AI-RAN Alliance Completes Formation of Its Working Groups

|

NEWS

|

This year’s Mobile World Congress (MWC) in Barcelona was unsurprisingly riddled with Artificial Intelligence (AI) announcements everywhere you turned. This included the formation of the AI-RAN Alliance, a new collaborative initiative aimed at integrating AI into cellular technology to further advance Radio Access Network (RAN) and mobile networks, consisting of Amazon Web Services (AWS), Arm, DeepSig, Ericsson, Microsoft, Nokia, Northeastern University, NVIDIA, Samsung, SoftBank, and T-Mobile as founding members. This alliance is not set up to rival the leading standardization bodies such as The 3rd Generation Partnership Project (3GPP) and ETSI, but will publish its findings on the applications of Artificial Intelligence (AI) within the RAN to help inform the industry as it standardizes the use of the technology.

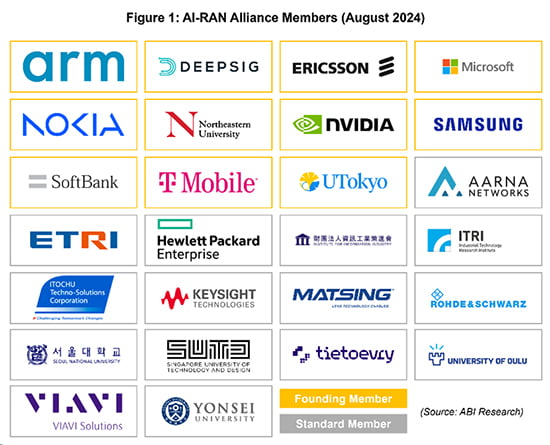

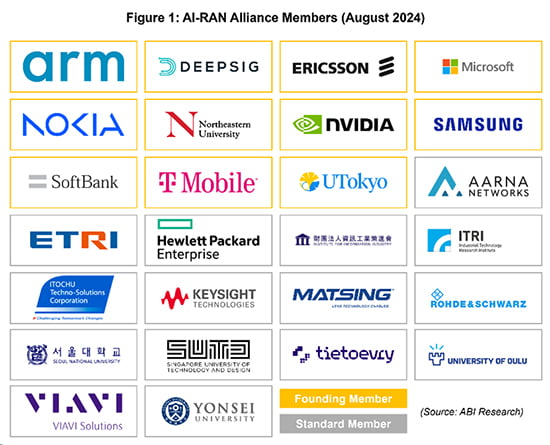

Given the sheer volume of AI announcements, it is fair to say that there was an air of skepticism around many of the AI announcements and a perception of them being more marketing exercises than substance, including the formation of the AI-RAN Alliance. However, now over 6 months since the initial announcement, this alliance has made significant progress in laying the foundations to contribute to the telecoms industry. As of the end of August 2024, 15 members have joined the alliance (beyond the founding members), with many more in the pipeline or not yet publicly announced on the website. Figure 1 shows the list of members. Furthermore, the alliance announced that it had completed the process for selecting both chairs and vice-chairs for its three Working Groups (WGs):

- AI-and-RAN: This WG will focus on infrastructure multi-tenancy and explore the combination of AI with RAN to create new use cases and monetization opportunities.

- AI-on-RAN: This WG will aim to understand traditional AI and Generative Artificial Intelligence (Gen AI) requirements on the RAN for existing and new types of use cases across consumer, enterprise, and government sectors.

- AI-for-RAN: This WG will aim to enhance the operation and efficiency of RAN through traditional AI and Gen AI algorithms.

Industry Focus Has Shifted Away from Open RAN

|

IMPACT

|

Alongside establishing the WGs, the AI-RAN Alliance has made key recruitments for its board of directors, with Dr. Alex Jinsung Choi now recently appointed as Chairman of the alliance, a highly respected industry figure who was formerly the Chairman of the O-RAN ALLIANCE. This may be indicative of the situation with Open RAN, in general, and the industry placing greater emphasis on developing AI technology for the RAN over creating a more open ecosystem.

There are a number of reasons behind this development. Despite AT&T’s announcement, the Open RAN market, in general, is not progressing as anticipated, fueled by interoperability challenges and incredibly low investment for new infrastructure by Mobile Network Operators (MNOs) affecting all RAN investment, not just Open RAN. While it is not at a sustainable level, when investment does begin to improve, the main priority of MNOs will be the “virtualization” or “cloudification” of their networks. Nokia and Ericsson have taken aggressive approaches to becoming Open RAN leaders, and new entrants have struggled to make ground and grow their presence, leading to some filing for bankruptcy and repositioning their Open RAN solutions for the private network domain, with an example being Airspan Networks. Cloud RAN and Virtual RAN (vRAN) solutions by industry-leading vendors are considered “Open RAN compliant,” so they would technically fall under the definition of an Open RAN deployment that will grow the Open RAN market, but it has become a background focus for MNOs as they upgrade their networks.

Another reason is that the growing importance of AI integration across all layers of the network has opened the door for vendors (both from the hardware and software sides) to begin a technological arms race in developing the “best” AI technology for the telecoms industry. A lot of the AI applications currently reside in the efficiency and cost reduction domains, but being first to prove a successful AI-driven revenue business case is incredibly important for all to market themselves as leaders in AI for the 5G era, but especially the 6G era when AI integration will play a much larger role in standardization than before.

Market Evangelization for the Alliance Is Important for Its Success

|

RECOMMENDATIONS

|

The importance of this alliance is clear—MNOs are beginning to explore moving into the edge cloud domain beyond telcos, and studies within this alliance can help accelerate the development and adoption of Cloud RAN technology. This transition is also important for the ultimate goal of making networks AI-native, especially in understanding how to utilize shared infrastructure for both the AI and telco workloads. Early studies of this alliance are targeted to be published for the next MWC Barcelona in 2025, so now that the WGs are officially formed, studies are likely already underway and the industry will be watching to see initial findings.

This alliance also has the potential to create new competitive dynamics between industry players, both from the chipset side and general infrastructure side. With NVIDIA being a founding member, it is likely that any research conducted by the respected WGs will revolve around Graphics Processing Unit (GPU)-based RAN technology for the foreseeable future. This is a strategic step by NVIDIA to make GPU technology an integral part of 6G standards and to ensure it can gain a more dominant market position against its main competitors, Intel and AMD. It followed the formation of this alliance with the release of its 6G Research Cloud Platform in March (see ABI Insight “Is NVIDIA Showing Us the Future of 6G?), given that it has found a successful entry into the telecoms domain more difficult than it may have anticipated in the 5G era on a large scale. It is important to note that other than the U.S. Entity List, there is no “blacklist” for who can join this alliance; therefore, while early studies are currently likely to focus on GPU technology, it does not mean Intel and AMD are not allowed to be part of the alliance in any capacity now or in the future.

From the AI-RAN Alliance’s perspective, better educating the industry about its purpose and value in shaping the utilization of AI technology within the RAN, highlighting its role in assisting the development and standardization of 3GPP standards related to AI/Machine Learning (ML) technologies, and showcasing the AI-driven revenue streams it uncovers in its findings to MNOs are perhaps the most important and valuable strategies it can take in the short term. Beside T-Mobile, no other MNO has been publicly announced as a member; it is critical to entice more MNOs to sign up and work in a collaborative environment to find successful AI-driven revenue streams.