HAPS Is Now on the Horizon

|

NEWS

|

Over the past 3 years, there has been voluble excitement regarding the rollout of Low Earth Orbit (LEO) constellations such as Starlink and OneWeb. LEO satellites orbiting at ~550 Kilometers (km) can significantly cut latency (50 Milliseconds (ms) versus 600 to 800 ms for Geostationary Earth Orbit (GEO) satellites) and potentially boost overall capacity, but require at least double-digit numbers of LEO satellites (e.g., Iridium has 66 satellites and Globalstar has 48) compared to the 3 or 4 needed for GEO satellites. GEO satellite constellations have been scrambling to form hybrid satellite orbital relationships with LEO constellations. There may be an alternative strategy to hybrid LEO/GEO constellations, where geostationary (GEO) satellites, in orbit at 36,000 km are then complemented by High Altitude Platform Stations (HAPS) that patrol dedicated areas at ~10 km to 30 km on Earth.

HAPS, as a concept, have been around since the late 1990s. Trials and even some proto-commercial deployments have taken place. Google’s Project Loon had steerable helium balloons that drifted up into the stratosphere and could hold position for a period of time before coming back to Earth. HAPS can be used to provide both fixed broadband connectivity for end users and backhaul links between the HAPS and the mobile operator’s core networks. The main HAPS applications are wireless broadband coverage in remote areas where terrestrial cellular or fixed telco coverage is either non-existent or unreliable. ABI Research estimates connecting the unconnected addressable market potential at 330 million Small and Medium Enterprises (SMEs) and household premises worldwide, which is equivalent to 1.3 billion household members. Another key application for HAPS is supporting disaster recovery communications in situations where the terrestrial telco networks have been damaged by disasters such as hurricanes or earthquakes. Inter-HAPS links allow the provision of services with minimal ground network infrastructure.

AALTO's Zephyr Network

|

IMPACT

|

While Project Loon had a shaky and ultimately terminal lifecycle, new HAPS solutions are entering the market. A consortium of Japanese businesses and banks plan to invest US$100 million in Airbus subsidiary’s AALTO. AALTO will manufacture and operate the stratospheric, solar-powered HAPS. The constellation will be known as Zephyr. NTT DOCOMO and SKY Perfect JSAT are prominent stakeholders.

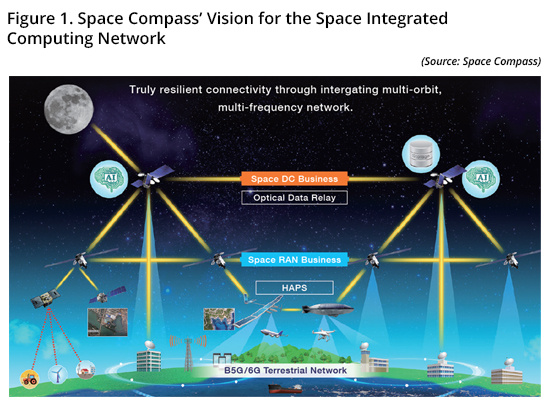

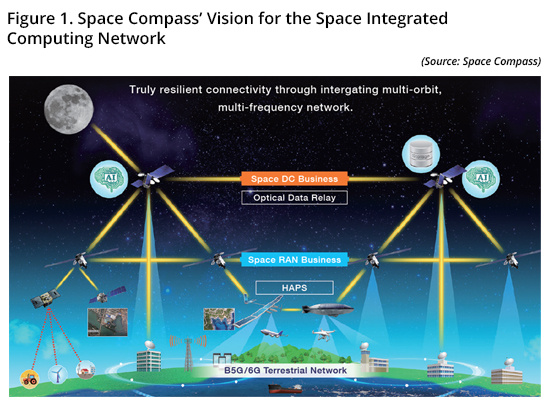

Zephyr’s HAPS will operate for several months at a time in the stratosphere, offering mobile connectivity (5G Direct-to-Cellular (D2C)) and Earth observation (Airbus’ Strat-Observer for monitoring, tracking, sensing, and detection applications). The constellation, however, intends to go beyond mobile connectivity and Earth observation. Space Compass, a joint venture between NTT and SKY Perfect JSAT, intends to integrate the Zephyr HAPS platform with their GEO satellites to establish a “Space Integrated Computing Network” that will offer data center and edge computing applications. The HAPS layer will provide low latency access and improved link budget for radio transmissions. However, the HAPS can also hand-off or reroute transmissions to JSAT’s GEO satellites to forward traffic to other parts of the globe or offer greater data handling capacity.

The ITU Has Been Prepping the Gorund for HAPS

|

RECOMMENDATIONS

|

While HAPS have taken several years to even achieve technical development, let alone commercial success, the International Telecommunications Union (ITU) has been undertaking the necessary groundwork for longer-term HAPS success.

ITU-R studies have estimated the total spectrum needed for HAPS applications to be around 400 Megahertz (MHz) to 3 Gigahertz (GHz) for the ground-to-HAPS platform links and 325 MHz to 1,500 MHz for the HAPS-platform-to-ground links. These spectrum ranges would potentially address the needs of specific applications (e.g., disaster relief missions) and connectivity applications (e.g., commercial broadband). The novel applications being expounded by AALTO’s Zephyr for the Space Integrated Computing Network could push those spectrum requirements to the higher end of spectrum requirements. It is likely that regulators would want to see demonstratable adoption and traffic utilization before allocating the larger spectrum band allocations.

Three World Radiocommunication Conferences (i.e., WRC-97, WRC-2000, and WRC-12) have built up the potential spectrum for HAPS in the frequency bands 47/48 GHz, 2 GHz, 27/31 GHz, and 6 GHz, respectively. At WRC-19, ITU Member States identified additional Radio Frequency (RF) bands where HAPS could operate under specified technical conditions. Notably, these include 31-31.3 GHz, 38 – 39.5 GHz, 47.2 – 47.5 GHz, and 47.9 – 48.2 GHz bands. Frequency bands 21.4 – 22 GHz and 24.25 – 27.5 GHz could be used by HAPS for fixed services in Region 2. Finally, at WRC-23, identification of bands below 2.7 GHz for HAPS to be used as IMT base stations were set out.

With demarcated spectrum bands in place, as well as technical prototypes being developed, full-scale commercial HAPS deployments should appear in the market later in the mid to late 2020s. Will they be a “LEO buster” for GEO satellite operators? Probably not, but there is potential to how HAPS can complement GEO. It is not inconceivable that LEO constellations could also incorporate HAPS into their constellations as a means to further reduce the end-to-end latency of Non-Terrestrial Networks (NTNs). Starlink wants to reduce latency from the current 50 ms to half that number. Why? Terrestrial 5G networks do have the advantage of lower latencies that can be in the sub-10 ms range.

Where is the potential market traction for HAPS? AALTO has declared that Asia and Southeast Asia will be a primary target market for Zephyr. ABI Research’s Connecting the Unconnected: Utilizing SatCom to Close the Digital Divide report (AN-5864) forecast Satellite Communication (SatCom)-enabled premises connections for Southeast Asia to potentially reach 1.24 million by 2026. Potential for connecting the unconnected market exists in most markets, especially in Africa, South America, Asia, and the Middle East, but even Europe and North America have rural premises (homes and SMEs) that would benefit from HAPS-enabled connectivity