5G Subscriptions Are Growing, but Cell Site TCO Challenges Are Mounting

|

NEWS

|

5G subscriber growth has been building. Out of the 8.56 billion cellular end users on the planet, by the end of 1Q 2024, there were more than 1.7 billion 5G subscriptions on more than 300 commercial mobile 5G networks. Within the top 30 markets ABI Research actively tracks, 5G subscriptions have the potential to grow to 4.19 billion by 2029. On the face of it, this looks impressive, but delving into the end-user metrics, a more nuanced picture emerges. While 5G subscription adoption is being driven by a combination of use cases from consumer to 5G-to-Business (5GtoB) and even the Internet of Things (IoT), the 5G Quality of Experience (QoE) is a function of connectivity, as well as lower latency and reliability considerations.

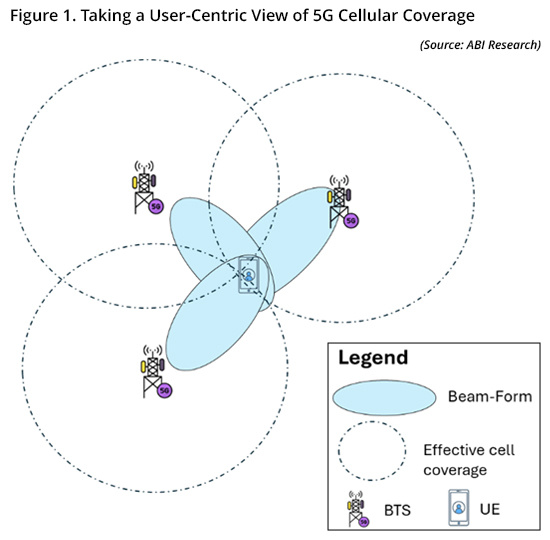

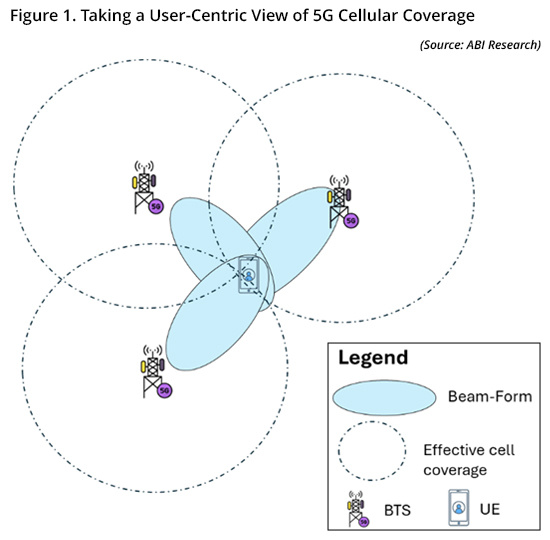

The fundamental reality is that end users, or IoT terminals, may not necessarily be in close proximity to the cellular base station. Cell site upgrades and greenfield rollouts still continue, but acquiring new cell sites, especially in dense urban centers, is becoming increasingly expensive. Just securing access to fiber-optic cable, electrical power, and cell site preparation on a rooftop can range from US$50,000 to US$70,000 and a macro-base station ranges from US$150,000 to US$200,000. It is interesting, therefore, to see cellular antenna solutions adapting to the cellular base station and end-user requirement landscape to deliver “user-centric” solutions.

Harnessing Extremely Large Antenna Arrays

|

IMPACT

|

Mobile operators have been able to boost throughput and sensitivity by deploying Massive Multiple Input, Multiple Output (mMIMO). mMIMO is one of the biggest breakthroughs with 5G networks, broadening mobile network coverage, expanding capacity, and providing an improved user experience for mobile users. By using multiple antennas, mobile operators can widen cellular coverage areas and increase data capacity and user throughput. Spatial multiplexing, beamforming, and other novel solutions with mMIMO can be deployed in the radio unit and the distributed unit. However, mMIMO performance can only be assured for the inner parts of the cell’s coverage area. Due to the challenges of not being able to increase cell site densification ad infinitum, as well as the presence of buildings, trees, and other obstacles in the landscape, QoE can differ substantially from the center of a mobile coverage “cell” to the “edge” of the cell. New 5G cellular application scenarios such as transportation, Unmanned Aerial Vehicles (UAVs), smart city applications, smart manufacturing, healthcare, and city-wide Closed-Circuit Television (CCTV) monitoring systems require stable and robust connections to demonstrate their value, especially at the fringes of a cell site.

To address these periphery cell scenarios, vendors like ZTE have developed a dynamic and distributed, but still deterministic connectivity solution. ZTE’s solution is the D3-ELAA (Dynamic, Distributed and Deterministic Extremely Large Antenna Array). Essentially, it creates an ELAA by dynamically networking a number of locally-adjacent base stations to address the needs of end users/terminals that are far from the center of their own cell sites.

The signals coming to and from the adjacent, multiple base stations can be aggregated to form a “User Equipment (UE)-level cooperation cluster.” By providing picosecond-level synchronization and calibration of each base station’s transmit/receive signals, a substantially enhanced level of connectivity and reliability is provided to each end user/terminal than what would be possible from a single base station. Furthermore, the beamforming capabilities of multiple mMIMO antennas in the UE cooperation cluster provide joint and distributed beamforming that can then be combined into a larger, “virtual” antenna array. What is notable about ZTE’s solution is that base station antennas with configurations from 4T4R to 8T8R to 64T64R, and even potentially 128T128R antennas can be combined into these dynamically distributed antenna arrays. The transmissions and traffic from the UE-level cooperation cluster is managed by a distributed beamforming algorithm. ELAA is not just expected to augment 5G-Advanced deployment, but even play a valuable role in 6G.

Investment in ELAAs and mMIMO to Grow

|

RECOMMENDATIONS

|

Mobile operators are facing a complex confluence of challenges. 4G subscribers will upgrade their subscriptions to 5G “if” they see the benefits of 5G over 4G. Many operators have upgraded their cell sites to support 5G and have even deployed some of the higher forms of mMIMO, such as 32TR or 64TR, to boost bandwidth and the link budgets of their cell sites. However, the Total Cost of Ownership (TCO) reality of today’s cell sites means many downtown areas cannot easily increase the number of cell sites, macro-cells, and small cells, per town or city. Operators will need to evaluate the potential of utilizing synergistic, dynamic solutions that maximize their Return on Investment.

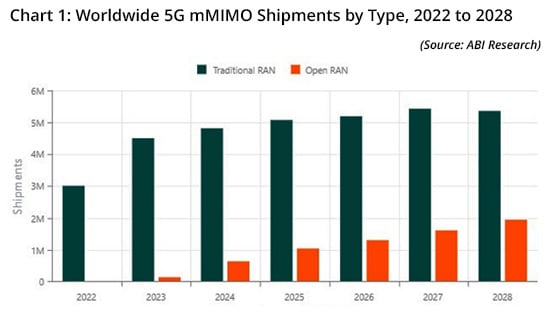

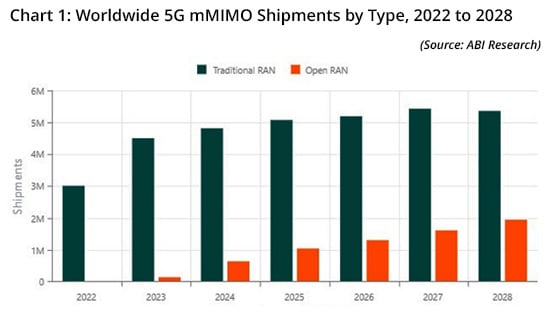

With vendors such as Ericsson, Huawei, Nokia, and ZTE developing ELAAs, this also underscores the value of mMIMO to the mobile telco community. Due to the need for ELAAs, as well as what mMIMO antennas, in general, can offer the mobile operator community, ABI Research anticipates that mMIMO shipments will grow from 4.65 million in 2023 to 7.29 million in 2028. Open Radio Access Network (RAN) shipments made their presence felt in 2023 and are expected to grow to 1.94 million; however, the bulk (73%) of the mMIMO shipment market is likely to be traditional RAN equipment (see Chart 1).