Batteries are often associated with being hazardous and harmful for the environment. While this is true, their mineral-richness should not be overlooked. When properly recycled, you can recover scarce materials like lithium, nickel, and cobalt from a battery. These minerals can then be reused for future battery manufacturing.

As Electric Vehicles (EVs) become increasingly frequent on U.S. roads, the role of battery recycling is essential. Recyclers break down scrapped EV batteries into a light powder without losing the mineral composition. This “black mass,” as it’s called, is then processed into new Precursor Cathode Active Materials (pCAM) and Cathode Active Materials (CAM) at large facilities. Recycling makes the EV supply chain more sustainable and economical.

Companies like Ascend Elements, Cirba Solutions, Li-Cycle, and Redwood Materials are the prominent battery recyclers in the United States. To prepare for the EV wave, billions of dollars are being invested in constructing new battery recycling plants in states like Ohio, Kentucky, South Carolina, Nevada, and Arizona.

Battery Recycling Methods

EV batteries can be recycled sustainably in three primary ways: pyrometallurgical, hydrometallurgical, and direct.

- Pyrometallurgical: This method requires smelting the battery to turn the metals into liquids. This method of battery disposal is not only bad for the environment, but it also fails to recover all critical minerals from the battery. Therefore, the pyrometallurgical recycling method is a poor fit for processing lithium-ion batteries and is not on the radar of U.S. recyclers.

- Hydrometallurgical: This is the leading recycling method among battery recyclers in the United States due to its high efficiency, sustainability, and ability to cover all cathode metals. The process involves shredding the EV battery and physically extracting the CAM from other battery parts, such as the anode and plastics.

- Direct: This is a newer battery recycling method championed by Ascend Elements. In this process, impurities are leached out from the used battery, and pCAM is directly synthesized. While direct recycling reduces cost, time, and environmental impact, it requires additional disassembly.

Where Do EV Batteries Get Recycled in the United States?

Most EV batteries get recycled within the “battery belt,” which spans from Quebec in Canada to Georgia in the south. This geographic range resembles the U.S. battery supply chain, including the Midwest's automotive hubs, the emergent Southeast with low labor costs, and Canada's plentiful natural resources. While not as crucial as the battery belt, the southwest U.S. has garnered some interest in EV battery recycling. Tesla’s EV Gigafactory in Nevada serves as a catalyst.

Battery Recyclers Are Ahead of the EV Boom

My team and I are confident that battery recyclers across the United States will comfortably meet the demand for EVs. Between significant private investments and generous government grants, battery recyclers are building capacity well beyond expected EV sales. Moreover, the overwhelming majority of U.S. citizens do not drive EVs yet, and it will take 10 to 20 years before an EV battery needs to be scrapped.

By 2030, recyclers will be able to reclaim 1.3 million Battery Electric Vehicle (BEV) equivalents of batteries every year, far exceeding the expected number of EV batteries scrapped. Some recyclers plan to construct new facilities by the end of the decade, but these projects may be scaled down, pushed back, or abandoned altogether. Expanding operations makes no business sense if recycling capacity is already ahead of demand.

Until EVs are fully mainstream in the United States and end-of-life batteries become more readily available, the EV battery recycling industry will primarily revolve around manufacturing scrap.

Major EV Battery Recyclers in the United States

The four leading recycling companies targeting the EV supply chain in the United States are Ascend Elements, Cirba Solutions, Li-Cycle, and Redwood Materials.

Ascend Elements

Ascend Elements recovers cathodes from an EV battery and turns them into new cathode pCAM using a direct recycling process. The company calls this process Hydro-to-Cathode. Ascend Elements’ plant in Georgia can reclaim 70,000 BEV equivalents per year—more than any other U.S.-based recycling plant.

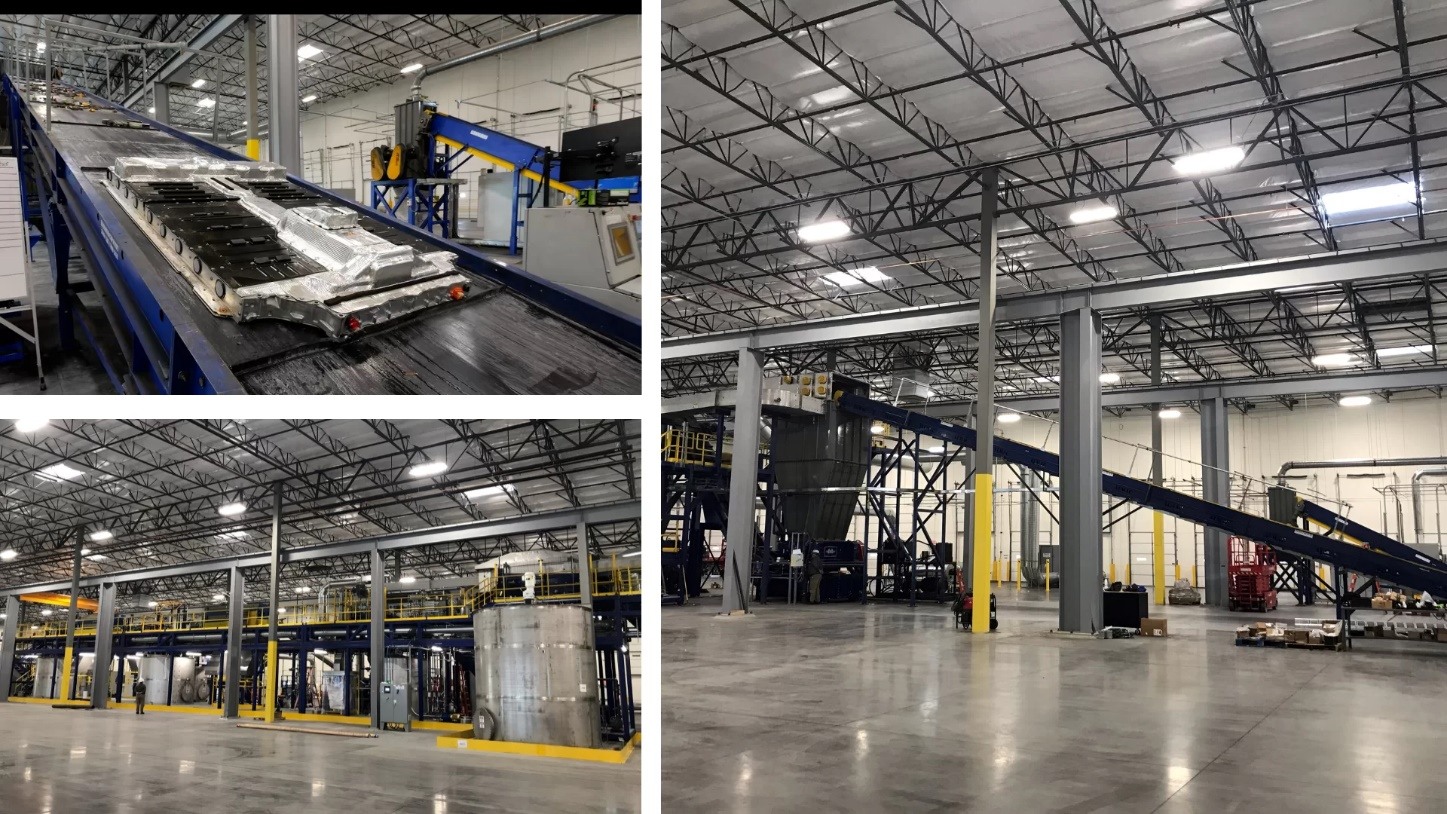

Ascend Elements and SK have partnered to construct the 500,000-square-foot Apex 1 facility in southwest Kentucky. At full capacity, the plant is expected to recycle enough pCAM and CAM for 750,000 EVs annually. The Westborough, Massachusetts-based company has signed a basic agreement with Honda to scrap lithium-ion batteries from Honda’s EVs in North America.

Figure 1: Construction of Ascend Elements’ Apex 1 Recycling Facility in Kentucky

Cirba Solutions

Cirba Solutions is the most experienced company in the U.S. battery recycling industry and one of the largest producers of black mass from lithium-ion batteries. It extracts critical battery minerals using a hydrometallurgical process and returns them to the supply chain for reuse.

For decades, Cirba Solutions has operated battery recycling plants in Lancaster, Ohio, and Trail, British Columbia. The company plans to open seven new plants across North America, with facilities in Ohio, South Carolina, and Arizona already confirmed for construction.

The new facility in Lancaster, Ohio will be able to recycle 200,000 new EV equivalents of battery-grade material per year. The Infrastructure Investment and Jobs Act, which provided US$75 million in funding, was a key enabler in making the facility possible to build.

The new plant in Chester County, South Carolina is strategically located within the battery belt. While the US$300 million construction project is currently in limbo, it’s expected to salvage lithium materials equivalent to 500,000 million EV batteries annually.

A smaller facility in Eloy, Arizona has also been announced. Cirba Solutions’ affiliate, Heritage Battery Recycling, will operate the plant and will process enough battery material to produce 50,000 EVs every year.

Figure 2: Cirba Solutions’ Planned Battery Recycling Facility in South Carolina

Li-Cycle

Li-Cycle is an innovator in the battery recycling industry, using a spoke-and-hub logistics model. In this model, Li-Cycle converts EV batteries into black mass in Arizona, Alabama, Ontario, and New York facilities. From there, the black mass is transported to a central plant in Rochester, New York, where a hydrometallurgical process turns the black mass into battery-grade materials. Under current plans, Li-Cycle’s Rochester plant will enable the reuse of 180,000 BEV equivalents per year. But in October 2023, the development was paused as construction costs climbed.

Li-Cycle is already a key player in the European battery recycling industry, having opened one of the largest facilities in Europe in 2023. The spoke facility in Magdeburg, Germany can process up to 30,000 tons of lithium-ion battery material each year. The plant is also capable of directly processing entire EV battery packs. In collaboration with Glencore, the planned Italian Portovesme Hub has a projected processing capacity of 50,000 tons to 70,000 tons of black mass annually. Li-Cycle will use its experience doing business in Europe and apply it to optimize recycling operations in the United States.

Li-Cycle also processes battery scrap into black mass at Ultium Cells’ gigafactory in Lordstown, Ohio, as the company is LG's preferred partner.

Figure 3: Interior of Li-Cycle’s Battery Recycling Facility in Gilbert, Arizona

Redwood Materials

Tesla co-founder JB Straubel heads Nevada-based recycler Redwood Materials. The startup is a vertically integrated supplier of anode copper foil and CAM. For example, Redwood recycles EV production scrap for Panasonic and supplies it with these critical battery materials for reuse. Like most other battery recyclers in the United States, Redwood uses the hydrometallurgical process.

Panasonic is Tesla's main battery supplier, making the partnership between Redwood and Panasonic one of the most prominent in the battery reuse space. Redwood also provides battery recycling services for automakers like Ford, Toyota, Volkswagen, and Volvo. With the Toyota deal, Redwood will supply a minimum of 20% reused nickel, 20% lithium, and 50% cobalt.

Redwood has been very active in the electrification transition in California, working closely with Governor Gavin Newsom’s administration. In 2022, Redwood launched the world’s first circular program for EV battery recycling. Working alongside automakers and battery dismantlers, the program recovered 1,268 end-of-life hybrid and EV battery packs. This translates to roughly 500,000 pounds of raw materials.

Redwood has grand ambitions. It expects to recycle enough anode and cathode to power 1 million BEVs annually by 2025 and 5 million by 2030. The company aims to create a closed-loop battery supply chain to minimize environmental impact and economic costs for EV production.

Redwood’s main battery recycling facility is located in McCarron, Nevada, and it recently received funding to expand the site. The company also plans to target the battery belt by opening a US$3.5 billion battery plant in Charleston, South Carolina. Hefty financial backing from investors like Goldman Sachs and loans from the Department of Energy enable Redwood to undertake these projects.

Figure 4: Redwood Materials Battery Recycling Plant in Nevada

The Future of EV Battery Recycling

Manufacturing scrap is currently the primary source for recycling EV batteries. Defective batteries that fail quality control at the manufacturing plant are broken down into black mass and processed for material extraction. However, as more U.S. consumers purchase EVs in the coming years, end-of-life batteries will gradually become the primary recycling source. ABI Research expects end-of-life batteries to overtake manufacturing scrap by 2033.

To learn how U.S. recyclers are responding to the surge in EV demand—including shifting logistical models, geographic distribution, and technological adoption—download ABI Research’s report, Securing the EV Supply Chain: Battery Recycling in the United States.