Recent report findings from ABI Research suggest the Generative Artificial Intelligence (Gen AI) software market is on a rapid growth trajectory with high expectations for both hardware and software. Principal Analyst Reece Hayden projects Gen AI’s software market size to increase from a modest US$10.45 billion in 2023 to over US$176 billion by 2030. This dramatic expansion, forecast at a Compound Annual Growth Rate (CAGR) of nearly 50%, demonstrates the market’s bullish expectations for the transformative power of Gen AI across industries and global markets

Chart 1: Generative AI Software Market Size: 2023 to 2030

North America Leads, Asia-Pacific Gains Momentum

While North America currently dominates investment in Gen AI applications, the Asia-Pacific region is expected to become the market leader by 2028. This shift will be driven by the rapid deployment of Gen AI in the region’s expansive industrial and enterprise sectors. Major Chinese tech companies like Huawei, Tencent, and Alibaba are taking a bullish approach to open source Artificial Intelligence (AI). For example, Huawei’s investment in AI hardware drives growth in AI spending in the region.

The market is primarily fueled by cloud-based and edge-based AI software. Enterprise services currently account for about 40% of the market, though this share will slightly decrease as more sectors expand their use of Gen AI.

Check out our total AI software market analysis

Unlocking Generative AI’s Potential in the Enterprise Space

Much of the early hype surrounding Gen AI has been focused on consumer applications, such as chatbots like ChatGPT. Despite this, the real opportunity lies in its untapped potential in the enterprise market.

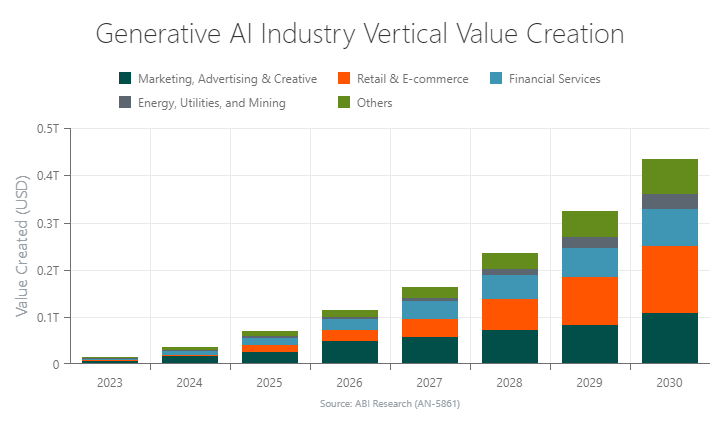

According to a recent study from our analysts, Gen AI use cases in enterprise settings will create US$434 billion in value annually by 2030 across 12 sectors. This immense value stems from its ability to reshape various business functions, from automating routine tasks to creating entirely new products.

Chart 2: Generative AI Industry Value Creation

Key Industries Embracing Generative AI

Several industries are poised to benefit significantly from Gen AI adoption. By the end of 2023, the marketing, advertising, and creative sectors have emerged as early adopters, accounting for an estimated 46% of Gen AI’s enterprise value creation. These industries leverage AI for tasks such as digital content creation, transforming Two-Dimensional (2D) assets into Three-Dimensional (3D) assets, and automating ad copywriting. However, this dominance is expected to wane, with their share decreasing to 25% by 2030, as other sectors ramp up their investments in Gen AI solutions.

Retail and e-commerce are expected to account for a significant 33% of the Gen AI value creation by 2030, up from just 7% in 2024. The sector will capitalize on AI-driven technologies like visual search tools, enhanced chatbots, and automated website optimization. As these applications scale, they will revolutionize customer interactions and streamline operations. These benefits will make retail one of the fastest-growing segments for Gen AI.

Financial Services: A Key Beneficiary

Already one of the biggest users of traditional AI, the financial services industry will capture around 20% of Gen AI’s enterprise value by the end of the decade. Gen AI-powered applications in this sector will focus on stock market analysis, cybersecurity improvements, and automated client communication. With AI systems handling vast datasets, financial firms can enhance decision-making processes, protect sensitive information, and improve client-facing operations.

Expanding beyond the Top Sectors

While marketing, retail, and finance are set to dominate Gen AI adoption, other industries are also beginning to see the potential. Companies in utilities, manufacturing, legal services, entertainment & multimedia, pharmaceuticals, telecommunications, and education are anticipated to invest billions in Gen AI-powered applications by 2030. These sectors will benefit from AI’s ability to streamline operations, boost innovation, and support new products and services.

Generative AI Supplier Ecosystem

Numerous company types can take advantage of the booming Gen AI market. Nearly every enterprise on Earth will leverage the technology one way or the other, opening up almost limitless possibilities for technology vendors. Companies like IBM, Capgemini, Huawei, OpenAI, Amazon Web Services (AWS), Google, Alibaba Cloud, Microsoft, AMD, NVIDIA, and Qualcomm are some of the many active players in the Gen AI space.

ABI Research identifies 7 company types that can exploit the growing demand for Gen AI solutions. Figure 1 includes these company types and the organizations in these categories.

Figure 1: Companies in the Generative AI Market

Conclusion

The Gen AI market is on the cusp of exponential growth, with its applications expanding far beyond consumer-facing technologies. As the enterprise space continues to embrace Gen AI, industries like retail, finance, and manufacturing are poised to reap substantial rewards. With projected spending on software exceeding US$176 billion by 2030, Gen AI is set to become a cornerstone of business transformation in the years to come.

However, our analysts stress that key challenges must be addressed before enterprises can fully harness Gen AI. Some notable obstacles to Gen AI implementation include skills gaps, the cost of Large Language Model (LLM) training, data privacy concerns, chip shortages, safety regulations, the trustworthiness of data, power consumption, and geopolitical tensions.

In our free whitepaper, Assessing Enterprise Generative AI Opportunities and Challenges, you can explore these challenges and future expectations for Gen AI.

About the Author

Reece Hayden, Principal Analyst

Reece Hayden, Principal Analyst

As part of ABI Research’s strategic technologies team, Principal Analyst Reece Hayden leads the Artificial Intelligence (AI) and Machine Learning (ML) research service. His primary focus is uncovering the technical, commercial, and economic opportunities in AI software and AI markets. Reece explores AI software across the complete value chain, with a cross-vertical and global viewpoint, to provide strategic guidance for, among others, enterprises, hardware and software vendors, hyper scalers, system integrators, and communication service providers.