ISAC Research for 6G Begins

|

NEWS

|

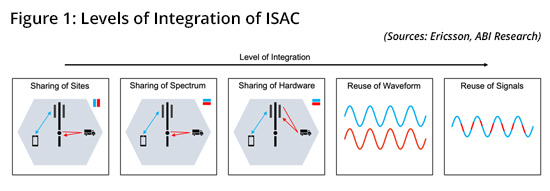

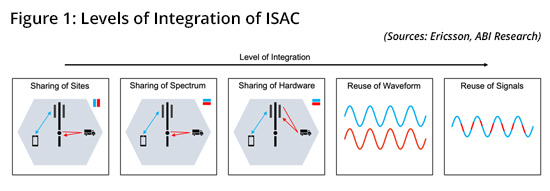

Previously referred to as Joint Communication and Sensing (JCAS), Integrated Sensing and Communication (ISAC) is a new concept that aims to combine the current communication model of mobile network operation with radar-like sensing capabilities and is one of the more ambitious technologies proposed for 6G networks. ISAC will be able to perform both functionalities using shared hardware, existing spectrum, processing and more. Figure 1 outlines the various ways these two concepts can be integrated.

While not a completely new concept, recent technological advancements, such as 5G Massive Multiple Input, Multiple Output (mMIMO) and Artificial Intelligence (AI) systems, have moved ISAC from being considered a hypothetical application to a commercial one, which has led to significant academic activity in the market.

In November 2023, ETSI launched its ISAC Specification Group (ISG) to streamline Research & Development (R&D) activities, with its first deliverable due in November 2024, and The 3rd Generation Partnership Project (3GPP) has initiated discussions and preliminary work on ISAC. The recently published feasibility study, TR 22.837, outlines what it believes to be key use cases and applications. Release 19 specifications are expected to include feasibility and use case studies, with specifications expected in Release 20 or even later in Release 21.

In terms of market activities today, China Mobile has already announced the deployment of 500 cell sites supporting ISAC in 2025 at the 4.9 Gigahertz (GHz) band as part of a commercial trial, with use cases primarily centered around the low-altitude economy, which is already strong in the Chinese market, and its government is making ISAC a strategic priority. This trial is in collaboration with ZTE and its 128TR mMIMO solutions, which has been chosen to provide a wide vertical beam to detect objects such as Unmanned Aerial Vehicles (UAVs). The choice of frequency band ensures that no interference occurs with its consumer business.

What Are the Potential Use Cases for 6G ISAC?

|

IMPACT

|

As always, it is important to understand the commercial use cases for new technologies. Unlike 3GPP, ETSI has yet to unveil what it believes the key use cases will be. There are many discussions among key industry players to position ISAC as a functionality enabler, rather than focusing on cost savings like previous technologies. Below, ABI Research highlights some of the key use case categories proposed by 3GPP and/or others:

- Low-Altitude Economy: Detecting and tracking UAVs is one of the most discussed use cases for ISAC in the industry today, with some trials already taking place in China, as it already has a business model for the low-altitude economy. ISAC can be applied from a number of different angles here, including navigation, collision avoidance, drone detection, and more.

- Automotive and Transportation: While most modern cars are equipped with sensors such as radar and Light Detection and Ranging (LiDAR), they fail to provide information from further away. ISAC technology can be used to complement existing onboard systems with a more “global” overview of the environment. Other modes of transportation, such as rail, can also benefit from detecting obstructions and relaying information to guidance systems.

- Industrial: This market often uses Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), with growing deployments of private cellular networks to cater to their special needs. ISAC can be deployed in this environment to assist in various cases, such as AGV detection and tracking, and AMR collision avoidance.

One of the challenges presented by ISAC is that transmitted signals must now cover twice the distance, with the sensed object being completely passive and not transmitting anything back to the cellular network. Activity within 3GPP suggests that handset and chipset vendors such as Xiaomi and Qualcomm are also participating in 6G ISAC research, perhaps to ensure that standards account for the potential of devices being sensed not being completely passive and allowing for uplink signals. This also suggests that competitive dynamics are beginning to take shape between handset and infrastructure vendors to shape the development of ISAC research. In theory, an uplink signal is not necessary for ISAC, but it could provide some value for specific niche use cases; for example, in emergency services, which was targeted by 5G positioning.

Spectrum and Business Model Are Key Issues

|

RECOMMENDATIONS

|

Spectrum is an incredibly precious commodity in the industry, and for 5G the 3.5 GHz band, it has been ideal for both coverage and capacity. However, with 5G now becoming mainstream and new services such as Fixed Wireless Access (FWA) being introduced, many networks will reach congestion. This means that ISAC is unlikely to be deployed in the spectrum being utilized for existing consumer applications, as well as the fact that sensing requires higher frequencies and bandwidth for radar-like sensing.

This suggests that ISAC will likely be deployed in new spectrum such as the FR2 (26.5 – 71 GHz) or FR3 (7.125 – 24.25 GHz) bands. This will require a clear and robust business case to justify large-scale deployments; however, sensing can be initially deployed at localized sites for a more gradual process before a nationwide rollout. From a Mobile Network Operator’s (MNO) perspective, the industry must work diligently to provide sufficient evidence of a robust business case for ISAC, with techno-economic studies for a variety of use cases and applications key to persuading MNOs to allocate spectrum for sensing capabilities, rather than their traditional consumer-focused applications.

As the industry is still in the early stages with regard to sensing, it is far too soon to say definitively if ISAC will be the key 6G technology that makes it a success; however, market activity by industry players and respective standardization bodies suggests that there is great effort to make it so. ABI Research believes that in the early days of 6G deployments, ISAC will remain in trials and perhaps we will see some early commercial networks consolidating third-party data and offering Sensing-as-a-Service. Full ISAC networks, with MNOs offering their own sensing services, are expected post-2035.

The key question the industry must address is whether sensing can provide a comparable dollars per Hertz ($/Hz) ratio to Enhanced Mobile Broadband (eMBB) deployments. Industry players must work to research and publish techno-economic findings to ensure that the understanding of ISAC use cases and applications from a monetization perspective is as robust as possible before network rollout to avoid repeating the current financial predicament the industry finds itself in, and to learn from previous failed concepts, such as 5G positioning and 5G Sidelink.

From a hardware perspective, the industry must also examine the optimal mMIMO configurations for ISAC and its various use cases, such as 128TR and 256TR mMIMO radios, which have had limited-to-no viable business case for commercial deployment so far. A concrete understanding is crucial for MNOs to plan their network deployments for 6G to maximize both the sensing and communication business models. Although it’s far too early to foresee whether ISAC will fund a new series of infrastructure investments, or even if it becomes commercially successful at all, the new concept is certainly seen as a key innovation for 6G. China’s trials and early commercial rollouts are already showing commercial interest, indicating that sensing may become a key component of 6G, particularly for enterprise use cases.