“Connect and Forget" Is Now a Distant Memory

In the early days of the Internet of Things (IoT) industry, Mobile Virtual Network Operators (MVNOs) had clearly defined roles. Virtual network operators considered themselves network resellers, repackaging carrier connectivity at discounted rates and offering few additional services in the process.

Times have certainly changed. As the IoT industry grew, customers began to search for value-added services, demanding advanced connectivity management platforms and verticalized expertise. When searching for service providers to manage their expanding IoT fleets, new clients found traditional Mobile Network Operators (MNOs) were unincentivized to support their scaling businesses.

MVNOs filled in the gaps, developing robust IoT service and network portfolios to cater to all IoT deployments and niche use cases. MVNOs have since become known in the industry as forward-thinking organizations, developing, and evolving cellular connectivity platforms and value- added services in order to serve the ever-increasing IoT embedded connectivity opportunity.

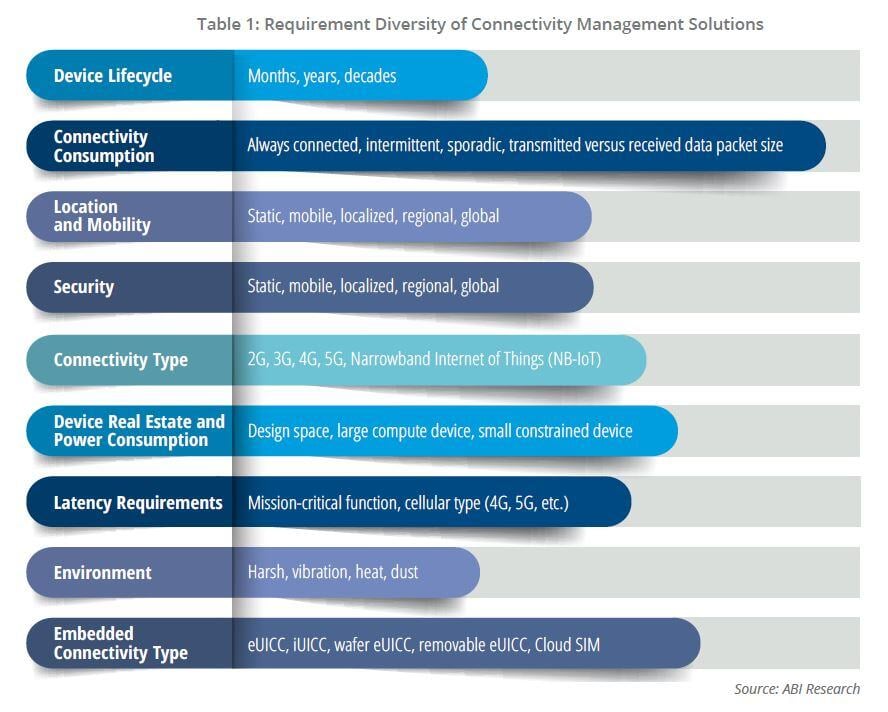

Parallel to this is the increasing demand for digitization and automation. The development of Embedded Subscriber Identity Module (eSIM) technology; ticked both boxes, designed to enable new levels of cellular digitization, out-of-the-box connectivity, and Over-the-Air (OTA) management. This was paired with powerful management platforms, whereby new levels of automation could be realized thanks to intelligence that could make and execute decisions based on pre-defined rules. Long gone are the days of connect and forget, and the connectivity requirements of today far exceed the ability to provide connection reliability. Although reliability remains a key factor, choosing a connectivity partner is hinged on their ability to provide a purpose- built connectivity platform, from initial design, to cellular enablement and ongoing management. Previous strategies evolved around the reuse or repositioning of existing connectivity management solutions, but the one-size-fits-all connectivity approach is no longer appropriate with myriad requirements that can significantly differ based on regionality, use case, device type, vertical, and/or application, in turn creating broad requirement diversity, some of which are outlined in Table 1.

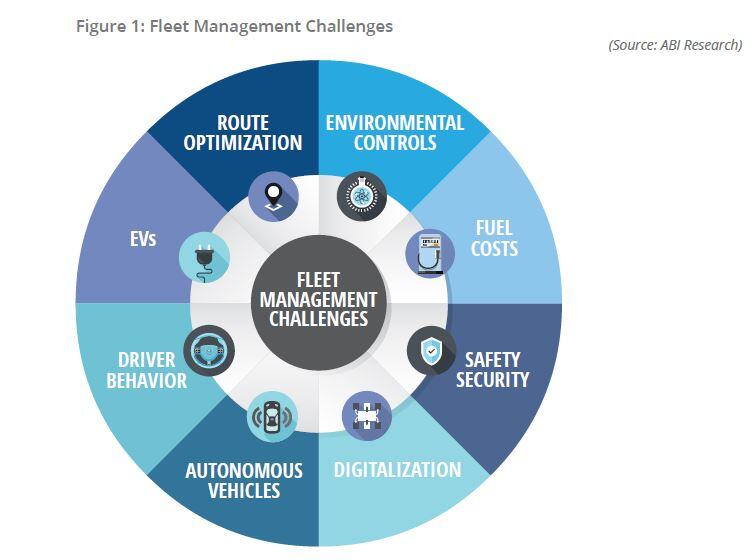

Although highlighting the importance of a customized vertical approach, it is equally important for connectivity providers to offer application customization. Even within the same vertical and use case, different requirements and priorities will prevail. In the instance of fleet management, there are several challenges a fleet manager may be trying to address, which could encompass all or a selection thereof.

In the example of fleet management, two different enterprises may wish to track their cargo, but the requirement can greatly differ depending on the cargo in question.

In one scenario, speed of delivery may be the priority. In this instance, intelligence can be built into the back end and a fleet rerouted to avoid traffic and/or congestion. In another scenario, the fleet may be carrying cargo that requires constant/consistent monitoring, such as the cargo’s temperature, to ensure the contents do not spoil. In these two instances, the requirements are very different, despite operating within the same vertical and application. These are just two examples of many, demonstrating the diverse range of different embedded connectivity and platform requirements.

Mapping enterprise requirements to connectivity capabilities also means that embedded connectivity partners need to be flexible, offering hyper customization and modular approaches to connectivity platform enablement from both a vertical- and application-specific standpoint. Hyper customization must be an achievable goal to deliver a meaningful connectivity service that can address a multitude of priorities and thus, pain points.

Embedded Connectivity and Customized Approaches are Reshaping the Connectivity Ecosystem

MVNOs are known for their agility. Virtual operators can more easily follow the IoT market, while carriers are often accused of providing “one-size-fits-all” IoT solutions.

MVNOs understand that flexibility and market expertise differentiate their businesses from carriers. Some virtual operators organize their businesses around one IoT market, confident that creating value-added services specific to a single market can insulate them from carrier competition and guarantee consistent business from a single set of customers. These verticalized MVNOs often provide customized offerings or consulting services tailored to the specifics of one industry—this could mean providing specialized security services for sensitive applications such as connected healthcare or specific software services for connected car and fleet management use cases.

Horizontal MVNOs, on the other hand, take a broader approach. Rather than molding their organization around specific markets, horizontal virtual operators offer an umbrella of IoT value-added services applicable to multiple markets. However, horizontal MVNOs still understand that different markets will require different services. Many horizontal MVNOs can tailor their broad offerings to specific markets through Application Programming Interfaces (APIs) to end- user applications or through personalized consulting services. Whether pursuing a vertical or horizontal strategy, MVNOs understand that their customers serve unique IoT use cases and expect adaptability and expertise. Flexible IoT expertise has allowed virtual operators to move fast, creating the opportunity to adopt innovations such as eSIM. Market agility—the ability to adjust service portfolios to different applications and markets—is part of an MVNO’s DNA.

eSIM Technology Is Reshaping Responsibilities and the Supplier Ecosystem

eSIM has brought an additional market paradigm shift, disrupting traditional supply chains, as well as Subscriber Identity Module (SIM) sourcing responsibilities. Before eSIM, device Original Equipment Manufacturers (OEMs) could simply integrate a removable SIM tray, with the SIM supply emphasis placed on the service provider or enterprise. As the market moves more heavily into the realms of embedded, not only is the supply chain shifting more heavily toward the silicon level, but SIM sourcing responsibilities are shifting toward the OEM. eSIM inherently means that device OEMs will now take the lead in SIM supply, having to consider this at the device design level, meaning closer collaboration with the chipset manufacturer is now required.

For OEMs, this is adding an additional layer of go-to-market complexity as it relates to Stock Keeping Unit (SKU) management, testing, certification processes and provisioning, whether that be in-factory or out in the field. This is on top of market unfamiliarity with SIM and cellular, and the fact that many OEMs may not have established partnerships or relationships with the leading eSIM silicon providers.

This new responsibility and supplier paradigm is a significant pain point, and although the requirement for strong collaboration with the silicon industry is clear, it is easier said than done.

To help alleviate this issue, connectivity platform providers, which have strong ties with the silicon industry, should be top of mind. A cellular connectivity provider that can offer an end-to-end solution or be considered an ecosystem/technology orchestrator, if you will, can help further reduce these go-to- market barriers. Although cellular connectivity partners are experts, as it relates to the connectivity piece of the puzzle, some are also able to help navigate the supplier ecosystem, providing a service/solution that provides support from the initial embedded cellular design phase to implementation.

IoT Customer Ambitions Have Grown

As demand for the IoT grows, it becomes more complicated, as customers are searching for specialized IoT partners that are reactive to their main application segments. Many are looking to MVNOs to provide additional services, alongside comprehensive global coverage. The days when IoT customers required little more than quick connectivity are over.

Some applications and companies with large, local IoT deployments might always favor large carriers that prefer to serve expansive, static fleets. However, Tata Communications’ MOVE™ has the expertise and toolset to capture a new type of customer, as large mobile fleets search for embedded connectivity providers and IoT organizations that can provide flexible, verticalized, and application-specific support. Tata Communications also has established relationships with some of the leading silicon vendors, including Infineon, a market leader in the supply of Machine-to-Machine (M2M) and IoT eSIMs. This places Tata Communications in a position of strength, able to not only provide a connectivity platform, but also support during the initial connectivity design phase of a device.

Leaning into specialization for different markets, MOVE™ is arming its client base with innovative purpose-built connectivity solutions, offering a single pane of glass to help enterprises from the connectivity design phase to enablement, thanks to strong partnerships that span the entire value chain, from chipset vendor to OEMs and connectivity partners. As a result, the MOVE™ platform can offer hyper- customizable solutions to cater to the broad array of use cases and requirements of IoT organizations.