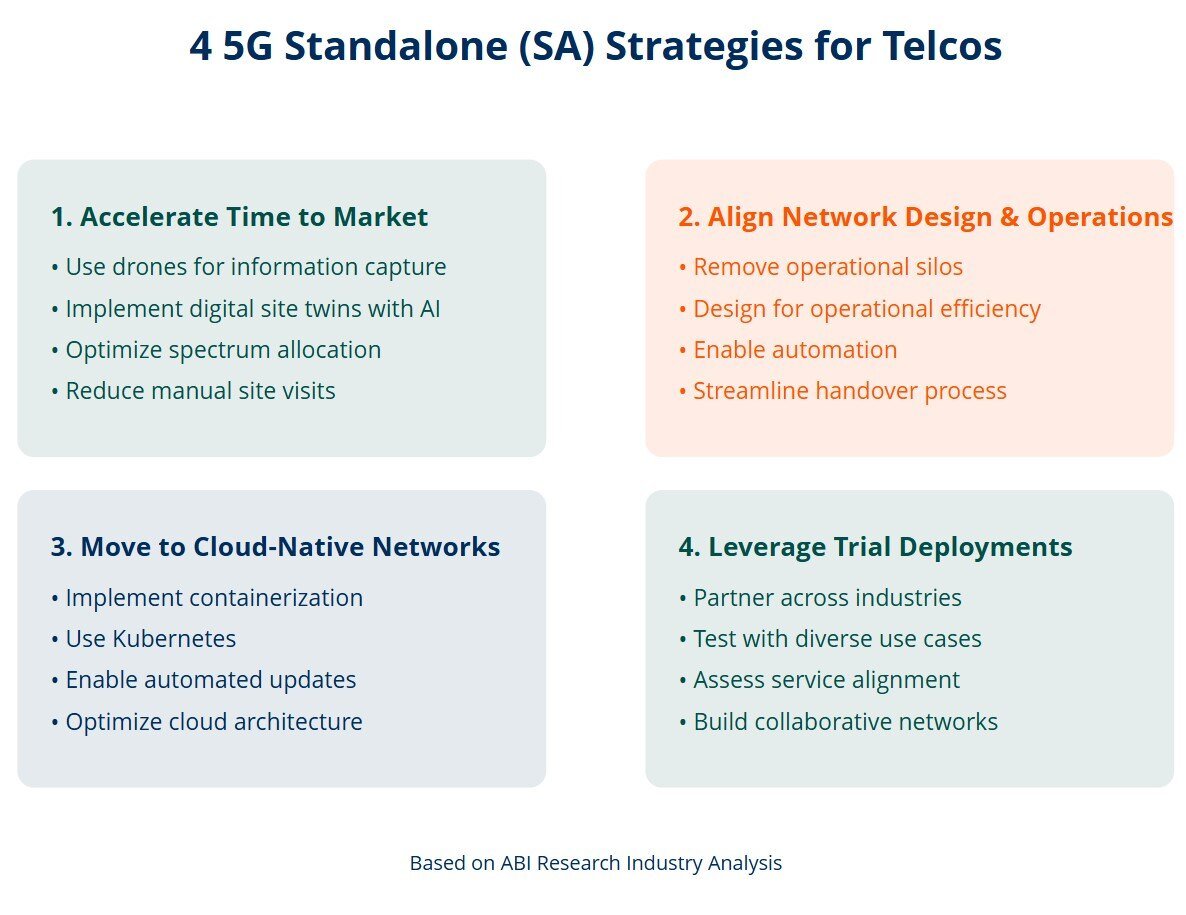

When Mobile Network Operators (MNOs) migrate to 5G Standalone (SA), they usually follow a similar strategic path through Non-Standalone (NSA). However, there are various deployment tactics that can enhance efficiency and add value throughout the operator transition. These differences matter to operators as they seek cost-effective ways to evolve from legacy systems. In this vein, ABI Research Industry Analyst Nelson Englert-Yang highlights four key deployment tactics for getting the most value out of the transition to 5G SA.

1. Accelerate Time to Market with Digitalization and Smart Deployment

Despite the widespread use of 5G New Radio (NR), Radio Access Network (RAN) deployment strategies remain a relevant topic for 5G SA because: 1) it is an essential component of the SA architecture where coverage is expanding, and 2) it is an expensive investment where deployment efficiency will impact subsequent 5G Core (5GC) investments. To ease the transition to 5G SA, operators must focus on efficient 5G NR deployment.

Technologies like drones for information capture and digital site twins powered by Artificial Intelligence (AI) optimize deployment before physical work begins. These digital models allow for better spectrum allocation, reduced waste, and streamlined network configurations. This approach simplifies network upgrades and enhances safety by reducing manual site visits. Ericsson and Nokia have pioneered these methods for faster deployment.

2. Align Network Design and Operations for a Smoother Handover

5G network architectures are complex, involving virtualization technologies, multi-layered software, and support for various mobile generations. To streamline operations, vendors are removing silos between network design and operations.

Proactively designing networks for ease of operation reduces complexity and opens doors for automation. This collaboration between design and operations teams optimizes efficiency, making the handover a smoother, more cost-effective process. Vendors like Cisco and Mavenir are notable champions of this highly collaborative approach toward 5G SA migration.

3. Move to Fully Cloud-Native Networks

Operators with cloud-based networks should leverage containerization technologies like Kubernetes for faster 5G rollouts and automated updates. However, many still rely on manual updates instead of fully adopting cloud-native principles.

Maximizing the potential of cloudified networks often requires revisiting the architecture. For example, Swisscom is updating its 5G setup to integrate Kubernetes Resource Models (KRMs) for automatic configuration. This cloud-native approach boosts automation and continuous deployment.

4. Leverage Trial Deployments to Expand Reach

5G SA networks require collaboration from a wide range of vendors, making coordination crucial for smooth deployment. 5G SA trials provide operators with the opportunity to assess how 5G services align with new industries, including government, emergency services, and manufacturing.

Case in point, Vodafone and Ericsson partnered to roll out private 5G networks in Spain, following their independent deployments at Ford’s factory in Valencia. Ericsson’s own pilot for Ford involved a diverse group of partners, including robotics companies, Internet of Things (IoT) specialists, and universities. The pilot demonstrates how collaboration across industries is key to advancing 5G SA solutions.

Early Movers to 5G SA

There has been remarkable market activity with 5G SA, despite the overall slow industry transition.

Mavenir is noteworthy for its 5G SA-first strategy, which works in the opposite direction of most other deployment strategies that start with 4G or other legacy generations and later build in 5G SA functionality. By starting with 5G SA, Mavenir prioritizes early access to 5G monetization and re-centers the network around a modern, cloud-native architecture. Legacy generations are then integrated into the “Any-G,” cloud-native converged packet core. Mavenir enables new services like network slicing along the way.

More generally, the converged cloud-native core supporting NSA and SA has become an industry standard for 5G transition. It is offered by various vendors, including Ericsson, Huawei, Mavenir, and Nokia. This solution consolidates legacy and modern infrastructure, while enabling MNOs to access advanced 5G features like differentiated connectivity, network Application Programming Interfaces (APIs), or optimized resource allocation.

Guided by progressive MNOs, the fast-track to 5G SA has also been supported by network vendors such as Cisco, which deployed the first U.S. nationwide 5G SA network for T-Mobile; Ericsson, which has been instrumental in deploying 5G SA for major operators Singtel and Jio; and Nokia, which deployed the 5G SA Core in the Amazon Web Services (AWS) public cloud for 02 Telefónica in Germany—to name a few.

On the MNO side, Vodafone illustrates how operators may push significant breakthroughs with 5G SA. Vodafone was the first telco to commercially launch 5G SA in Europe back in 2022. While the initial deployment was confined to Germany, the network has since expanded to the United Kingdom. Vodafone has shown resilience to a strict European regulatory environment and has pushed for better spectrum policies and enhanced security standards to increase competition and investment in 5G SA. Vodafone has also combined national deployments with localized efforts, including private network slicing for industries like railways and police.

Recently, successful 5G SA rollouts have proven that this transition can become a reality with the right strategies and partners. ABI Research has taken special notice of how vendors differentiate themselves by offering unique advantages, such as Cisco’s open architecture, Huawei’s focus on network autonomy, Nokia’s multi-cloud positioning, and ZTE’s Core enhancements via in-line accelerators. As more telcos embark on this journey and implement the necessary strategies, the goal of monetizing 5G throughout the transition is coming into reach.

For a more in-depth guide on 5G SA implementation strategies and monetization opportunities, download the following ABI Research reports:

About the Author

Nelson Englert-Yang, Industry Analyst

Nelson Englert-Yang, Industry Analyst

Nelson Englert-Yang is an Industry Analyst on the Strategic Technologies team at ABI Research. Nelson provides research, analysis, and insight into 5G and 6G cloud-native systems. Nelson's current research assesses strategies for implementing Artificial Intelligence (AI) for telco network automation and data practices.