and advanced positioning support, many stakeholders across the IoT ecosystem question whether RedCap offers any radical performance uplifts on LTE. Indeed, some of the core RedCap optimizations are, in fact, continuations of previous LTE standards. For example, the use of a single transmit and 1 or 2 receive antennas, which enables OEMs to reduce the physical size of the device, was already present in Cat-1bis. Likewise, optional support for half-duplex Frequency Division Duplex (FDD), which simplifies the architecture so that devices cannot transmit data when they’re receiving data, is rooted in LPWA.

Consequently, 5G RedCap is widely seen as a replacement technology and natural successor for LTE Cat-4, with its core migration incentive being the ability to future-proof devices against LTE network shutdowns. In this case, the question over “when to migrate” boils down to weighing the relative cost of RedCap hardware compared to LTE, and when LTE networks are expected to be phased out.

The IoT encompasses a broad spectrum of connected devices, but many mid-tier devices, such as wearables and health trackers, have shorter life spans of between 2 and 5 years. IoT OEMs with shorter device lifecycles incorporate significantly less risk in terms of network longevity from deploying a device today, compared to, say, a metering OEM, with a device that may remain in the field for over 15 years. As a result, in the near term, many IoT OEMs will be sticking with their LTE modules until 5G RedCap becomes a viable alternative financially.

Short-term migration to 5G RedCap is also inhibited by the following:

- The Price Premium of RedCap Modules: The price of cellular modules is largely derived from the cost of the modem chipsets that are integrated within them. The first generation 5G RedCap chipsets is expected to be priced at a significant mark-up over existing LTE chips, pushing module prices to a 50% premium on LTE Cat-4, which are typically priced at US$16 to US$20 per unit. Without the immediate threat of LTE network shutdowns, IoT device OEMs with shorter device lifecycles are unlikely to switch out their connectivity technology when it isn’t perceived as necessary.

- The Suitability of LTE to the IoT: In the 4G era, mid-range IoT devices have been well-served by the LTE categories, ranging from 1 to 20, by allowing OEMs to fine-tune individual devices’ throughput and performance requirements to these tightly defined categories (Cat-1bis being the most simplified, offering the lowest throughput, and LTE Cat-20 being the most complex and offering the highest data rates). While existing 5G RedCap chips unlock the performance advantages from upgrading to 5G, these enhancements can only be accessed through 5G SA networks. As with LTE Cat-1, RedCap will be a coverage-based technology, but given that there are currently only ~55 known live public 5G SA networks worldwide, as of 1Q 2024, migration is not likely to gain momentum until 5G SA becomes ubiquitous.

eRedCap Emerges as the IoT Front-Runner, but Chipset Vendors Can Still Drive 5G RedCap Migration

|

RECOMMENDATIONS

|

While 5G RedCap may prove too expensive for IoT device OEMs in the near term, 3GPP’s R18 details the second iteration of the RedCap standard, with enhanced RedCap (eRedCap) capabilities. These are expected to reduce device complexity sufficiently to deliver comparable performance with LTE Cat-1 and LTE Cat-1bis, with data rates of 10/5 Mbps DL/UL. LTE Cat-1 and Cat-1bis are used almost exclusively for the IoT, representing an extensive addressable market for eRedCap.

A host of IoT device OEMs have already expressed their intention to migrate to eRedCap, including in Advanced Metering Infrastructure (AMI), telehealth, remote monitoring and control, and asset-tracking. Those with LTE Cat-1 based mobile devices will be encouraged that RedCap, like LTE Cat-1, will be a coverage-based technology, relying on access to widely available 5G SA networks to enable reliable connection for its users across regionalities.

As it stands, eRedCap seems to be considered the greater market opportunity for the IoT, but as with 5G RedCap R17, whether eRedCap will gain early momentum will depend on the relative prices of the first eRedCap chipsets, expected in 2026/2027, compared to LTE Cat-1 and Cat-1bis. As chipset manufacturers develop their eRedCap offerings, they should also take the following steps to drive R17 5G RedCap in the IoT:

- At the current price range, Qualcomm, MediaTek, ASR Microelectronics, and UNISOC are unlikely to achieve mass adoption of their 5G RedCap chips within the IoT, at least in the near term. IoT OEMs with shorter device life spans are likely to require unit module prices to get closer to price parity with LTE before switching out their existing modules. To capture revenue from the wider IoT ecosystem, chipset vendors should continue to develop enhanced second-generation 5G RedCap R17 chipsets, which can be sold at a lower unit price to module vendors, which can then develop more price-competitive modules. Doing so should incentivize migration from producers in OEM telematics, commercial telematics, and aftermarket telematics applications, which often make use of LTE Cat-4 and LTE Cat-6.

- While the incumbent 5G RedCap chipset vendors have, to date, focused on 5G RedCap R17 chips, the mounting interest from implementers around eRedCap should spur development plans for an eRedCap chip. Sequans has already announced its intention to develop an eRedCap chipset, and we can expect the first first-generation eRedCap chips to arrive by mid-2026.

- Conversely, chipset manufacturers leaning heavily on LTE Cat-1 and Cat-1bis revenue should weigh the trade-off of pushing an eRedCap chipset alongside their existing LTE modules. Unless eRedCap can unlock additional market opportunity for device innovation that was not possible on LTE, eRedCap chips will compete side-by-side with Cat-1 and Cat-1bis chips for module integration. As it stands, eRedCap is primarily seen as a replacement for LTE, rather than offering transformational performance uplifts. If the chips are placed in direct competition, vendors will need to scrutinize the likely Return on Investment (ROI) from persisting with either Cat-1bis, eRedCap, or both.