The North American Rail Industry

|

NEWS

|

In September 2024, RailPulse launched a platform to facilitate rail visibility across North America. Some context is needed.

RailPulse is an initiative created in 2020 by leading railcar owners in North America (Canada and the United States), including Class 1 and 2 railroads, lessors, and railcar-owning shippers, with the goal of pushing rail digitization. The problem it aimed to solve was that despite having the largest Total Addressable Market (TAM) in the world, with over 1.6 million railcars, the North American market is notoriously underpenetrated by Internet of Things (IoT) visibility technology. While Europe started adopting railcar telematics many years ago, for over 40 years, North America has been using wayside technology that enables a snapshot view of railcar location and condition using machine vision and sensor-based inspection devices mounted on the side of the tracks, usually at rail-grade crossings. While the technology has been considered “good enough,” rail adopters were increasingly afraid that as their digitization lagged behind other transport modes such as truck, air, and ocean, the rail sector would lose modal share to these—thus decreasing volumes transported and revenue, and sending the industry into an underinvestment spiral.

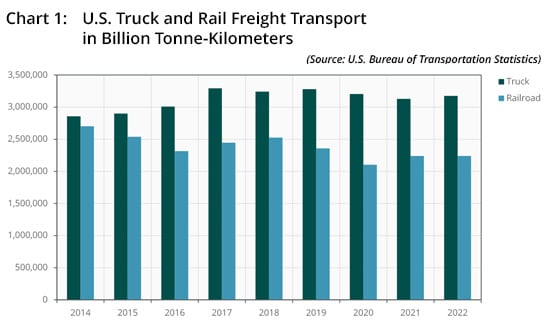

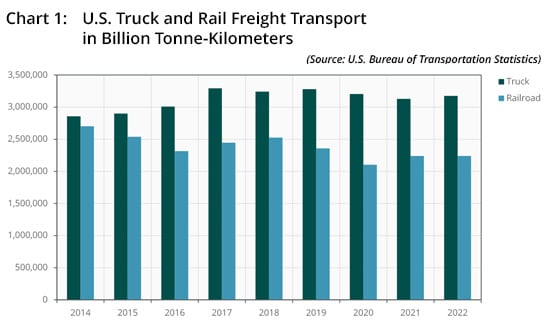

According to the U.S. Bureau of Transportation Statistics, since its peak of 2,704 billion tonne-kilometers of freight transported by rail in 2014, volumes transported by the rail freight industry have, in fact, declined by an average of 2.3% Year-over-Year (YoY) to 2,239 billion tonne-kilometers in 2022. Despite rail being both one-third of the cost of trucking and emitting around 8X less Carbon Dioxide (CO2), freight transport by truck increased by an average of 1.3% YoY over the same period, from almost the same level as rail in 2014 to 3,175 billion tonne-kilometers, making it the clear modal leader in the United States.

Instead of every railcar owner or operator setting out on their own digitization journeys and experimenting with technologies and implementations, leading U.S. rail representatives banded together to limit the complexity of technology procurement and to drive industry-wide digitization. The role RailPulse was designed to fill in the market was as a middle-entity, assembling leading railcar IoT suppliers, creating a set of hardware and data standards, and to bundle a uniform technology solution for the diverse requirements of railcar owners and operators. The reason such an initiative is possible for rail, but not for any other transport mode is that rail does not have the same competitive dynamics. Rail routes tend to be operated by one or two carriers, which compete much less for volumes than in the trucking industry. Digital technology is not as significant a competitive differentiator for U.S. railcar owners or operators against their peers, as much as it is for the rail industry against other modes of transport. What’s good for the goose is good for the gander.

Since 2020, RailPulse has been busy bringing on new members (membership now stands at 11, including 4 out of the 7 U.S. Class 1 railroads), setting standards for hardware and data (hardware is required to be certified intrinsically safe and to support four external sensors—specified as load/empty, handbrake, impact, and open/close—in addition to Global Positioning System (GPS) in the gateway device), and evaluating rail technology supplier partners (to date, these are Amsted Digital, ZTR, Nexxiot, and Wabtec). This brings us to September 2024 and RailPulse’s platform launch.

A New Procurement Model

|

IMPACT

|

The RailPulse platform acts as a front end single pane rail telematics view for railcar owners. The platform ingests data from third-party telemetry vendors—Amsted Digital, Nexxiot, Wabtec, and ZTR (for whom BlackBerry bundles hardware and a Software-as-a-Service (SaaS) platform)—and presents the data to the customer. Having a universal platform reduces the need for railcar owners and railcar lessees to move between different user interfaces, as well as structuring the data in a coherent and cohesive manner so that adopters who wish purely to consume data via an Application Programming Interface (API) can integrate the data into their own systems with minimal effort. The data from the RailPulse platform can also be sent via an API to shippers or lessees who can gain much greater visibility into their own shipments.

One core differentiator of the RailPulse platform is that it is developed alongside Railinc, a software and data messaging provider for the rail industry. Railinc’s unique strength is that railcar owners and operators are obligated to use several of Railinc’s data systems. By being so deeply embedded in the North American rail industry, Railinc sits on a treasure trove of data. Part of the agreement between RailPulse and Railinc involves the latter sharing some of this unique data to enhance the telematics data coming into the RailPulse platform. Specifically, three types of data are included in the agreement: Car Location Messages (CLMs), waybills, and Umler data. Waybills provide information on point of origin, route, and destination, consignor and consignee, and cargo description and weight They are highly valuable documents in supply chain visibility, often essential for pulling a rail shipment status; even the biggest data aggregators like project44 and FourKites do not have default access to waybills. Umler data provides many kinds of data around railcar dimensions and capacity, as well as information supporting assessments of equipment health.

This is one of the key areas where RailPulse’s platform adds value compared to the standard digital service offerings of vendors like Amsted Rail, Nexxiot, ZTR, and Wabtec. These vendors tend to offer SaaS platforms offering use case-specific analytics, such as analytics around wheel health, brake slides, loading/unloading detection, and impact analytics, among many others. RailPulse can significantly enhance these data to provide additional value, such as pairing load information with telematics data, understanding equipment health by pairing sensor data from the telematics vendors with Umler data, or knowing rail traffic on a particular route. Rail digital service providers can focus instead on the device-to-cloud logic and processing, which is where a lot of the competition resides, as vendors look to provide a best-in-class solution based on the data types available to them—in other words, they remain the engine, while RailPulse provides the front end.

Another aspect of the platform launch is that it provides a different go-to-market model for digital service providers in North America compared to Europe. In Europe, telematics vendors contract directly with the railcar owner for procurement and implementation. In North America, RailPulse acts as the middle entity that pools demand from adopters and connects them with suppliers. In May 2024, Amsted Digital signed a reseller agreement with RailPulse to this end.

The Highway to Railway Visibility

|

RECOMMENDATIONS

|

The RailPulse initiative is already seeing success. A typical figure cited is that the North American rail market is less than 2% penetrated by telematics technology, of which the majority is deployed on tank cars carrying crude oil (the result of a 2014 emergency order by the U.S. Department for Transport). This number has been growing steadily, however, in the past few years, and ABI Research is aware of a number of large-scale projects with rail lessors and railroad operators. As a result of the rail industry’s unique competitive dynamics, the RailPulse initiative has provided an opportunity for an accelerated deployment of IoT technology in North America. While adopters will still approach digitization at different speeds, the initiative certainly lowers the barrier to entry.

One thing seems certain: participation in the RailPulse initiative will become an increasingly important requirement for rail technology solution providers wishing to serve North America’s enormous rail market. RailPulse currently has 11 members, with a full 3 new members added in 2024, suggesting the consultative phase of standard setting and infrastructure building is over and that the organization is turning to signing up members for its services. As RailPulse’s standards become more ubiquitous, RailPulse is likely to become a default for railcar digitization in North America, much as Railinc is now for data feeds, and the incentive for adopters to use an external vendor will continue to diminish.

In 2025, we will continue to see an acceleration of deals and deployments. Lessors will be the first major target, representing around 57% of the railcars in the North American market. Top targets include GATX (around 110,000 railcars in the U.S. market), Wells Fargo (135,000), Trinity Rail (140,000), and CIT Rail (120,000); of these, GATX and Trinity Rail are RailPulse members. The demand is there—it is rare that adopters give such a clear demand signal by forming a technology adoption initiative like RailPulse. The initiative has created the framework and lowered the entry to adoption; the speed of adoption and deployment is the remaining question.