There’s a fierce game of tug-of-war taking place within the telecommunications industry. On one side of the rope is the consumer-centric business model that Communication Service Providers (CSPs) have traditionally relied upon. On the other end are 5G cloud and software services that define a future, digital-first world. Each telecom domain vies for the attention of CSPs equally. Operators must look both to the future—promising new growth opportunities in the enterprise—while also being careful not to let their hands slip from the consumer side of the rope.

The potential for new business lines is significant with 5G, but CSPs must understand that the strategies used for the consumer domain do may not apply to decisions made outside of it.

Consumer Value Creation

Making up about 75% to 80% of Tier One CSPs’ overall revenue, the consumer segment is the telecoms industry’s bread and butter. Mobile operators have traditionally conducted their business under the mindset of “build it and they will come”, implying that, as long as you build new and improved cellular technologies, consumers will flock to them.

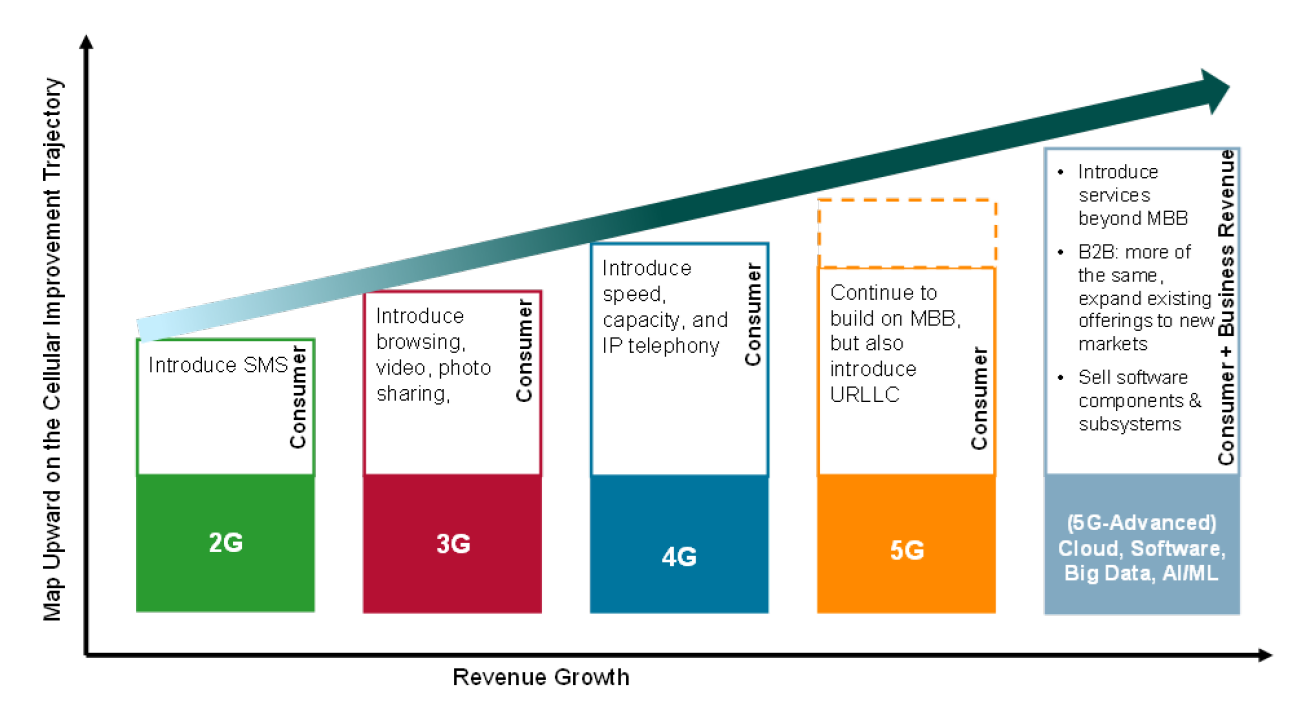

Whether it’s 3G’s introduction of browsing, video, and photo sharing, or 4G’s faster network speeds and higher data capacity, CSPs have successfully driven additional revenue for telephony products by introducing iterative improvements each generation. Under this consumer operating model, the CSP takes control from the top down. To this extent, the mobile technologies they develop serve as the impetus for new revenue streams.

However, this traditional subscriber-only growth is approaching its maximum potential, especially in developed countries. 5G Mobile Broadband (MBB) services drive new growth, but additional revenue results have not been robust. To tap into new revenue opportunities, CSPs may have to take different approaches to managing their base business while pursuing new disruptive options. As pointed out in a recent ABI Insight (IN-6907), driving further growth in telecoms is now more about the strategic leap forward that tech can propel and less about the tech itself.

The figure below, which can be found on our Instagram account, depicts the existing consumer value chain in the telco industry.

Figure 1: Existing Consumer Value Chain (Source: ABI Research)

Evolution of the Consumer Value Chain

The telecoms industry is evolving, and CSPs cannot avoid the ripple effects. On their journey to seizing untapped potential in 5G, CSPs must be wary of the following shifts in cellular network architectures:

- Vertical Openness: Vertical openness refers to the decoupling of the user plane and control plane, as well as the separation of hardware and software components. To illustrate, in a 5G Cloud Radio Access Network (RAN), the deployment of the Virtualized Distributed Unit (vDU) and Virtualized Central Unit (vCU) is done independently from traditional Data Center (DC) x86 hardware.

- Horizontal Openness: Horizontal openness alludes to the presence of open interfaces between network elements, encompassing fronthaul, mid-haul (F1 interface), and other interfaces such as E2 and X2. A prime example of this concept is observed in Open RAN. The combination of vertical and horizontal openness empowers network programmability and fosters innovation by leveraging open Application Programming Interfaces (APIs). These open APIs enable greater flexibility, allowing for the seamless integration of different network components and stimulating the development of novel applications and services.

- Ecosystem Decentralization: The increased deployment of 5G Core (5GC) and Open RAN will lead to enterprises increasingly moving some of their network and computing resources to the local edge. This is a golden opportunity for CSPs to reinvest their time, money, and resources to improve existing products/services and build new ones.

Three Avenues for New Growth

When driving new growth, 5G Non-Standaolone (NSA) networks likely will not be enough. It serves as a good initiation point for enhanced bandwidth and increased capacity requirements at a lower cost per Megabyte (MB), but eventually, new growth will require the transition to Standalone (SA) modes.

Operators can either leverage their existing strengths to expand 5G services or develop new use cases. The former option is lower-risk and more straightforward but doesn’t necessarily forge new markets. In contrast, developing new use cases has significant growth potential for operators. However, this approach comes with more risk, a high barrier to entry, and the need for a new operating model that prioritizes huge, long-term revenue potential over short-term gains. To put it more clearly, the three avenues for new CSP business growth are articulated below.

- Better Execution of Traditional Use Cases: In the short to medium term, there is an opportunity for upselling within the consumer domain. This entails transitioning customers to premium phone plans and adjusting prices accordingly. However, this strategy's success depends on the market's specific dynamics.

- Expand Traditional Use Cases in New Domains: CSPs can generate additional revenue by becoming aggregators, providing connectivity services to new verticals while leveraging their existing business divisions. This allows them to expand their offerings and tap into new markets.

- Establish New Business Models and New Use Cases: According to a 2022 survey from manufacturing company Jabil, 53% of telecommunications experts expect new business models to materialize during the transition to 5G. CSPs can potentially enter new verticals by selling “new” products and services. This is a more radical approach with a high degree of risk if not approached with caution. This necessitates changes in behavior.

A Blueprint for New Growth

Now that the avenues for new 5G growth have been identified, how can CSPs seize these opportunities? This section lists five essential aspects of the blueprint for new growth.

1. Innovate the Operating Model

The transition from a closed ecosystem to an open and decentralized one will inevitably face challenges. This shift will test factors such as commercial focus, strategies, and operating models, as they need to adapt and align with the new decentralized setting. Above all, mobile operators must fully embrace digital transformation to ensure brownfield deployments are ready for a digital-first world. Highlighting this fact, legacy infrastructure was deemed the most significant barrier to automated zero-touch services, according to a recent survey from Telecoms Intelligence.

There’s also increased demand for telecom partners that deeply understand enterprises’ specific pain points and business outcomes so that the 5G network caters to them in a tailored manner. For example, how can a 5GC network speed up the checkout process in the retail sector? How much data can a supermarket chain send to an end customer digitally? These are the kinds of business outcomes that cellular tech unlocks, and enterprises seek.

2. Plan for Bottom-Up Strategies

CSPs can capture greater enterprise value by offering custom solutions, necessitating operators to build their 5G solutions from the bottom up. In other words, the customer pain points are the seeds that bear the fruit of new 5G software and services. To get there, ABI Research advises CSPs to adapt their approach in three areas for enterprise expansion:

- Enterprise Product Type: Focus on industry-specific 5G offerings that address the business outcomes enterprises seek rather than just the technology itself.

- Enterprise Market Segment: Shift segmentation criteria to understand the specific circumstances and needs of target customers, enabling the provision of outcome-oriented solutions.

- Enterprise Operating Model: Align the operating model with customer needs and create tailored network solutions to become trusted partners for enterprise customers.

3. Initiate Services Convergence

Service convergence allows CSPs to gain operational efficiencies and economies of scale. This is done by taking all the siloed-off services and unifying them all under the same umbrella. When 5G network services converge, service functions not only share network infrastructure, but knowledge as well. The end result is the removal of the limits imposed by the existing consumer-oriented organizational structure. Consequently, resources can be allocated to the right tasks at the right time.

4. Establish a Mainstream New-Growth Interface

The traditional CSP organizational structure revolves around mapping upward on the cellular trajectory to drive new revenue. Anything diverging from that path, including new growth strategies, is categorized as disruptive. To date, CSPs have struggled to balance their sustained base business with new ventures into 5G services. Business logic tailored for the consumer domain is not a good value predictor outside of it. This mindset impedes additional telecom revenue and must be removed.

These findings come from ABI Research’s Operator Growth Strategies: 5G and Network Automation Beyond Consumer Markets report. Learn more about the commercial challenges facing CSPs and the strategies that will translate to sustained new growth by reading the associated Research Highlight: How Communication Service Providers Can Drive Change in the 5G Market and Reap Rewards beyond the Value Chain.

This content is part of our 5G Core & Edge Networks Research Service.